|

| VN-Index continued to increase strongly in the first trading session of the week. |

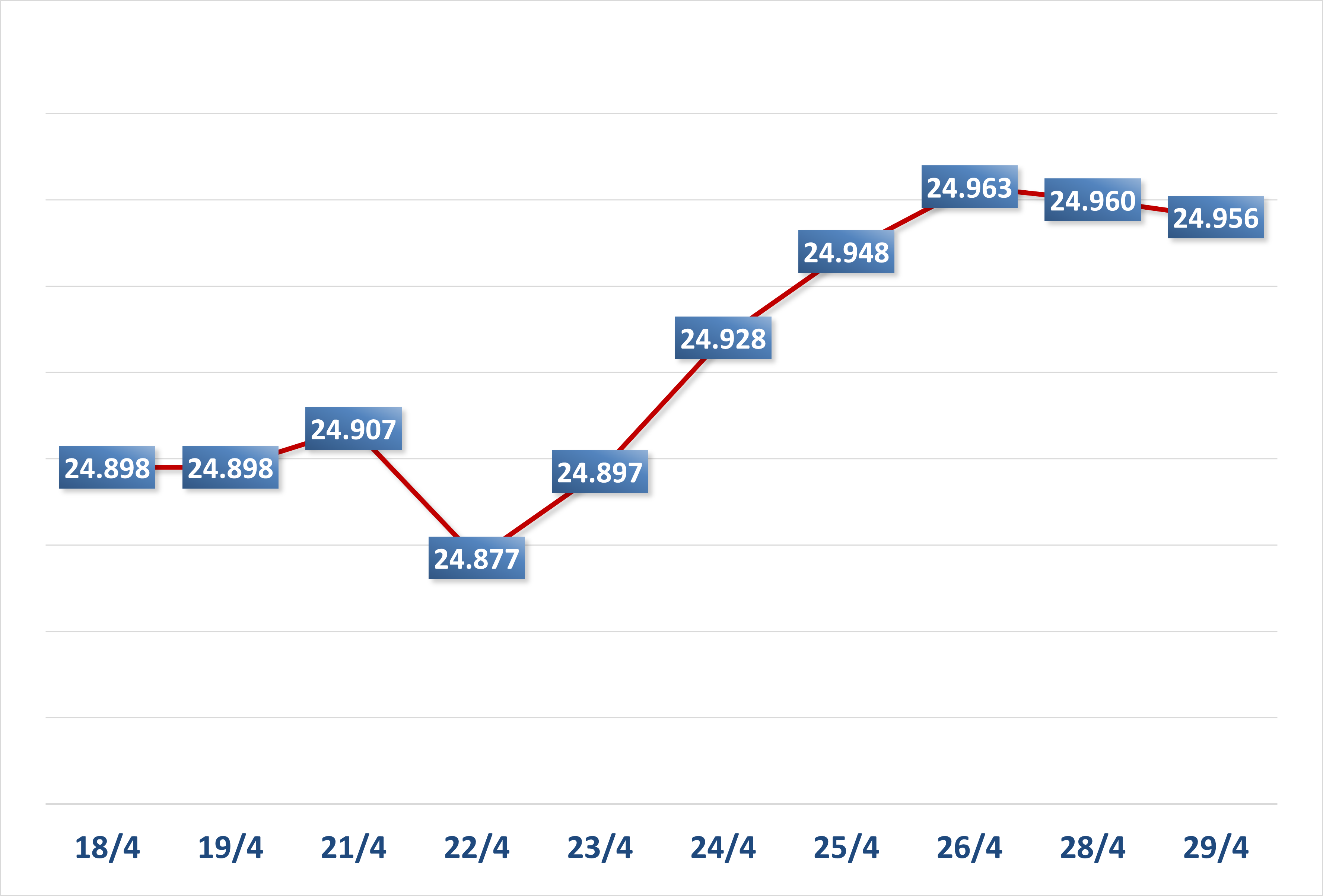

In the early afternoon session, a series of large and small stocks skyrocketed, including some codes affected by tariffs such as ANV, VHC, VGC. The price explosion of these stocks, combined with the ceiling increase of nearly 30 other codes, helped HSX record more than 300 codes increasing. The VIC duo, VIC and VHM, continued their strong increase when increasing to the full amplitude. Thanks to that, the VN-Index closed up nearly 19 points compared to the reference. However, liquidity only reached more than 24 trillion VND.

Commenting on the underlying market, experts said that Asian stocks increased in unison as there were brighter prospects in trade negotiations with the US. Domestically, the VN-Index increased by nearly 19 points with the VIC duo leading the way.

Technically, the VN-Index increased sharply and closed with a small candlestick, showing that although buying power is still dominant, it is no longer completely overwhelming selling power like in previous sessions. The index is approaching the resistance of 1,250 points and is expected to fluctuate around the range of 1,230-1,250 points in the next few sessions. Investors should limit chasing purchases at the next resistance zone.

From VCBS's perspective, the VN-Index continued to recover, increasing by 19 points despite slowing liquidity. The main driving force was Vin Group (VIC hit the ceiling, VHM +4.86%, VRE +3.09%) and HPG (+4.12%). In contrast, banking stocks showed signs of correction, which somewhat affected the growth of the general index. Cash flow showed a clearer differentiation when rotating to other stocks/industries such as real estate-industrial parks, retail, chemicals-fertilizers, and construction. Liquidity was recorded to decrease by about 45% compared to the same time of the previous session, showing that the market is finding its balance after two previous strong recovery sessions.

With more active participation of demand, VN-Index recorded a widening of the increase in the afternoon session, the highest level of the day increased by more than 20 points compared to the reference. In addition to the stock groups that maintained the increasing momentum from the morning session, the afternoon session saw the participation of the securities group (VIX +7%, VND +6.6%) and the shipping group (HAH +5.88%, PVT +7%). Foreign investors returned to slight net selling with a total net value of 113.82 billion, mainly selling FPT, HCM, VNM. At the end of the session, VN-Index closed at 1,241.44 points, up 18.98 points, equivalent to 1.55%.

Technical analysis, VCBS believes that VN-Index closed at a near session high, reflecting the efforts of demand and the support of some large-cap stocks. On the daily chart, the general index is getting closer to the old support zone of 1,250 points with clearer differentiation between industry groups. The CMF indicator crossed the 0 mark, showing that demand is still temporarily dominant with smart money looking for stocks with good potential in the short and medium term. However, all 3 lines +/-DI and ADX are moving above the 25 mark, so it is highly likely that VN-Index will move sideways in the 1,230-1,250 point range to find balance before moving up to higher points.

On the hourly chart, the RSI and MACD indicators are moving up and have not yet shown any signs of forming a peak. At the same time, the CMF money flow indicator continues to hover above the 0 mark and is pointing upwards, indicating that the market is still in a stable recovery phase. However, with liquidity no longer fluctuating as strongly as in previous sessions, there is a high probability that the general index will move back to a stable support zone of 1,230-1,250 points to balance in the short term.

Regarding trading strategy, VCBS believes that the market continues to recover and increase points, however, the increase has slowed down somewhat as cash flow signals that differentiation may occur in the coming sessions. With the current developments, investors are recommended to continue holding stocks that are maintaining strong growth momentum, and can select some stocks in industry groups that are attracting good cash flow in the session to disburse exploratory investments with a small proportion to take advantage of the recovery momentum of the general market. Some notable industry groups include retail, shipping, and securities.

Source: https://thoibaonganhang.vn/tiep-da-hoi-phuc-vn-index-tang-gan-19-diem-162741.html

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] Nghe An: Bustling atmosphere celebrating the 50th anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/64f2981da7bb4b0eb1940aa64034e6a7)

![[Photo] Prime Minister Pham Minh Chinh meets to prepare for negotiations with the United States](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/76e3106b9a114f37a2905bc41df55f48)

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

![[Photo] People choose places to watch the parade from noon on April 29](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/3f7525d7a7154d839ff9154db2ecbb1b)

Comment (0)