On the morning of March 25, at the National Assembly House, giving opinions on the draft Law on Digital Technology Industry, full-time National Assembly deputies agreed on the necessity of promulgating the Law to institutionalize Resolution No. 57-NQ/TW of the Politburo on breakthroughs in science and technology development, innovation and national digital transformation; creating a solid legal foundation, bringing the Party's policy into life, promoting the digital technology industry to become a driving force for the country's economic growth.

Through research, delegate Tran Van Khai (Ha Nam) said that Resolution No. 57-NQ/TW requires innovation in management thinking, avoiding the mindset of "if you can't manage it, then ban it," paving the way for new technology through a controlled pilot mechanism.

According to the delegate, the draft Law has made progress with the regulation of the testing mechanism (Chapter V), but the scope of testing is still too narrow (Article 42), omitting many innovations; at the same time, the list of prohibited acts is still general (Article 12) and imposes a number of additional business conditions. This overly cautious management will stifle innovation, making businesses hesitant to experiment with new technologies in Vietnam.

Delegates proposed expanding the scope of the controlled testing mechanism (sandbox) for all new digital technology products and services that are not yet regulated by law; simplifying testing approval procedures; removing unnecessary prohibitions and conditions. At the same time, it is necessary to empower the Government to temporarily allow piloting of new technologies and models that are not yet regulated by law (to be reported to the National Assembly later) in order to promptly seize development opportunities.

In addition, Resolution No. 57-NQ/TW considers digital data as a strategic resource, requiring "making data the main means of production" and developing the data economy. The draft law has not clearly demonstrated this policy, the regulations are mainly on technical management, and there is no mechanism for sharing and effective exploitation. For example, there is no provision promoting the opening of public data or the development of the data market.

"This cautious approach leads to an untapped 'data gold mine', businesses lack raw materials to develop artificial intelligence, and reduce competitiveness," the delegate noted.

Therefore, delegates proposed to add regulations to promote the data economy: the principle of "open data" and data sharing between state agencies and enterprises; forming data centers and exchanges. At the same time, the Government is assigned to regulate the list of open data and the mechanism to ensure safety and privacy when sharing data, thereby creating momentum for the data industry to develop in accordance with the spirit of Resolution No. 57-NQ/TW.

According to the delegate, Resolution No. 57-NQ/TW requires special policies to attract and employ domestic and foreign technology talents with breakthrough mechanisms. The draft Law has raised this issue (Article 25) but is still general, not specifying outstanding incentives.

Delegates cited the lack of regulations on exemption or reduction of personal income tax for high-tech experts, or facilitation of long-term residence procedures for foreign experts; and the lack of policies to attract good students to strategic technology sectors. These limitations make it difficult to compete for brainpower, and the shortage of high-quality human resources continues.

Delegates proposed adding breakthrough talent policies such as: exemption and reduction of income tax for technology experts; simplifying residence procedures for foreign experts and increasing support for training digital technology talents. These solutions will institutionalize the orientation of Resolution No. 57-NQ/TW, creating advantages for Vietnam in competing for high-quality human resources.

Expressing his interest in developing human resources, delegate Pham Trong Nghia (Lang Son) said that the draft Law has provided a number of incentives to train and attract human resources for the digital technology industry through policies such as: supporting scholarships; attracting foreign experts; and promoting talents.

However, attracting human resources, especially digital talent, requires high international competition; preferential policies must be outstanding, specific, and special as determined in Resolution No. 57-NQ/TW; at the same time, they must be competitive enough with other countries. Therefore, the delegate requested the drafting agency to report more on preferential policies of some countries in the ASEAN region./.

Source: https://www.vietnamplus.vn/dai-bieu-quoc-hoi-de-xuat-mien-giam-thue-thu-nhap-cho-chuyen-gia-cong-nghe-cao-post1022529.vnp

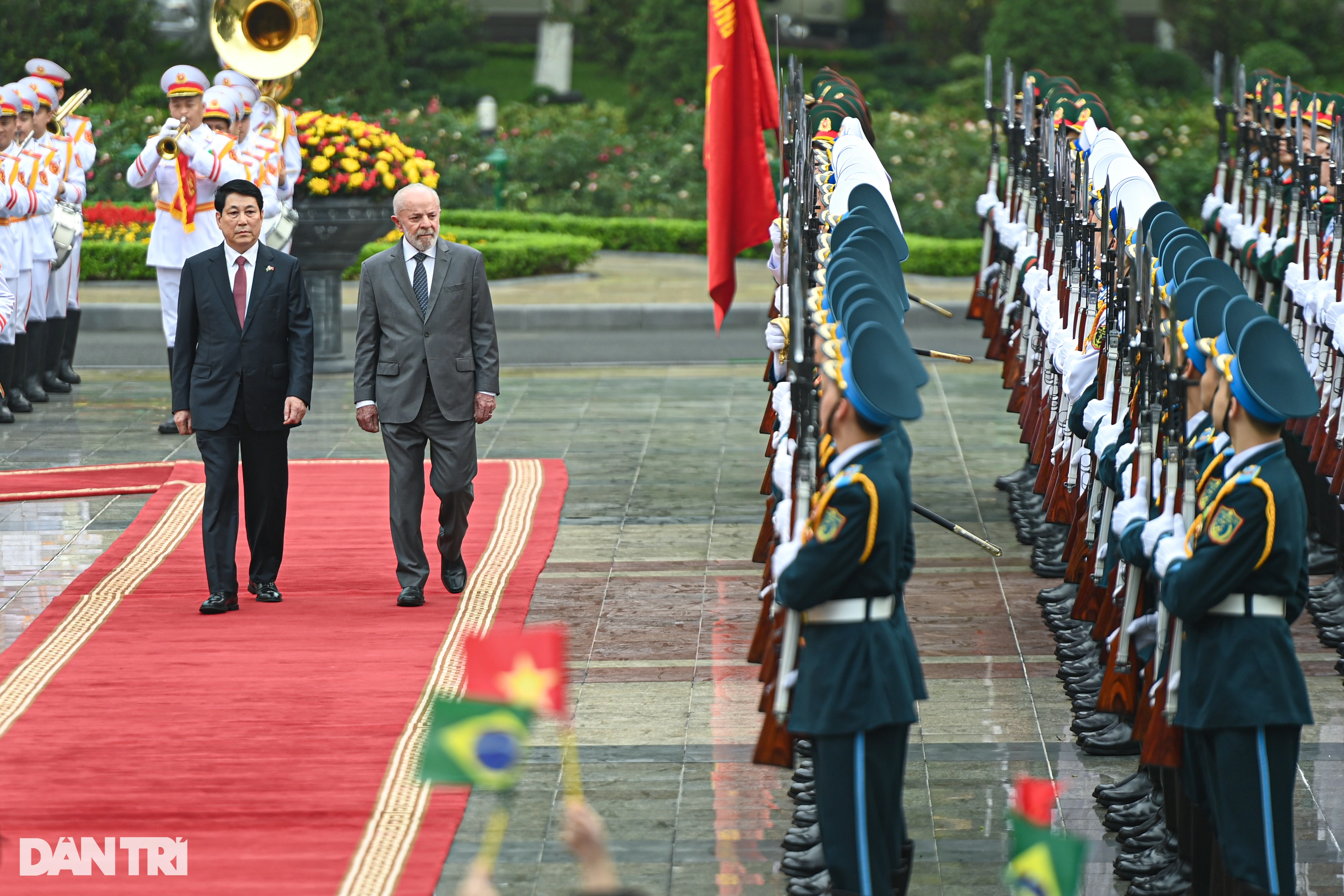

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

Comment (0)