Real estate stocks continue to attract cash flow, MSN makes "huge" deals

Cash flow is still strongly concentrated in small and medium-sized stocks, especially real estate stocks. MSN shares were negotiated “hugely”, in which foreign investors net sold more than 1,000 billion VND.

After a session of increasing points with low liquidity, investor sentiment on March 27 remained quite positive. This helped pull the indices above the reference level. However, the general market situation was fluctuating within a narrow range when there was a strong dispute between buyers and sellers.

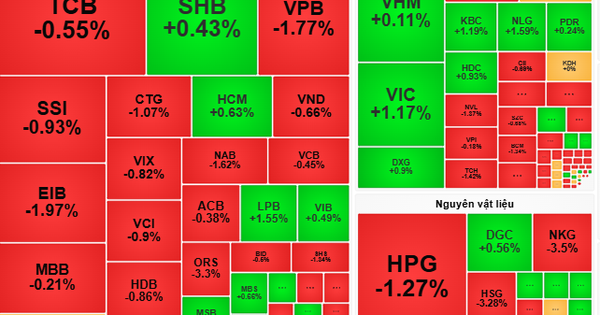

By the end of the morning session, trading on the market was more negative when the banking group encountered strong selling pressure and started a correction trend afterwards. The afternoon session was not too negative despite strong selling pressure in the morning session. The main trend was still a tug-of-war with alternating increases and decreases. Although selling pressure increased somewhat in the early afternoon session, demand later reappeared and pulled some stock groups, thereby helping the VN-Index recover, even closing in the green.

The mid-cap stocks were the focus of today's session when many codes made strong breakthroughs. In particular, codes such as VSC, QCG, CSV... were all pulled up to the ceiling price. After trading sluggishly in the morning session, VSC shares suddenly increased sharply at the end of the session. In addition, stocks in the port or shipping group such as HAH, GMD, VOS... also increased quite well in the afternoon session. The information that is said to have affected this group is that a major US port had to close after a bridge collapse, causing the logistics industry to rush to respond.

The real estate group also attracted good cash flow when PIV, VRC, QCG and TN1 all hit the ceiling. Besides, DIG increased by 2.5%, DXG increased by 2.3%, HDG increased by 2.1%...

In the securities group, all investors' attention is still focused on VND as VNDirect has not yet reconnected with the exchanges. The selling pressure on VND stocks has weakened significantly today and this stock only decreased slightly by 0.64%. Other stocks in the securities group also have strong differentiation, in which, FTS, CTS, VCI and VDS are all in red.

On the other hand, HCM and SSI increased sharply at the end of the session, SSI increased by 1.3% and HCM increased by 2.5%. At the end of the trading session, there were some rumors about payment guarantees for foreign investors who bought first and paid later, this is considered the main reason for SSI and HCM to increase at the end of the session.

In the steel group, after a very positive trading at the beginning of the session, the fluctuations at the end of the session went in the opposite direction, HPG and NKG increased quite well before, but closed with no significant changes compared to the previous session. NKG returned to the reference level while HPG increased slightly by 0.16%. HSG was different from the above two codes when it increased by 2.6% and matched orders of more than 27 million units.

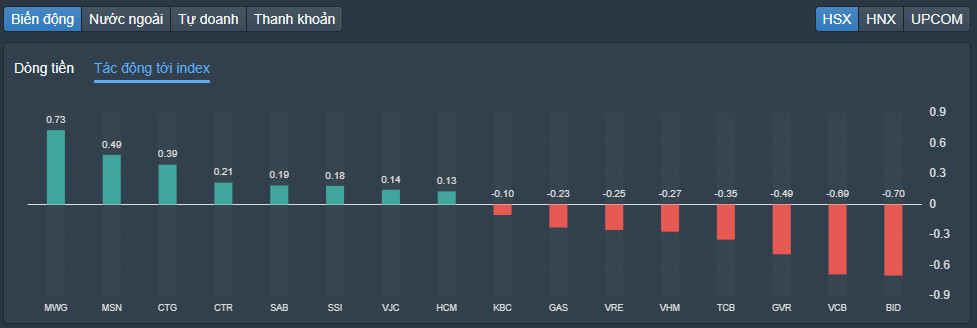

In the banking group, BID and VCB were the two stocks that had the worst impact on the VN-Index, taking away 0.7 points and 0.69 points, respectively. At the close of the session, BID fell 0.94% and VCB fell 0.52%. In addition, large stocks such as GVR, TCB, VHM, VRE... were also in the red.

In contrast, MWG surprised everyone by increasing sharply by 4.2% and contributing 0.73 points to the VN-Index. Following that, MSN and CTG increased by 1.9% and 0.85%, respectively, with contributions of 0.49 points and 0.39 points. MSN had a negotiated transaction of more than 39.6 million shares at a price of VND69,500/share, equivalent to a transaction value of more than VND2,750 billion. Foreign investors also net sold nearly 14.3 million units today.

|

| Stocks strongly impact VN-Index. |

At the end of the trading session, VN-Index increased by 0.88 points (0.07%) to 1,283.09 points. The entire floor had 244 stocks increasing, 209 stocks decreasing and 95 stocks remaining unchanged. HNX-Index increased by 0.82 points (0.34%) to 242.85 points. The entire floor had 103 stocks increasing, 64 stocks decreasing and 63 stocks remaining unchanged. UPCoM-Index decreased (0.02 points -0.02%) to 91.19 points.

Total trading volume on HoSE alone reached 919.3 million shares, worth VND24,061 billion, up nearly 10% compared to the previous session. Of which, negotiated transactions contributed VND4,557 billion. Trading values on HNX and UPCoM reached VND1,784.4 billion and VND563 billion, respectively. NVL had the strongest matching order in the market today with 43.8 million units. Following that, VND and HSG matched orders with 37 million units and 27.4 million units, respectively.

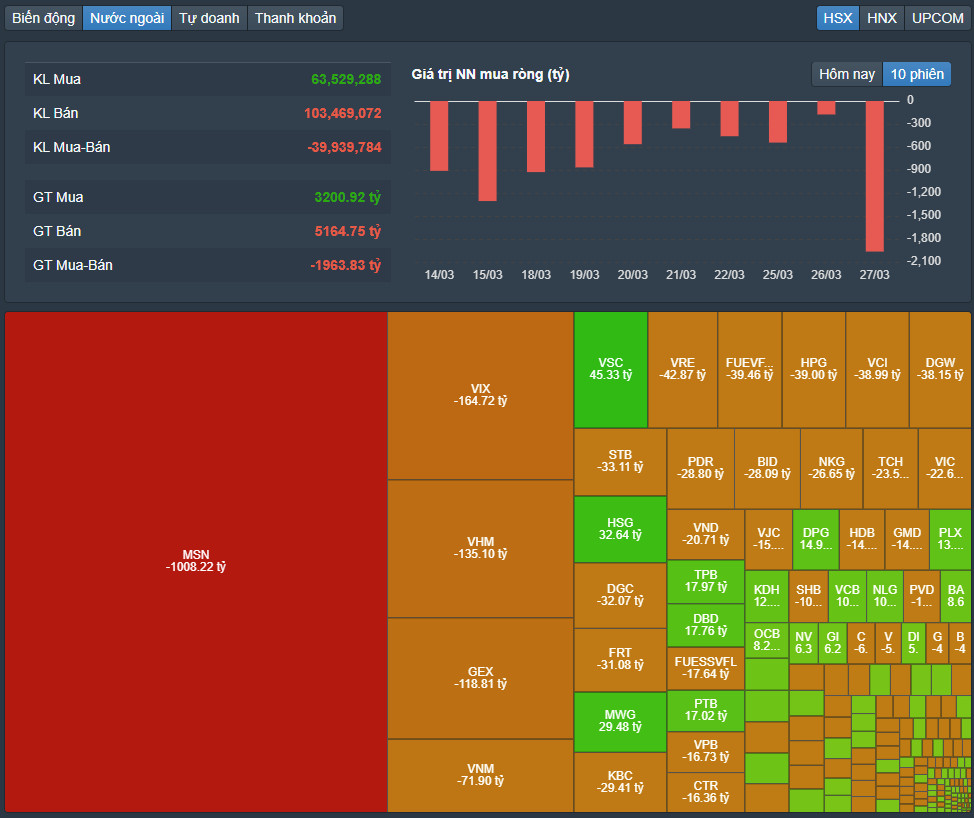

|

| Foreign investors earned more than 1,000 billion VND from net selling of MSN shares. |

Foreign investors increased net selling by nearly VND2,000 billion on HoSE, of which MSN was the strongest net seller with VND1,008 billion. VIX, VHM and GEX were all net sold over VND100 billion. Meanwhile, foreign investors net bought the strongest VSC with VND45 billion. HSG and MWG were net bought VND33 billion and VND30 billion, respectively.

Source

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

Comment (0)