According to PVN, the total revenue of the whole group in the first 6 months of the year is estimated at 420,100 billion VND, exceeding the 6-month plan by 24%.

Contribution to the State budget (excluding Nghi Son Refinery and Petrochemical Company Limited - NSRP) is estimated at over VND 66,000 billion, exceeding the 6-month plan by 63%. Consolidated pre-tax profit is higher than the 6-month plan; stable and maximum supply of strategic products: gas, electricity, fertilizer, gasoline, etc. for life and production.

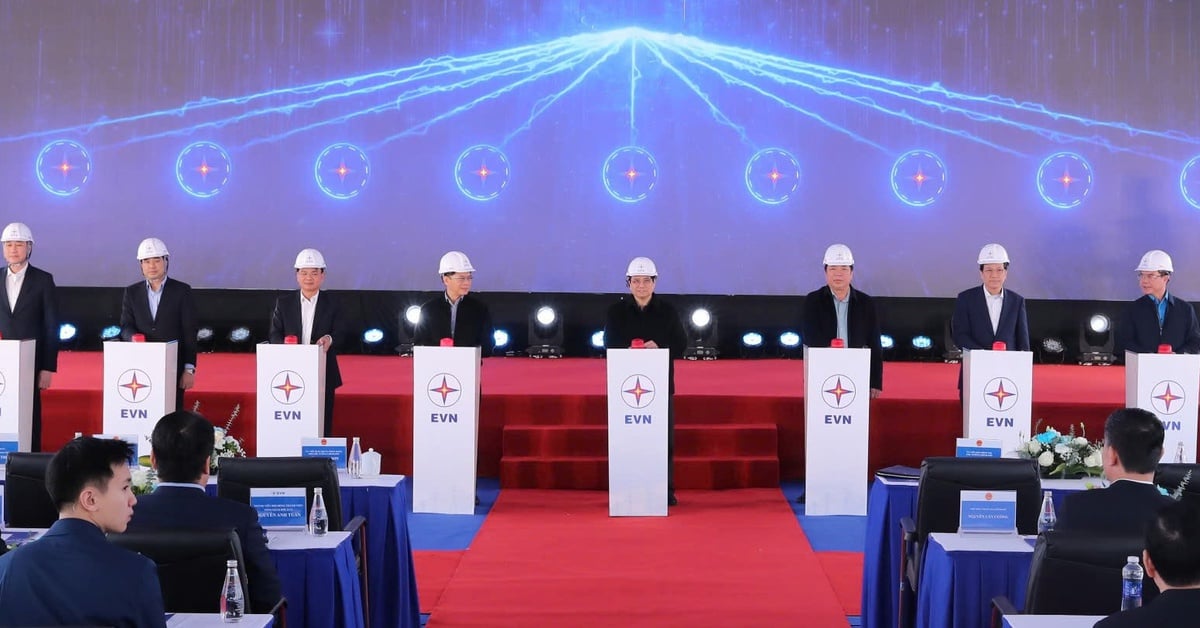

However, PVN said that one of the major problems and difficulties is that EVN owes nearly 23,000 billion VND to the entire PVN. Of which, the debt due for payment is over 14,000 billion VND, greatly affecting PVN's production and business activities and cash flow balance.

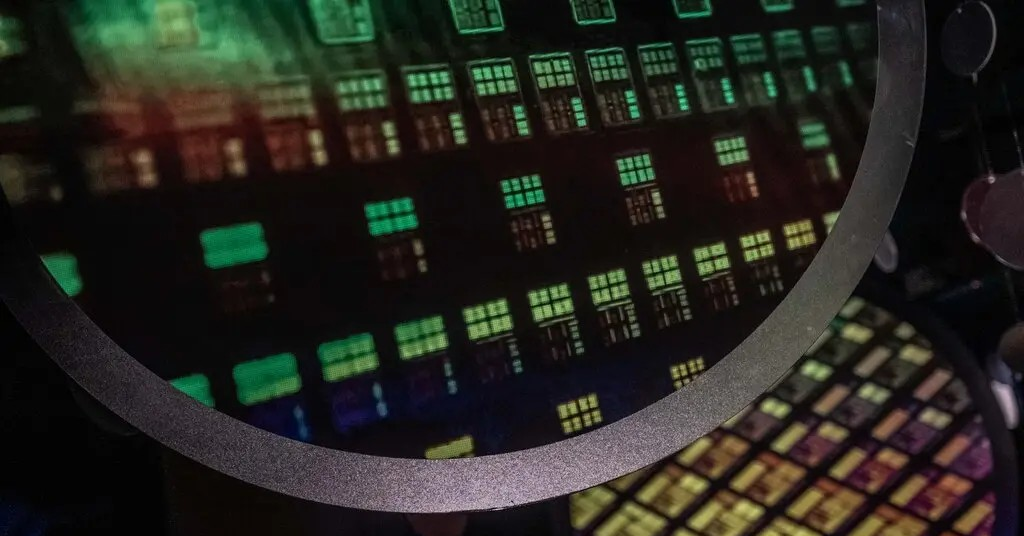

In addition, prioritizing the mobilization of electricity from renewable energy sources but with low stability leads to gas-fired thermal power plants continuously mobilizing and shutting down machines, increasing the probability of generator failures, affecting the cost of electricity production as well as the readiness to ensure the electricity output plan target of PVN.

According to EVN's audited consolidated financial statements, the total loss of EVN's parent company in 2022 was more than VND26,500 billion. In consolidated business results, EVN lost VND20,700 billion. Meanwhile, in 2021, this unit made a profit of more than VND14,700 billion.

In 2022, if EVN's consolidated revenue is more than VND 463,000 billion, revenue from electricity sales will account for more than 98%, with over VND 456,000 billion.

Audited figures also show that the reason for EVN's loss is that the selling price of electricity is lower than the purchasing price, reflected in electricity sales revenue and electricity cost.

Source

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)