| Commodity market today, June 11, 2024: World raw material prices fluctuate in opposite directions Commodity market today, June 12, 2024: Energy prices record a stable increase |

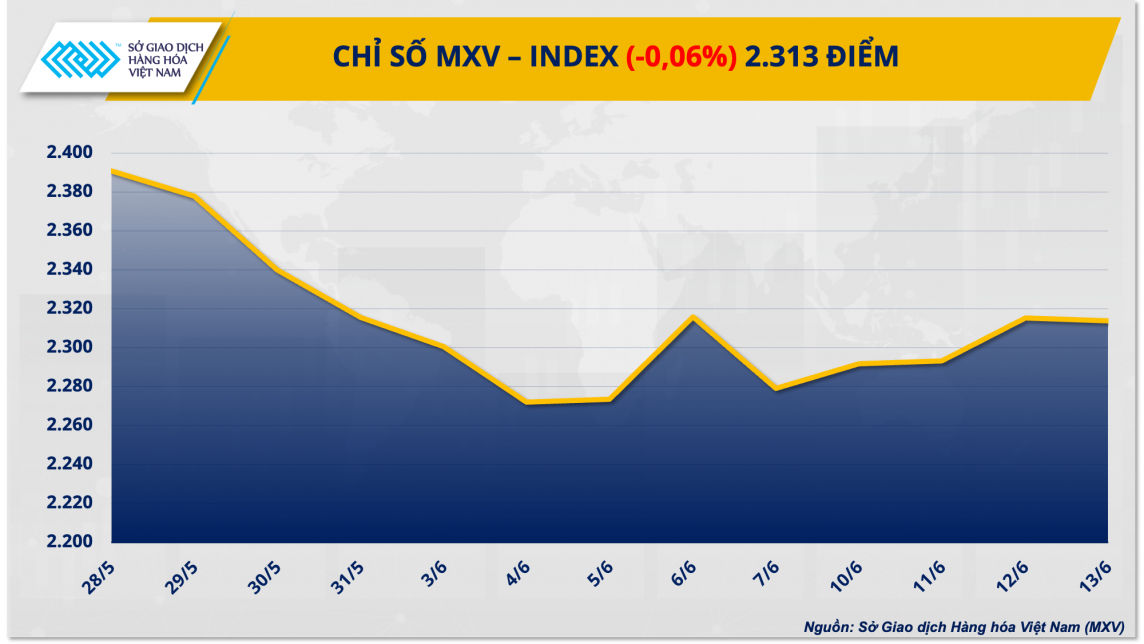

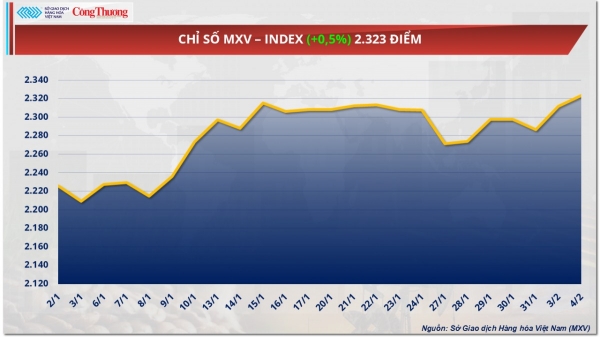

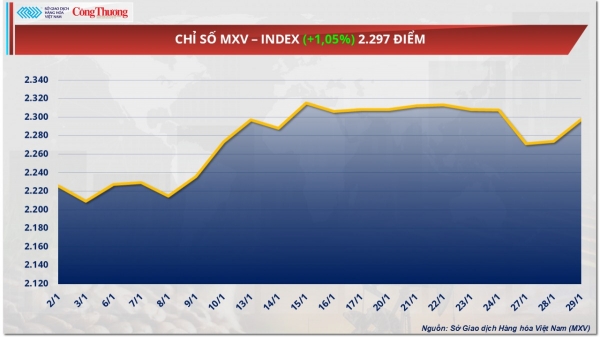

Green and red colors intertwine the price charts of energy and industrial materials. Agricultural products increased in price while metals fell sharply. The MXV-Index weakened slightly after three consecutive sessions of increase, with a decrease of 0.06% to 2,313 points.

|

Cocoa prices continue to head towards new highs amid supply shortage concerns

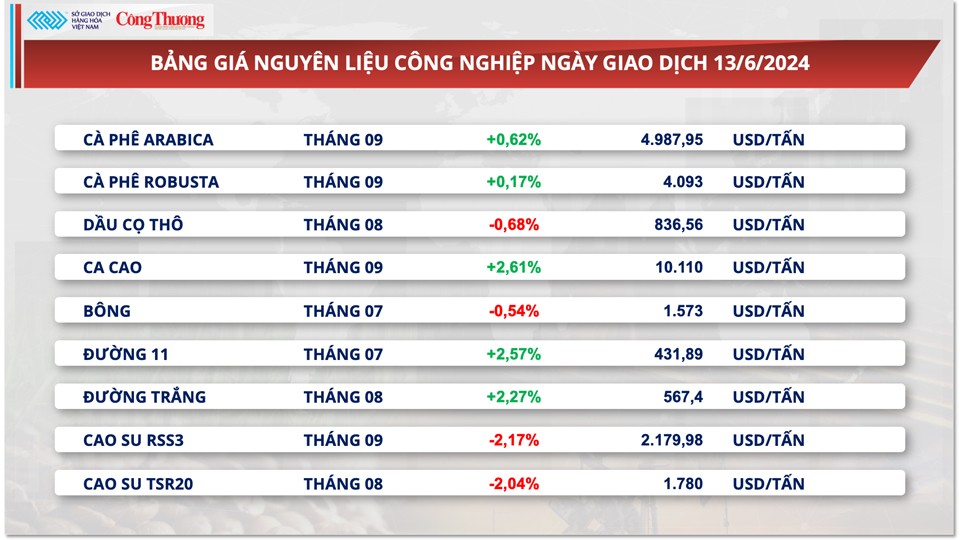

At the end of the session on June 13, the price of cocoa for September continued to increase strongly for the third consecutive session, with an increase of 2.61% to 10,110 USD/ton. This is the highest price in the past 1.5 months. Concerns about cocoa supply shortage have been raised as leading producers have shown signs of stopping exports and pre-selling for the new crop.

Ivory Coast, the world's largest cocoa exporter, has suspended cocoa exports and sales for the 2024-2025 crop year, down about 35% from the previous crop, Reuters reported in June. The export ban will last until after June for multinationals. Currently, sales are for domestic consumption only. Exporters said they are waiting for clearer information on expected production to decide how much to sell and export.

|

| Industrial raw material price list |

Ghana, the world’s second-largest cocoa producer, said earlier that its cocoa exporters were seeking to delay the delivery of 350,000 tonnes of beans for the 2024-2025 season due to poor harvests. Sources predicted that Ghana’s cocoa sales could be as low as 100,000 tonnes following the announcement, a figure far below the average of 750,000-850,000 tonnes in previous seasons.

Traders are also becoming more pessimistic about the prospects for new crop supplies in the two countries that account for over 60% of global cocoa production. Accordingly, cocoa production in Ivory Coast and Ghana could decrease by up to 30% compared to the previous crop, posing a high risk of short-term supply shortages. Of which, the size of Ghana's crop could be just under 500,000 tons, lower than the amount of cocoa exported in previous crops.

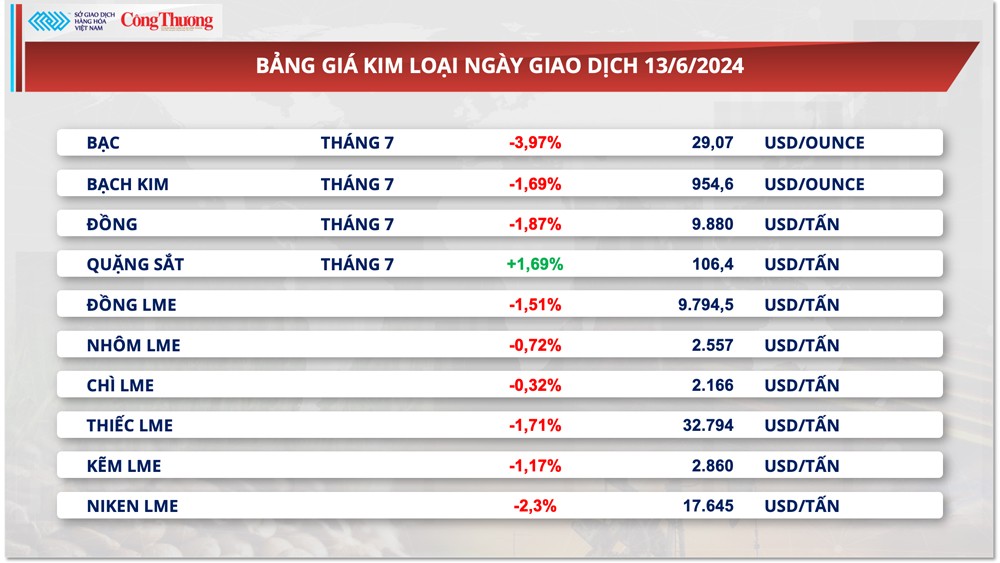

Tough message from the FED sends metal prices plunging

At the end of the trading day on June 13, red dominated the metal price chart with 9 out of 10 items falling in price. For precious metals, with overwhelming selling pressure from the beginning of the session, silver and platinum prices fell sharply due to increasing macro pressure. At the end of the day, silver prices fell 3.97% to $29.06/ounce, the lowest level in nearly a month. Platinum prices also weakened to a 6-week low with a decrease of 1.69% to $954.6/ounce.

|

| Metal price list |

Since the US Federal Reserve (FED) announced its interest rate decision early yesterday morning, the precious metals market has been under considerable pressure. According to the FED's statement, the FED is expected to cut interest rates only once this year, much less than the forecast of three cuts in March. This has raised concerns that the FED may continue to maintain the current high interest rates and may delay the timing of monetary policy easing until December, much later than the previous forecast of July or September.

This tough move from the FED has helped strengthen the USD. The Dollar Index closed yesterday up 0.53% to 105.2 points. High investment costs combined with interest rate risks have caused silver and platinum prices to plummet.

In other developments, increasing macro pressures are also a negative factor for base metal prices. Copper and nickel, important input materials in the production of electric vehicle batteries, have faced strong selling pressure due to concerns about slowing consumption in the green energy sector. At the end of the day, COMEX copper prices fell 1.87% to $4.48/pound. Nickel prices fell 2.3% to $17,645/ton, the lowest level since early April.

In its latest Electric Vehicle Outlook report, BloombergNEF warned that a wave of rapid global battery production growth could cause supply to outpace demand for the rest of the decade. By the end of 2025, the global battery industry will be able to produce five times more batteries than the world needs, the report said.

Prices of some other goods

|

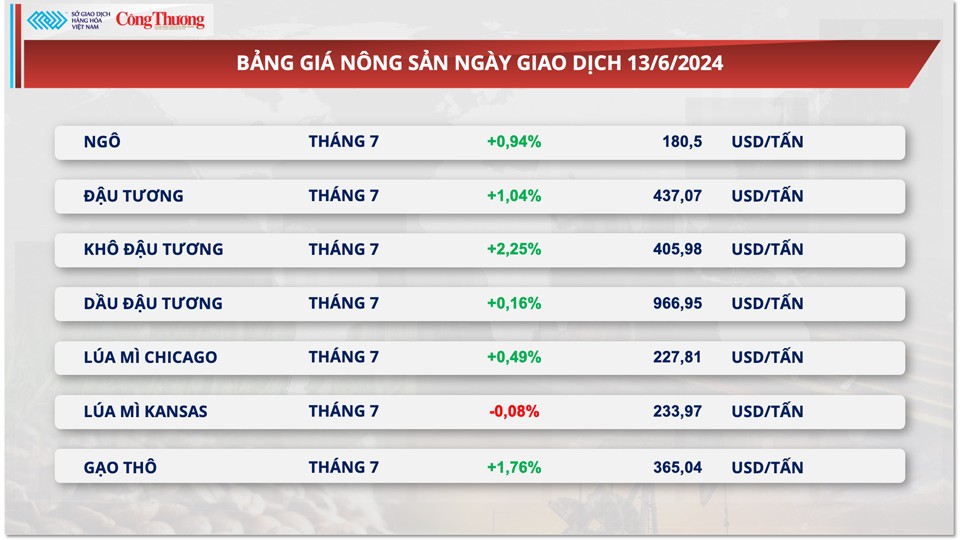

| Agricultural product price list |

|

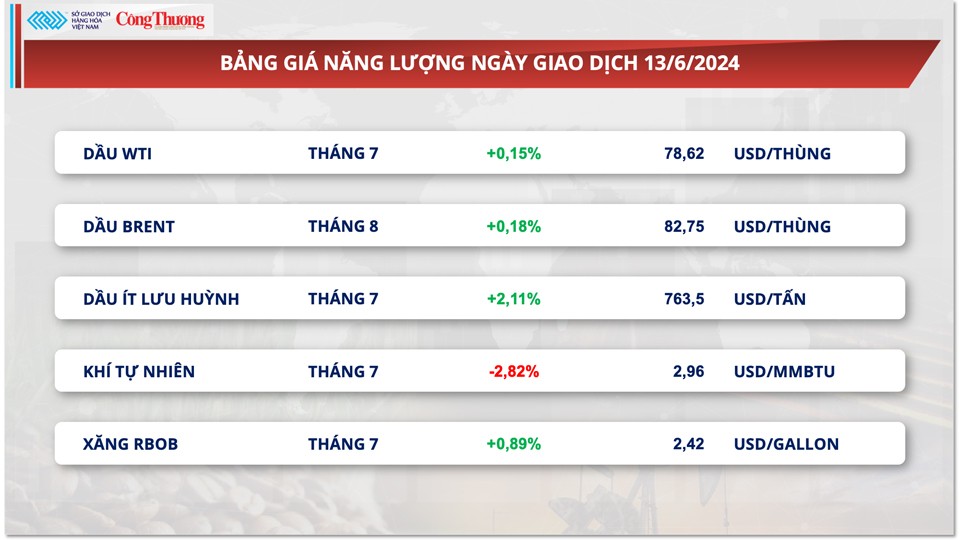

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1462024-chi-so-mxv-index-suy-yeu-nhe-sau-ba-phien-tang-lien-tiep-326090.html

Comment (0)