According to regulations of the State Bank of Vietnam (SBV), from July 1, credit institutions must apply biometric authentication solutions for money transfer transactions over 10 million VND, and the information of the money transferor must match the database from the chip-embedded citizen identification card (CCCD).

New solution to prevent fraud

Decision No. 2345/QD-NHNN on implementing safety and security solutions in online payments and bank card payments of the State Bank of Vietnam clearly states: from July 1, money transfers over VND 10 million must be authenticated by face or fingerprint; total transaction amounts over VND 20 million/day must be authenticated by biometrics (can use chip-embedded ID card, VNeID account or biometric data stored in the bank's database).

According to experts, biometric authentication can minimize the possibility of counterfeiting and has the highest security today. This solution allows management agencies and service providers to accurately identify account holders, transaction makers, and beneficiaries. This contributes to further improving the effectiveness of high-tech crime prevention in cyberspace.

These solutions are aimed at responding to the situation where the financial and banking sectors are always the top targets of high-tech criminals. Subjects often use bank accounts and e-wallets that are not owned by the owner to receive and transfer fraudulent money, then use cryptocurrencies (USDT, Bitcoin...) as a money laundering tool. "The State Bank has researched and amended legal regulations, applying biometric authentication to individual customers when making online transactions, banks must identify that the person using the payment account is the owner" - the representative of the State Bank informed.

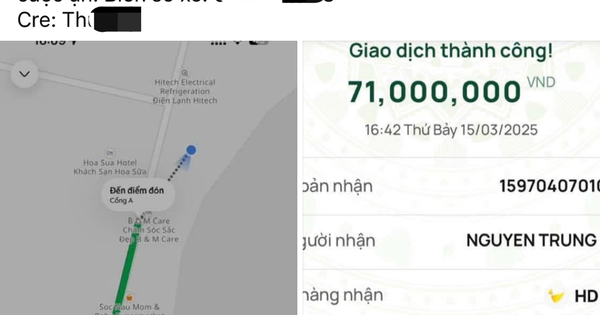

Banks have begun implementing biometric data authentication to prepare for application to money transfer transactions over 10 million VND from July 1. Photo: BINH AN

According to the reporter of Nguoi Lao Dong Newspaper, up to now, a series of banks have deployed solutions, encouraging customers to install and authenticate transactions using biometrics on digital banks.

For example, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has implemented a biometric transaction authentication method on the BIDV SmartBanking application. Accordingly, when customers make a money transfer of more than VND 10 million/transaction or less than VND 10 million/transaction but the total transaction amount in the day is VND 20 million or more, they must conduct facial authentication.

BIDV also recommends that individual customers, before making their first transaction using the Mobile Banking application or before making a transaction on a device other than the one they last made the transaction on, need to set up biometric authentication to ensure safe and secure transactions.

Asia Commercial Joint Stock Bank (ACB) said it is ready to authenticate money transfers using biometrics. Before making the first transaction using the Mobile Banking application or on another device, the bank will authenticate customers using biometric identification signs that match the data stored in the CCCD card chip; or through authentication of the customer's electronic identification account created by the electronic identification and authentication system...

Many other banks such as TPBank, Techcombank, OCB... are also implementing biometric data collection or have applied customer authentication using facial recognition instead of passwords or OTP codes. At OCB, after successfully installing the owner's facial image or fingerprint on the OCB OMNI application, all transactions of the account owner will be authenticated in just a few seconds.

"No door" to impersonation

According to Mr. Nguyen Dinh Tung, member of OCB's Board of Directors, connecting with the national population database helps the bank distinguish between real and fake information of the transactors, especially the act of impersonating someone else to open an account for fraud will be detected.

Mr. Hoang Minh Ngoc, Deputy General Director of the Bank for Agriculture and Rural Development of Vietnam (Agribank), said that biometric authentication linked to data with the Ministry of Public Security will help the bank prevent fraudulent transactions, and customer information will also become more accurate. From there, the bank will have a long-term customer data warehouse to reduce administrative procedures.

A leader of Nam A Commercial Joint Stock Bank (Nam A Bank) believes that the new regulation will help strengthen security and prevent high-tech criminals from taking advantage of customers' personal information to commit fraud. "The bank is implementing the requirements of Decision No. 2345 and applying the regulations correctly from July 1," the bank representative affirmed.

Mr. Vu Ngoc Son, Department of Research, Consulting, Technology Development and International Cooperation, Cyber Security Association, said that biometric authentication in money transfer transactions can help limit fraud. Recently, banks have discovered many transactions made by virtual accounts. That is, scammers buy people's accounts and then use the phone number registered to that account to transfer money to others to hide the flow of embezzled money.

However, according to the reporter of Nguoi Lao Dong Newspaper, some e-wallets and commercial banks said they are having difficulties in implementing the biometric authentication regulation, especially with total transactions of over 20 million VND/day. For example, if the 4th transaction of the day of a customer has a total value of 19 million VND but the 5th transaction the customer transfers 1.5 million VND, is biometric authentication required because at this time the total value will be 20.5 million VND.

What will happen to customers who have not yet verified their information or updated their biometric data after July 1? The leader of a joint stock commercial bank said that since it is a regulation, it must be applied and the bank will try to inform all customers to update.

"In the beginning, customer operations and experiences may not be as fast as they are now, but in the long term, it is necessary to ensure the safety of customer accounts, especially in the context of increasingly sophisticated high-tech crimes, the number of fraud cases of appropriating money in accounts and the scale of money loss cases is growing larger as it is today," the leader of this bank analyzed.

Bank data can still be faked

According to Mr. Vu Ngoc Son, the biometric data stored at some banks is collected by the banks themselves and may not be real, because scammers can provide fake data. Therefore, banks need to clean this data and connect with the national population database of the Ministry of Public Security to synchronize information.

Cross-checking the data of the transactor with the data stored by the Ministry of Public Security will help the bank determine whether the transaction is genuine or not. If there is no match, the transaction will be rejected, helping to prevent fraudulent acts of the bank.

Many countries have applied

Deputy Governor of the State Bank of Vietnam Pham Tien Dung said that so far, the Ministry of Public Security and the banking sector have cleaned up 49 million data sets of the National Credit Information Center, 3.5 million data sets of credit institutions, payment intermediaries and e-wallets. With this cleaning of data, if bad guys use fake or non-owner ID cards to open bank accounts to commit fraud, they will be detected.

According to statistics from the State Bank of Vietnam, currently only 10% of transactions are transfers of over 10 million VND. Thus, the impact of biometric authentication on people is not large. The money transferer only needs to show his face for the bank's system to identify and match the stored data within 3-5 seconds to complete the authentication.

Currently, some countries in the world have applied this measure. Most recently, the Central Bank of Thailand has stipulated that from June 2023, money transfers over 50,000 baht (1,400 USD) must be biometrically authenticated.

Source: https://nld.com.vn/chuyen-tien-an-toan-bang-sinh-trac-hoc-196240527214102517.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)