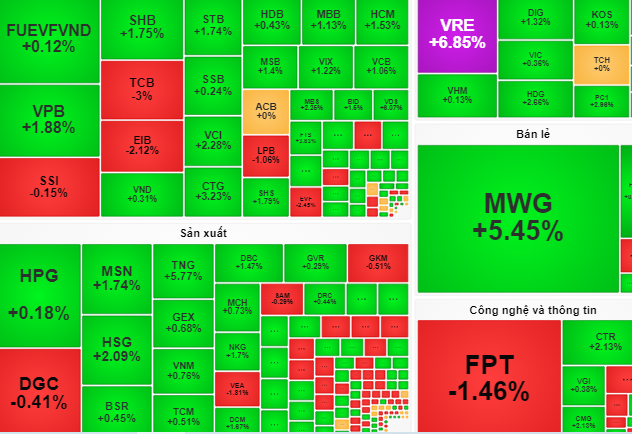

At the end of the session on July 1, the VN-Index increased by 9 points (+0.74%), closing at 1,254 points.

Investors continued to be cautious when entering the first stock trading session of July 2024. After a few minutes of green, the market quickly returned to the red price zone. At the end of the morning session, the VN-Index fell to 1,240 points.

Entering the afternoon session, investors bought and sold stocks more actively, bottom-fishing cash flow appeared, helping many groups of stocks increase in price again.

At the end of the session, VN-Index increased by 9 points (+0.74%), closing at 1,254 points. Liquidity decreased when HoSE only had 487 million shares successfully traded.

Among the 30 large stocks (VN30), 22 codes increased in price such as VRE (+6.8%), MWG (+5.4%), CTG (+3.2%), VPB (+1.9%), SHB (+1.8%) ... On the contrary, 7 codes decreased in price such as TCB (-3%), POW (-2.3%), FPT (-1.5%), BCM (-1.1%), VJC (-0.8%) ...

Dragon Capital Securities (VDSC) commented that the sharp decrease in liquidity on July 1st showed that the supply of stocks had cooled down, giving the market a chance to recover.

VDSC forecasts that the VN-Index will be supported at the 1,250-point level in the coming time. Therefore, investors can consider the good price range of some stocks to buy for short-term surfing.

However, VCBS Securities Company believes that the market will still need more time to accumulate before entering a new uptrend. Investors can consider partial disbursement for stocks that maintain support price levels and show signs of recovery in the retail and electricity sectors.

Source: https://nld.com.vn/chung-khoan-ngay-mai-2-7-dong-tien-bat-day-gia-co-phieu-con-tiep-dien-196240701173516397.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)