Ms. Nguyen Thanh Phuong - President of Vietcap - Photo: VCI

Vietcap Securities Joint Stock Company (VCI) has just announced the Board of Directors' resolution approving the private issuance plan with a volume of more than 143.6 million shares. The offering price is 28,000 VND/share.

Cheaper than outstanding shares

The above expected issuance level is equivalent to 25% of the number of outstanding shares. The expected amount of revenue is more than 4,021 billion VND.

On the market, VCI shares are trading at VND35,900/share (closing price on September 27). Thus, the private offering price is about 22% lower.

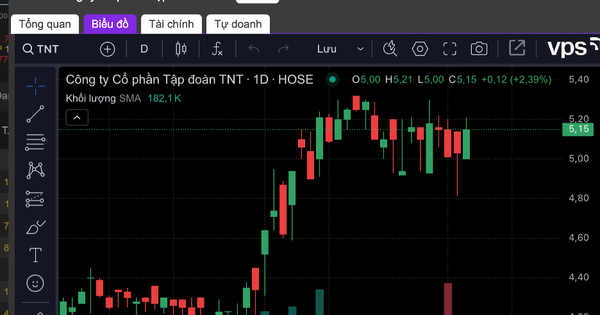

According to the resolution signed by Ms. Nguyen Thanh Phuong - Chairman of Vietcap, the purpose of the mobilization is to supplement more than 3,522 billion VND (equivalent to 87.6%) for margin lending activities, the remaining capital is to supplement more than 498 billion VND (12.4%) for self-trading activities.

In case the actual amount collected from the offering is lower than VND 4,021 billion, Vietcap leaders said they will proactively allocate it to each purpose according to the above ratio.

The offering and disbursement are expected to take place this year or the first quarter of next year.

Vietcap representative also said that in this offering, 66 professional securities investors registered to participate.

In the attached list, it is noteworthy that foreign fund Pyn Elite Fund registered to buy the largest quantity of 21.5 million VCI shares, equivalent to more than 600 billion VND.

Currently, Vietcap's charter capital is over VND4,400 billion. After the private issuance, Vietcap Securities is expected to increase its charter capital to nearly VND7,181 billion.

How is Ms. Nguyen Thanh Phuong's company doing margin lending and securities trading?

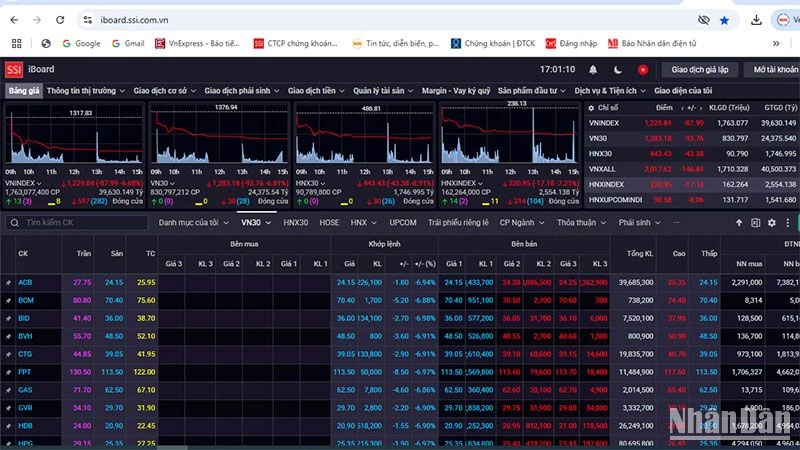

Regarding Vietcap, this securities company has the 6th brokerage market share on HoSE in the 2nd quarter of 2024 ranking, behind VPS, SSI, TCBS, VNDirect and HSC.

At this year's annual general meeting of shareholders, Mr. To Hai - General Director of Vietcap - said that the company's strategy in the coming time will focus more on attracting individual investors.

Previously, VCI's strategy focused heavily on institutional clients. But in 2023, Vietcap "dropped" from the top 5 in market share to 8th place.

By raising a large amount of additional money after the private placement for margin operations, it can be seen that this securities company wants to increase its position in the lending market, which has potential "competitors" such as TCBS, SSI, HSC...

In the 2024 semi-annual financial report, Vietcap has a margin debt balance of VND 7,863 billion at the end of June this year. The value of assets securing this loan has a market value of more than VND 24,320 billion.

With a large outstanding loan balance, Vietcap's interest from loans and receivables in the first 6 months of this year reached 414 billion VND, an increase of nearly 28% over the same period.

This profit is larger than the revenue recorded from securities brokerage activities (with 362 billion VND).

Vietcap also has a strong proprietary trading portfolio, contributing significantly to business results. There was even a time when many investors were very interested in which code Vietcap "held" because the company's portfolio was often profitable.

At the end of June 2024, Vietcap is investing in stocks IDP of International Dairy Products Joint Stock Company, KDH of Khang Dien House, FPT, MBB of MBBank, STB of Sacombank, MSN of Masan, PNJ...

The total original value of Vietcap's investments in listed, unlisted stocks and bonds is more than VND5,300 billion, but the market value is more than VND8,500 billion, corresponding to a provisional increase of 60%.

Vietcap raises capital after a major shareholder gradually withdraws

Recently, Ms. Truong Nguyen Thien Kim successfully sold 13.2 million VCI shares of Vietcap. The transaction was conducted from September 4 to 11.

After the transaction, Ms. Kim reduced her holding ratio from 5.17% to 2.18% of capital. Ms. Kim is the wife of Mr. To Hai - General Director and member of the Board of Directors of Vietcap.

Mr. To Hai currently holds more than 99.1 million VCI shares, equivalent to 22.44% ownership - higher than Ms. Nguyen Thanh Phuong - chairwoman of this securities company (3.97% of capital).

It is estimated that Mr. To Hai's wife can earn more than 600 billion VND after selling a large amount of Vietcap shares.

Source: https://tuoitre.vn/cong-ty-chung-khoan-cua-ba-nguyen-thanh-phuong-huy-dong-4-000-ti-lam-gi-20240929152752082.htm

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] A brief moment of rest for the rescue force of the Vietnam People's Army](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a2c91fa05dc04293a4b64cfd27ed4dbe)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Infographic] Government bond market March 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/e13239cdbcfd4968abc836c201204c43)

Comment (0)