Banking stocks lead the stock market; A series of important events impact the VN-Index; Securities stocks welcome investment waves awaiting the effectiveness of the new circular; Dividend payment schedule...

Banking stocks rise, VN-Index "struggles" before 1,300 points

VN-Index closed the week with a slight decrease of 0.6 points, holding at 1,290.92 points. This was the result after 3 consecutive sessions of strong increase last week. Looking back at the developments last week, it can be seen that there were times when the index approached the 1,300 point zone, but selling pressure gradually appeared at the end of the week, causing the market to turn around and decrease slightly.

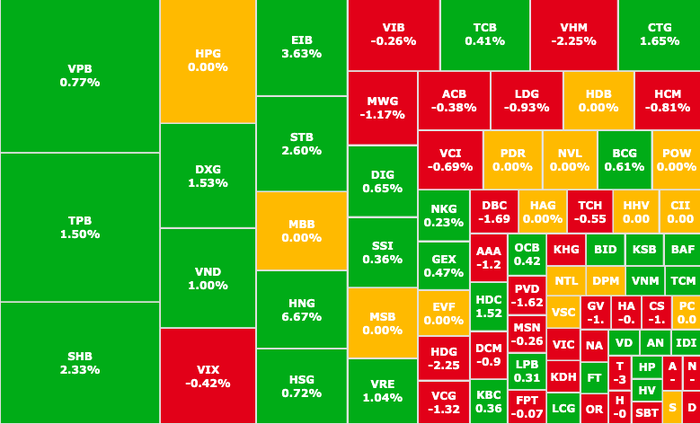

Banking stocks attract strong cash flow, leading the market (Photo: SSI iBoard)

Banking stocks dominated. The focus was on STB (Sacombank, HOSE) which became the stock with the strongest increase in the VN30 group, up 9% after 4 consecutive sessions of increase, reaching 33,600 VND/share, approaching the historical peak. Following were SHB (SHB, HOSE), CTG (VietinBank, HOSE), BID (BIDV, HOSE).

Liquidity improved significantly, with transactions mainly at the threshold of VND20,000 - 24,000 billion/session. This had the positive contribution of foreign investors with net buying power returning.

In the last session of the week alone, foreign investors net bought 140 billion VND, focusing on: CTG (VietinBank, HOSE), SSI (SSI Securities, HOSE), VNM (Vinamilk, HOSE), TPB (TPBank, HOSE), FPT (FPT, HOSE).

Series of alarms in Novaland's semi-annual audited business results

In the 2024 semi-annual audit report of No Va Real Estate Investment Group Corporation - Novaland (NVL, HOSE), the auditor raised doubts about the company's ability to continue operating, due to tight cash flow, high debt pressure, and restructuring plan.

Legal problems in real estate projects increase debt repayment pressure for Novaland (Photo: Internet)

Accordingly, the 2024 semi-annual loss was VND 7,327 billion while total assets also decreased by VND 2,700 billion compared to the beginning of the year, down to VND 238,800 billion, causing the company's financial quality to decline significantly.

Payables increased to over VND200,000 billion, of which financial debt was VND59,200 billion. Debt repayment pressure was heavy in the context of large inventories and slow sales due to legal and planning problems.

Thus, the debt ratio is 5 times higher than equity (about 38,000 billion VND).

According to TCBS Securities analysis, NVL is expected to make a loss in the next 3 years before the situation improves in 2028.

Stock market stocks catch the wave

Circular 68/2024/TT-BTC allows securities companies to provide services allowing foreign institutional investors to place securities orders without sufficient funds from November 2.

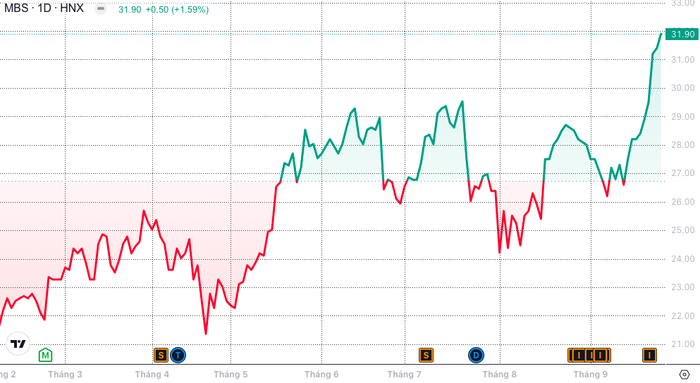

MBS shares hit a new peak, up 67% year-to-date (Photo: SSI iBoard)

Analysts say the securities group is benefiting from this as it serves more foreign investors thanks to increased income from brokerage as liquidity increases.

Last week, MBS stock (MB Securities, HNX) increased by 10.4% in value, extending 6 consecutive sessions of increase, reaching a historical peak of nearly VND32,000/share. Thus, since the beginning of the year, MBS's market price has increased by 67%, with its capitalization increasing to VND17,450 billion.

In addition, SSI (SSI Securities, HOSE), VND (VNDirect Securities, HOSE), DSC (DSC Securities, UPCOM),... also recorded positive developments on the floor last week.

Industry groups expected to report Q3/2024 financial statements

Accordingly, many experts believe that two major industry groups: banking and retail are expected to be important drivers for the market. Oil and gas, pharmaceuticals and technology groups are likely to record positive profit growth.

In addition, the impact of large-scale economic stimulus packages from China, in the field of monetary easing and supporting the real estate market, is expected to have a positive impact on countries in the region, including Vietnam. This could help maintain monetary easing policies, promote economic growth and increase the attractiveness of the stock market.

Some industries that are expected to benefit from these policies include: Steel, Oil and Gas, Rubber and Seafood.

October is a key period for the Vietnamese stock market with many events and factors both domestically and internationally, such as: Announcement of FTSE Russell market classification results, Q3/2024 financial reporting season, revaluation of VNDiamond and VNFIN Select index baskets, XV National Assembly session, etc., thereby affecting investors' psychology and investment strategies.

Comments and recommendations

Mr. Bui Ngoc Trung, investment consultant, Mirae Asset Securities, commented that profit-taking pressure appeared and the index decreased slightly at the end of the week, but this was a normal and short-term psychological development for a correction, gaining momentum for VN-Index to continue conquering higher points.

VN-Index faces short-term profit-taking pressure before the 1,300-point resistance zone

The market can maintain a positive uptrend as cash flow has returned more strongly, focusing on leading and large-cap groups: Banking and Real Estate.

In addition, the Government's determined support, the Bank's credit growth expectations, market liquidity improved by more than VND 20,000 billion/session, strong net buying by foreign investors, etc. Combined, the above factors are key to helping the market almost overcome previous difficulties and move towards higher growth targets at the end of the year and beyond 2025.

TPS Securities believes that VN-Index will have another week of trading without surpassing the resistance zone of 1,300 points with selling pressure appearing. Investors should be cautious this week, taking partial profits. If the market shows a positive scenario, breaking out of the resistance zone of 1,300 points, investors can buy when the market tests this zone, avoiding chasing if liquidity does not pass.

SHS Securities assessed that the short-term trend of VN-Index is growing at the support zone around 1,280 points, the resistance zone is 1,300 points. This is not a reasonable price zone for disbursement. The index is likely to fluctuate within 1,280 - 1,300 points.

VNDirect Securities recommends that investors should be cautious and consider taking profits with stocks that have increased by more than 15% in the past 2 weeks, reducing the proportion of stocks. Disbursement should only be made when the VN-Index surpasses the 1,300 point zone or falls to the support zone of 1,260 - 1,270 points.

Dividend schedule this week

According to statistics, there are 18 enterprises that have dividend rights from September 30 to October 4, of which 16 enterprises pay in cash, 1 enterprise pays in shares and 1 enterprise pays in combination.

The highest rate is 46%, the lowest is 0.4%.

1 company pays stock:

Bao Minh Corporation (BMI, HOSE) closed the ex-right trading date on October 3, at a rate of 10%.

1 business pays combination:

Siba High-Tech Mechanical Group Corporation (SBG, HOSE) pays dividends in the form of shares, additional issuance and exercise of purchase rights. The ex-right date is October 2, the rates are 22%, 32% and 46% respectively.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| SEA | UPCOM | September 30 | 10/25 | 5% |

| SZE | UPCOM | September 30 | 10/15 | 8% |

| PVC | HNX | 1/10 | 10/24 | 0.6% |

| ISH | UPCOM | 1/10 | 10/23 | 10% |

| LMI | UPCOM | 1/10 | 10/18 | 8% |

| DNC | HNX | 1/10 | 10/25 | 10% |

| ALT | HNX | 1/10 | 10/24 | 10% |

| HNF | UPCOM | 1/10 | 10/16 | 10% |

| THB | HNX | 1/10 | 10/24 | 3.5% |

| VNC | HNX | 1/10 | 10/24 | 10% |

| PRT | UPCOM | 2/10 | 10/28 | 3% |

| AGR | HOSE | 2/10 | 10/18 | 7% |

| PNJ | HOSE | 2/10 | 10/16 | 14% |

| BMI | HOSE | 3/10 | 10/23 | 19% |

| CKD | UPCOM | 3/10 | 10/23 | 19% |

| NTL | HOSE | 3/10 | 11/10 | 12% |

| LNC | UPCOM | 4/10 | 10/18 | 0.4% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-30-9-4-10-co-phieu-nganh-chung-khoan-don-song-20240930075818217.htm

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)