Closing, Arabica coffee prices broke the record and set an unprecedented peak when they increased by 2.53%, surpassing 8,081 USD/ton; Robusta coffee prices increased by nearly 0.9% to 5,609 USD/ton.

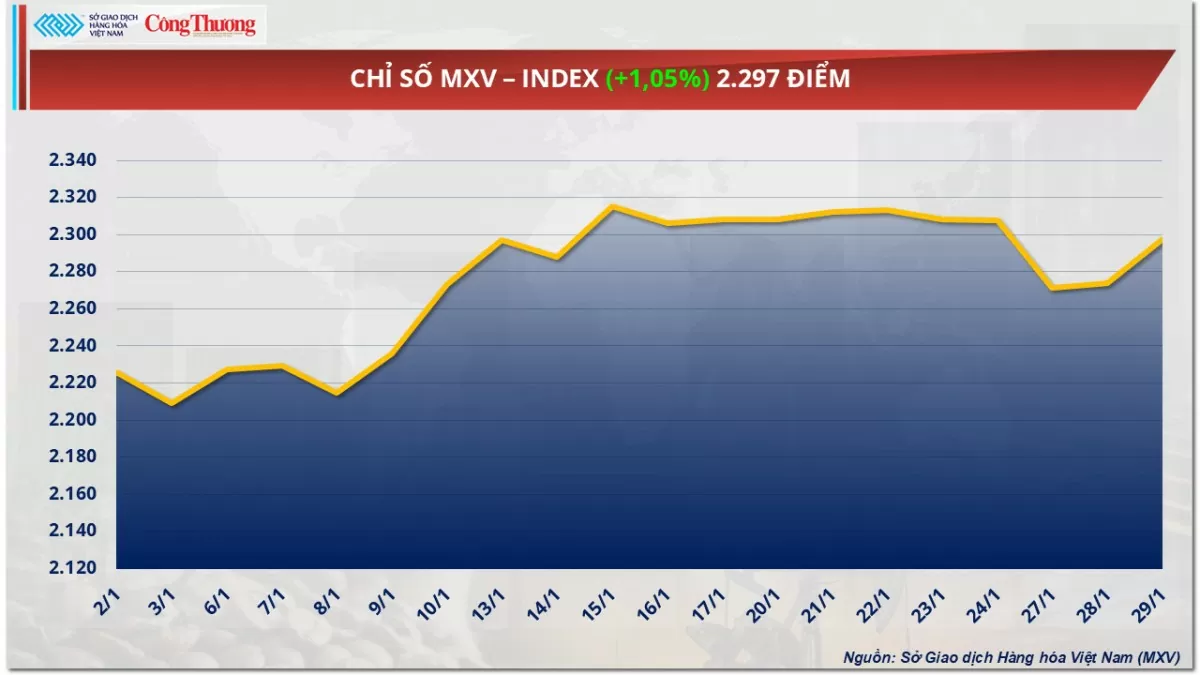

According to the Vietnam Commodity Exchange (MXV), buying power dominated the world raw material market in yesterday's trading session (January 29). At the end of the session, the MXV-Index increased by 1.05% to 2,297 points. Notably, Arabica coffee prices continued to set a new all-time high. In addition, soybean prices extended their increase to the second session due to weather concerns in South America.

|

| MXV-Index |

Arabica coffee climbs to new peak

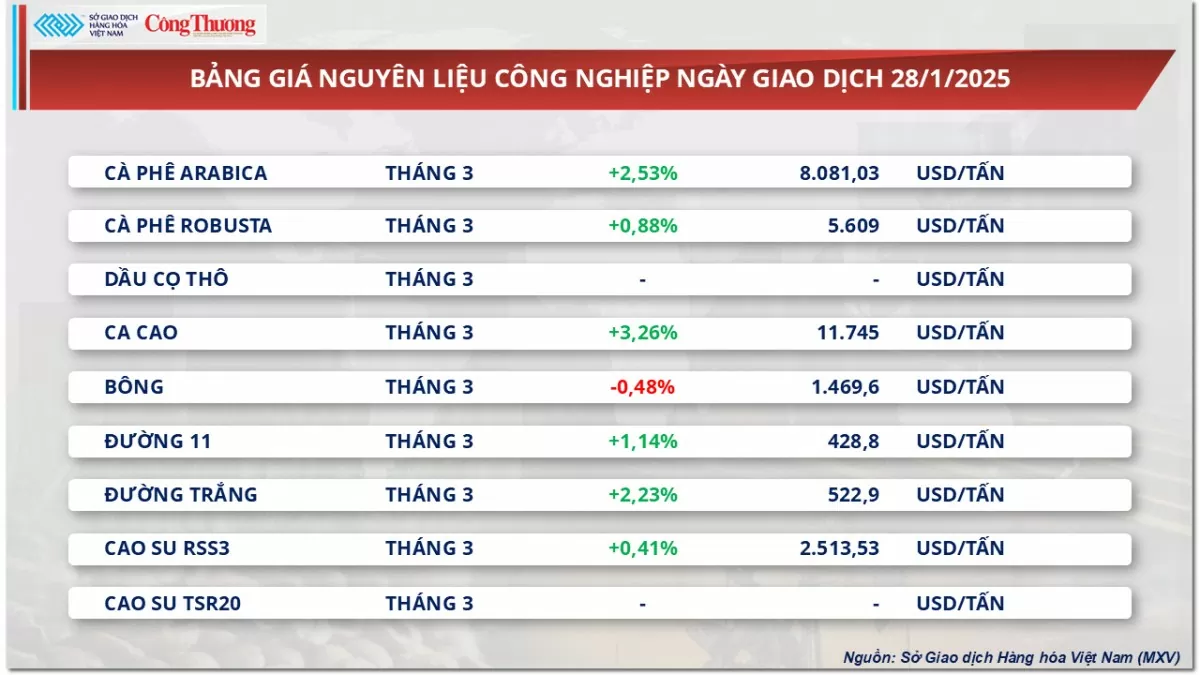

Green dominates the price list of industrial raw materials. In particular, coffee attracted special attention from the market in yesterday's trading session.

Closing, Arabica coffee prices broke the record and set an unprecedented peak when they increased by 2.53%, surpassing 8,081 USD/ton; Robusta coffee prices also increased by nearly 0.9% to 5,609 USD/ton - the highest level in the past two months.

|

| Industrial raw material price list |

Although the weather in Brazil, the world’s largest coffee producer, has recently improved after a drought last year, concerns about supply from the country remain. On Tuesday, the Brazilian Crop Supply Agency (CONAB) forecast that Brazil’s 2025-2026 coffee crop will fall 4.4% year-on-year to a three-year low of 51.81 million bags.

The country’s current coffee stocks have fallen to around 500,000 bags, down from the usual 8 million bags, brokerage Sucden said in a report, meaning any weather disruption could have a major impact on global coffee prices.

Sucden added that Brazilian farmers are prioritizing domestic sales rather than exports in USD. The weakening USD/BRL exchange rate has indirectly affected coffee exports in Brazil, while also boosting coffee buying in yesterday's session.

Additionally, brokerage HedgePoint Global Markets said yesterday that global coffee supplies remain tight. While Vietnam’s Robusta sales remain sluggish, the Arabica harvest in Central America and Colombia is taking longer to reach the market, and Brazilian farmers are not eager to sell more.

In India, one of the world’s top producers of Robusta coffee, exports are expected to fall more than 10% this year from last year’s record 295,402 tonnes even as coffee prices hit record highs due to lower output and falling inventories from the previous crop.

According to the latest weather forecast, the Central Highlands region will record temperatures 1°C higher than average, along with rainfall exceeding 15mm compared to the average over the next 15 days. These weather conditions are forecast to have a significant impact on the progress of local coffee harvests and continue to affect coffee prices in the coming time.

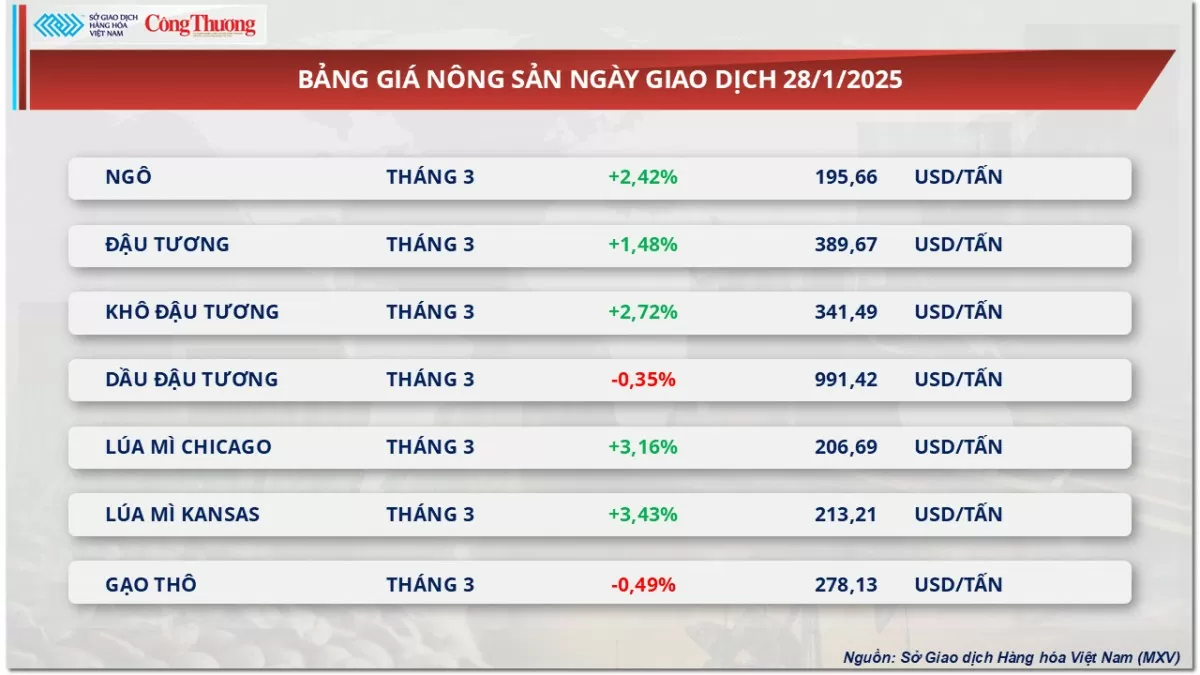

Green covers the agricultural market

The agricultural market closed the trading session on January 29 on a positive note, recording strong demand. In line with the increase in grain products, soybean prices recorded an increase of 1.48% to 389.6 USD/ton. According to MXV, the market was supported by the forecast of bad weather in the Southern Hemisphere, raising concerns about the short-term supply outlook.

|

| Agricultural product price list |

Weather forecasts for next week show less rain in dry areas of Argentina and southern Brazil, while areas currently harvesting soybeans will see more rain. Last week's rain in Argentina was not enough to lift soybeans out of drought, experts said. In addition, showers in Brazil have slowed the soybean harvest. Against this backdrop, LSEG Commodity Research has slightly lowered its forecast for Brazil's soybean production to 170.2 million tonnes as unfavorable weather conditions late in the season delayed harvesting, causing significant delays in the main production areas of the Midwest and Southeast of Brazil. Concerns about South American supplies have fueled buying in the market.

Corn prices closed up nearly 2.5% on Thursday, hitting their highest level since mid-November. The market was supported by the possibility of easing tariffs on Mexico. President Trump’s nominee for Secretary of Commerce, Howard Lutnick, said Canada and Mexico could avoid 25% import tariffs if the two countries take drastic action to stop the flow of fentanyl and illegal immigrants into the United States. According to Mr. Lutnick, this is a separate tariff measure to put pressure on Mexico and Canada to take specific actions. He also revealed that he has received positive signals that both neighboring countries are taking quick steps and if this trend is maintained, there is a high possibility that tariffs will not be applied. As the largest market for corn imports from the United States, the prospect of Mexico avoiding tariffs has painted a positive picture of demand, thereby supporting the rise in corn prices.

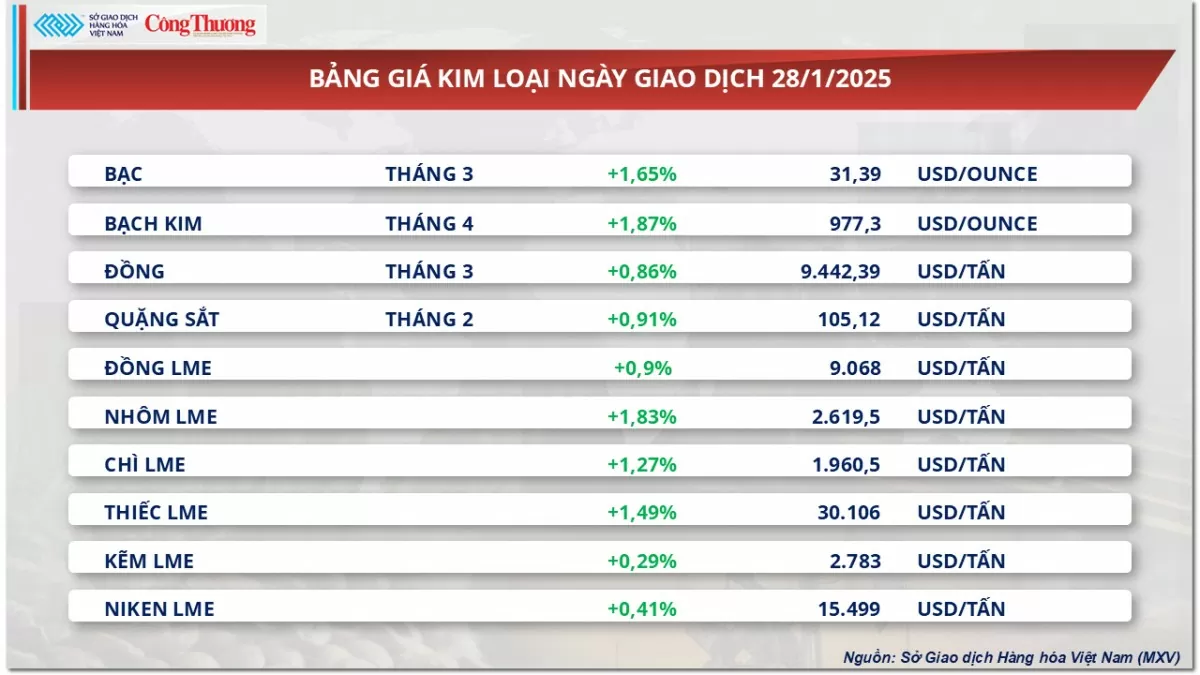

Prices of some other goods

|

| Metal price list |

|

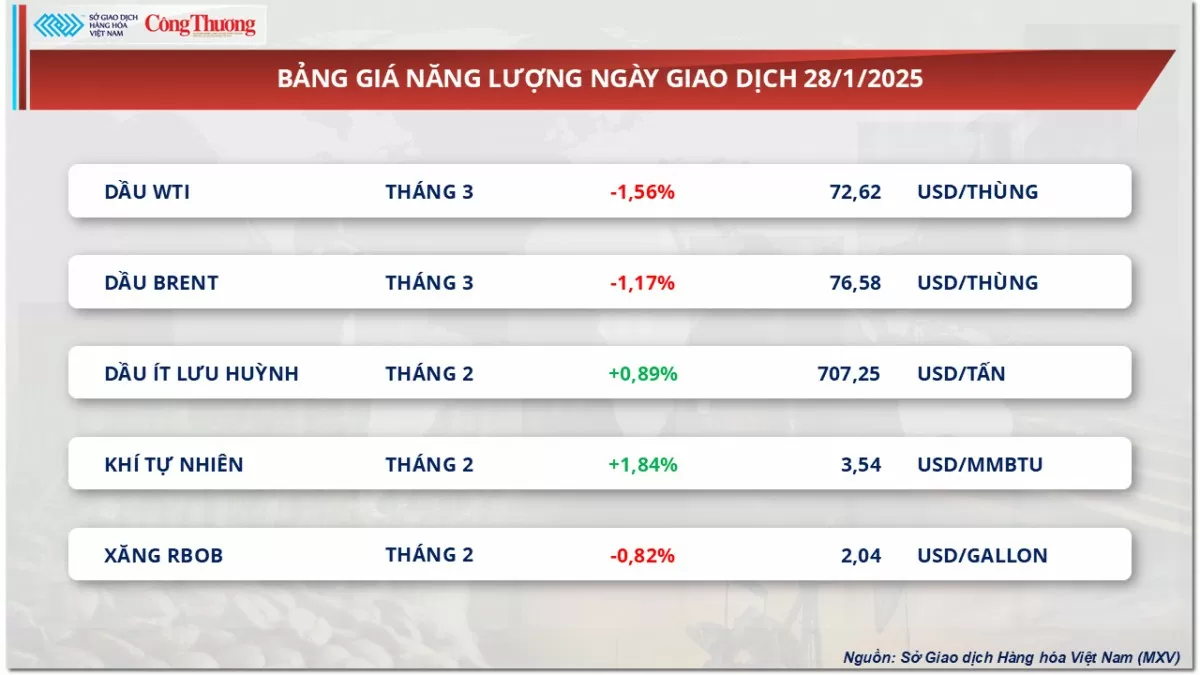

| Energy price list |

Source: https://congthuong.vn/gia-ca-phe-arabica-pha-vo-ky-luc-lich-su-371703.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)