Reducing value added tax contributes to reducing the cost of goods and services to promote production and business.

At the meeting, reporting the summary of this draft resolution, Minister of Finance Ho Duc Phoc emphasized the goal of building the resolution to stimulate consumption, in line with the current economic context, thereby promoting production and business activities to recover and develop soon to contribute back to the state budget as well as the economy to implement the 5-year socio-economic development plan 2021-2025, the annual socio-economic development plan, and the economic restructuring plan for the period 2021-2025.

Regarding the content of the draft resolution, Minister of Finance Ho Duc Phoc said that the current Law on Value Added Tax stipulates two value added tax rates of 5% and 10% (excluding the 0% rate applied to exported goods and services; subjects not subject to value added tax).

According to Minister of Finance Ho Duc Phoc, in order to stimulate consumption, economic recovery and development, in 2022 the National Assembly issued Resolution No. 43/2022/QH15 dated January 11, 2022 on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program, including a policy to reduce 2% of value-added tax rates in 2022. The total reduction in value-added tax of about VND 44,000 billion has contributed to stimulating consumption, promoting production and business development.

However, in addition to the achieved results, during the implementation process, both taxpayers and tax authorities encountered difficulties in determining goods and services that are not eligible for tax reduction.

Therefore, in 2023, the Government proposes to reduce the value added tax rate by 2% for all goods and services subject to the 10% tax rate (to 8%); reduce the % rate for calculating value added tax by 20% for business establishments (including business households and individual businesses) when issuing invoices for all goods and services subject to the 10% value added tax rate.

Assessing the impact on economic growth, Minister of Finance Ho Duc Phoc stated that reducing value-added tax will contribute to reducing the cost of goods and services, thereby promoting production and business and creating more jobs for workers, contributing to stabilizing the macro economy and economic recovery in 2023.

Disagree with the expansion of scope of application

Representative of the agency examining the draft resolution, Deputy Chairman of the Finance and Budget Committee Nguyen Van Chi said that the majority of opinions in the Standing Committee of the Finance and Budget Committee agreed with the necessity of issuing a resolution on reducing value-added tax to support the production and business sectors and people who have faced many difficulties after the Covid-19 pandemic in the context that the growth rate has begun to show a downward trend from the fourth quarter of 2022 and especially in the first months of 2023.

However, according to Vice Chairman of the Finance and Budget Committee Nguyen Van Chi, at present, it is expected that the state budget collection in 2023 will still face many difficulties. Therefore, the majority of opinions in the Standing Committee of the Finance and Budget Committee do not agree with the expansion of the scope of application and suggest that the value-added tax should only be reduced to the same extent as in 2022 according to Resolution No. 43/2022/QH15.

Agreeing with the above viewpoint and expressing agreement with the policy of reducing value added tax, National Assembly Chairman Vuong Dinh Hue proposed the scope of application as in Resolution No. 43/2022/QH15.

According to the National Assembly Chairman, the contents of Resolution No. 43/2022/QH15 have been carefully assessed and calculated with the mindset of reducing taxes to stimulate demand and increase revenue, which is correct. However, the current situation is different from the time right after the pandemic, the revenue situation in 2023 is very difficult, businesses are in difficulty, people are in difficulty, so the concern is whether the policy when issued will really stimulate demand or not?

The National Assembly Chairman also noted that the draft resolution should stipulate that the Government is responsible for timely implementation; emphasizing the requirement to organize implementation to ensure feasibility, benefit both people and businesses, but not reduce budget revenue and not increase the budget deficit of 2023.

From another perspective, it is also believed that reducing tax from 10% to 8% is necessary, but Chairman of the Economic Committee Vu Hong Thanh said that the proposal to reduce value-added tax in May 2023 is relatively late, making the solution to reduce value-added tax rates not implemented continuously, so the policy does not really have an effect on the business sector.

Chairman of the Economic Committee Vu Hong Thanh also asked the Government to assess more clearly the impact of the tax reduction policy on stimulating consumption; at the same time, the impact of the policy on reducing state budget revenue, so that National Assembly deputies have more information.

NGUYEN THAO

Source

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

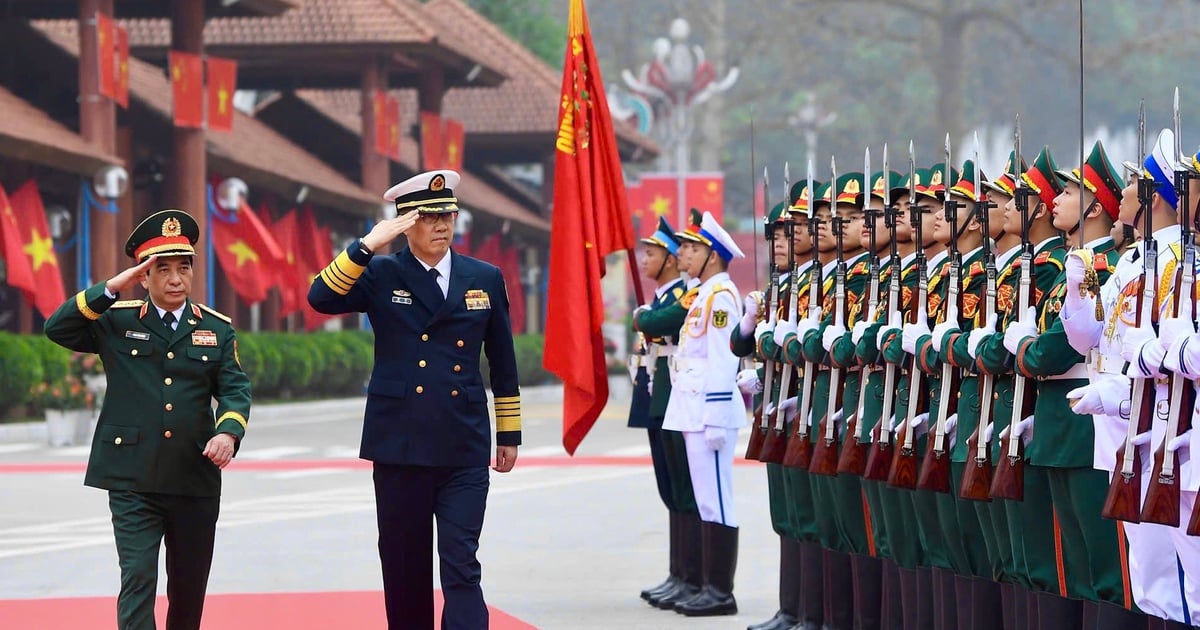

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)