|

Is the insurance premium refunded when transferring vehicle ownership?

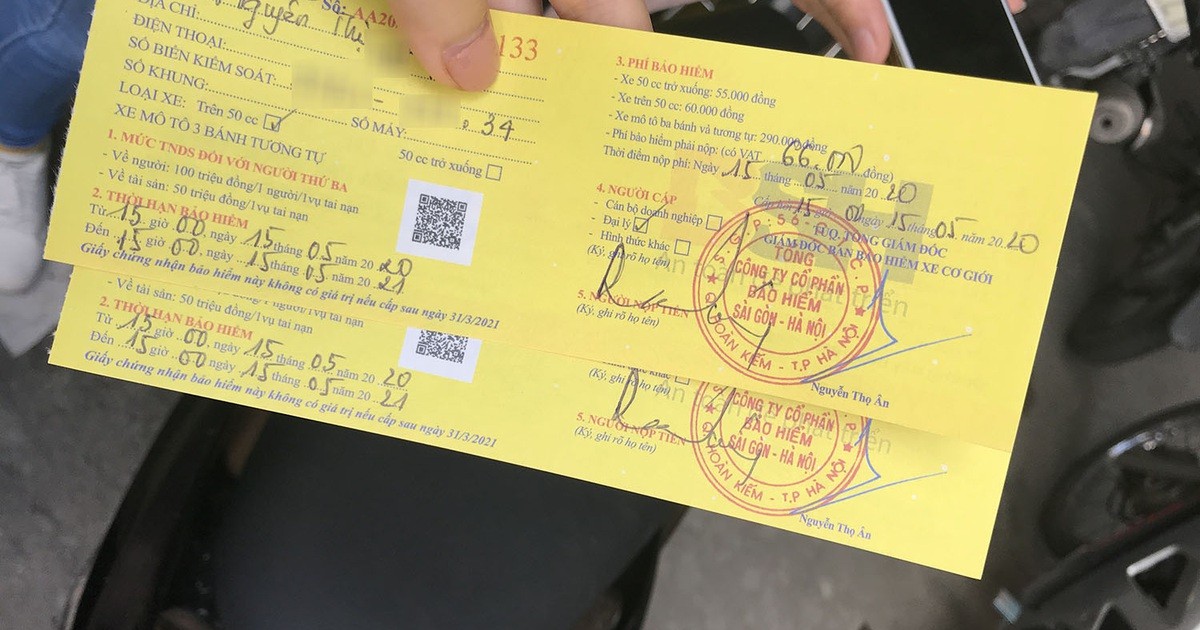

Pursuant to Clause 3, Article 9 of Decree 67/2023/ND-CP, within the effective period stated on the Insurance Certificate, if there is a transfer of ownership of the motor vehicle, the old motor vehicle owner has the right to terminate the insurance contract and receive a refund from the insurance company of the premium paid corresponding to the remaining term of the insurance contract.

Thus, when transferring vehicle ownership, the old vehicle owner can request to terminate the insurance contract to get back the insurance money corresponding to the remaining term on the insurance certificate.

Car Insurance Liability Limits

According to Article 6 of Decree 67/2023/ND-CP, the limit of vehicle insurance liability is prescribed as follows:

- The insurance liability limit for damage to health and life caused by motor vehicles is 150 million VND per person in an accident.

- Limit of liability for property damage:

+ Caused by two-wheeled motorbikes; three-wheeled motorbikes; motorbikes (including electric motorbikes) and vehicles with similar structures as prescribed by the Law on Road Traffic is 50 million VND per accident.

+ Caused by cars; tractors; trailers or semi-trailers pulled by cars or tractors as prescribed by the Road Traffic Law is 100 million VND in one accident.

How long is the insurance period?

The compulsory civil liability insurance period of motor vehicle owners is at least 1 year and at most 3 years, except for the following cases where the insurance period is less than 1 year:

- Foreign motor vehicles temporarily imported and re-exported with a duration of participation in traffic in the territory of the Socialist Republic of Vietnam of less than 1 year.

- Motor vehicles with a usage period of less than 1 year as prescribed by law.

- Motor vehicles subject to temporary registration according to regulations of the Minister of Public Security.

In case a motor vehicle owner has many vehicles insured at different times during the year but in the following year needs to bring them back to the same insurance period for management, the insurance period of these vehicles can be less than 1 year and equal to the remaining validity period of the first insurance contract signed in that year.

The insurance term of the following year for insurance contracts and insurance certificates after being brought back at the same time shall comply with the above provisions.

(Article 9 of Decree 67/2023/ND-CP)

How to refund insurance premiums, issue invoices and calculate taxes?

According to Clause 2, Article 9 of Circular 09/2011/TT-BTC, the regulations on insurance premium refund, invoice issuance and tax calculation are as follows:

- In case the insured customer is a business organization, when refunding the insurance premium (partially or in full), the insurance company requires the insured organization to issue a VAT invoice, clearly stating the amount of insurance premium refunded by the insurance company, VAT amount, and reason for refunding the insurance premium.

This invoice is the basis for insurance companies to adjust sales and output VAT, and for insurance participating organizations to adjust insurance purchase costs and declared or deducted VAT.

- In case the insured customer does not have a VAT invoice, when refunding the insurance premium, the insurance company and the insured customer must make a record or reach a written agreement clearly stating the amount of the refunded insurance premium (excluding VAT), the amount of VAT according to the insurance premium invoice that the insurance company has collected (invoice number, date, month), and the reason for refunding the insurance premium.

This record is kept together with the insurance premium invoice as a basis for adjusting the insurance company's revenue and VAT declaration.

In case the customer cannot provide the insurance premium invoice, the insurance company shall base on the invoice kept at the company and the minutes or agreement document to refund the insurance premium amount excluding VAT.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)