At the end of the session on October 9, the VN-Index closed at nearly 1,282, up 9.8 points, equivalent to 0.78%.

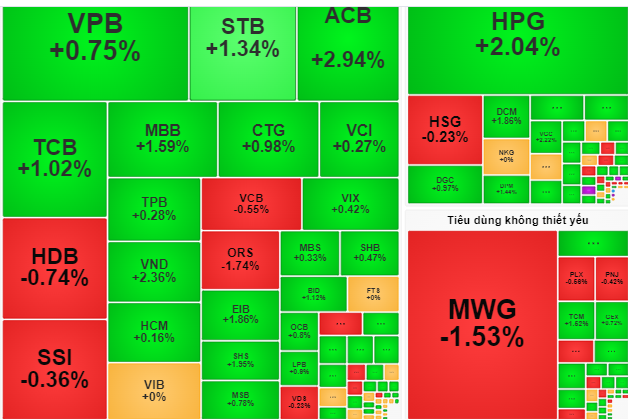

Vietnamese stocks spread green from the beginning of the morning session thanks to active demand. The positive point is that many large stocks in the banking, real estate, steel groups and some individual stocks increased in price, helping the market consolidate its upward momentum.

The increase was expanded in the afternoon session with increased active buying liquidity. Accordingly, the codes in the large-cap group increased in price such as VHM (+2.16%), HPG (+2.04%), ACB (+2.94%)... spreading this trend to many other stocks, strongly affecting the market index.

At the end of the session, the VN-Index closed at nearly 1,282, up 9.8 points, equivalent to 0.78%.

Vietcombank Securities Company (VCBS) commented that the active buying liquidity of the session on October 9 increased, focusing on large-cap stocks, along with the widespread movement of cash flow, creating the premise for the next uptrends. Therefore, many investors expect cash flow to continue pouring into stocks, supporting the market to rise in the session on October 10.

ACBS Securities Company said liquidity increased compared to the previous session, showing that buying pressure is gradually overwhelming selling pressure.

"In the coming time, the 1,300-point threshold of the VN-Index will be an important milestone to confirm the market trend" - ACBS forecasts.

Therefore, VCBS recommends that investors maintain the proportion of stocks in banking and securities sectors that are showing signs of recovery, taking advantage of fluctuations in each session to disburse stocks that are moving sideways in real estate, public investment, transportation, oil and gas, etc.

Source: https://nld.com.vn/chung-khoan-ngay-mai-10-10-co-phieu-lon-tiep-tuc-ho-tro-da-tang-diem-196241009180529305.htm

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)