Duc Long Gia Lai (DLG) and the record loss of VND 1,197.2 billion in 2022

Duc Long Gia Lai Group Joint Stock Company (DLG) was formerly Duc Long Private Enterprise, established in 1995. The company operates mainly in the fields of infrastructure, real estate, energy and electronic components manufacturing.

Duc Long Gia Lai's business activities over the past year have been associated with losses.

In the second quarter of 2022, although this unit achieved revenue of 375.4 billion VND, it recorded a loss after tax of up to 309 billion VND. In the third quarter of 2022, the loss decreased to only 19.2 billion VND but continued to increase to 504.5 billion VND in the fourth quarter.

The two losses recorded in the second and fourth quarters made 2022 the most loss-making year for DLG since its 10-year listing on the stock exchange. In 2022, the company achieved a total revenue of VND1,347.9 billion but a loss after tax of VND1,197.2 billion.

Duc Long Gia Lai (DLG) suffered a loss of thousands of billions and was just asked by its partner to open bankruptcy proceedings (Photo TL)

Previously, the company's 'record' loss was recorded in 2020 with a loss after tax of VND 929.8 billion. The reason for Duc Long Gia Lai's record losses of hundreds of billions of VND in the fourth quarter came from the fact that this unit had to record a sudden increase in business management costs to VND 492 billion. Mainly due to having to set aside provisions for bad debts overdue according to state regulations.

Loss escape in Q2/2023 but stocks are still cheap as 'vegetables'

Despite having to go through a not-so-smooth 2022, DLG's business results in the first and second quarters of 2023 have improved slightly.

Specifically, the company recorded revenue in the first quarter of VND 222.7 billion, increasing to VND 288.8 billion in the second quarter of 2023. Profit after tax has also improved from a loss of hundreds of billions of VND to a profit of VND 6.9 billion in the first quarter and a profit after tax of VND 28.5 billion in the second quarter of 2023.

In terms of asset structure, the company recorded total assets of VND 5,736.8 billion at the end of the second quarter, down 2.8% compared to the beginning of the period. Of which, liabilities accounted for a relatively large proportion, up to VND 4,593.8 billion, equivalent to 80% of total capital.

Compared to the beginning of the year, the company's equity was eroded by nearly VND260 billion, down to only VND1,143 billion.

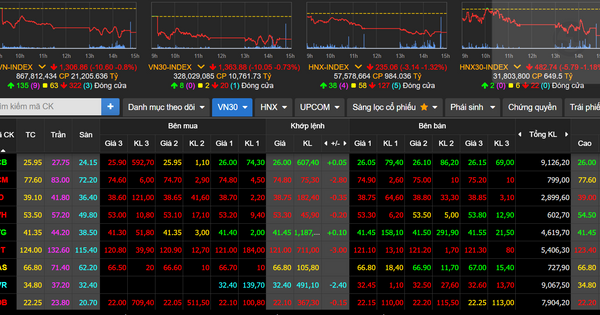

It is worth mentioning that although business results have improved a lot and the company has escaped losses in the second quarter, DLG shares are still only traded at a low price of around VND 3,000/share, almost no growth compared to a year ago. Even on November 7, 2022, DLG shares hit bottom at VND 1,660/share.

At the trading session on September 5, 2023, DLG code is being traded at VND 3,000/share and is still on the list of stocks under warning.

DLG was requested by its partner to open bankruptcy proceedings.

According to a recent announcement, Duc Long Gia Lai said that the Gia Lai Provincial People's Court has accepted the petition to open bankruptcy proceedings. The petitioner is Lilama 45.3 Joint Stock Company, headquartered in Quang Ngai province.

After receiving the application on July 24, 2023, Gia Lai Provincial People's Court sent a notice to Duc Long Gia Lai and requested that within 30 days, it must send a response to the court along with the presentation of documents as required by regulations.

Regarding Lilama 45.3 JSC’s request to open bankruptcy proceedings, Duc Long Gia Lai said the company is facing financial difficulties. Lilama 45.3’s debt is about 20 billion VND, very small compared to the company’s current total assets.

Looking at the figures recorded in the company's books, it can be seen that DLG is holding total assets of up to 5,736 billion VND at the end of the second quarter of 2023. But 80% of that is payable debt. Not to mention the current market capitalization value of DLG is only recorded at 897.9 billion VND at the end of the trading session on September 5, 2023.

Source

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)