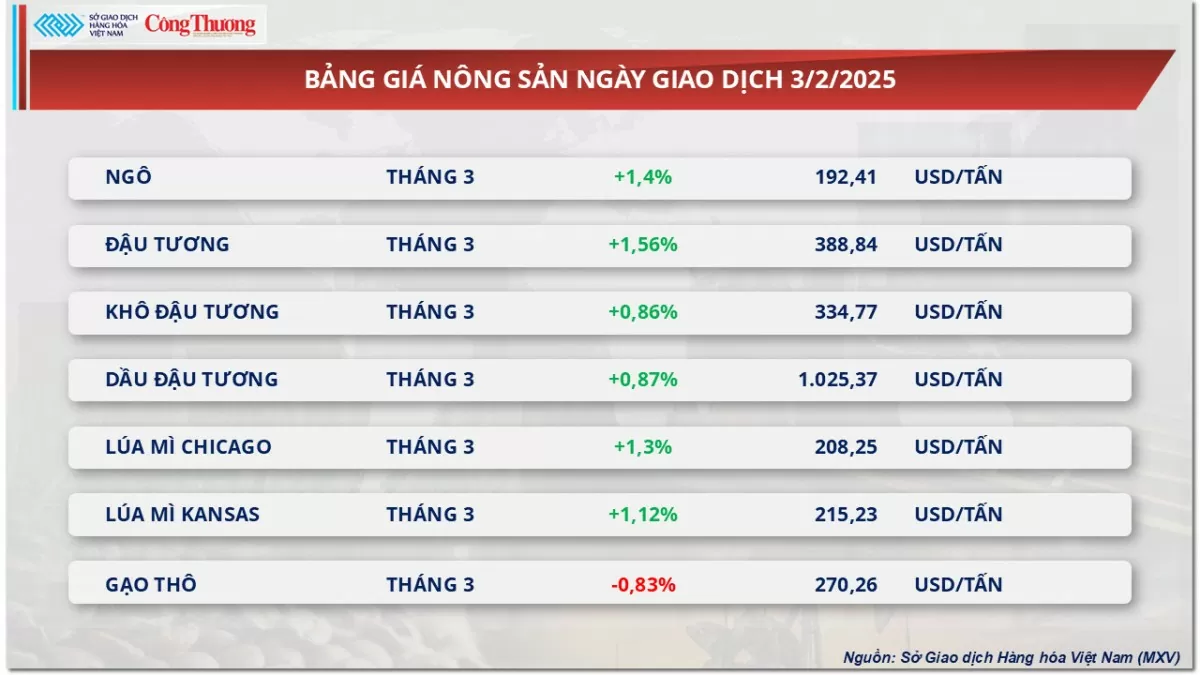

Closing the first trading session of February, soybean prices recovered more than 1.5% to 388 USD/ton, completely erasing the decrease in the previous session.

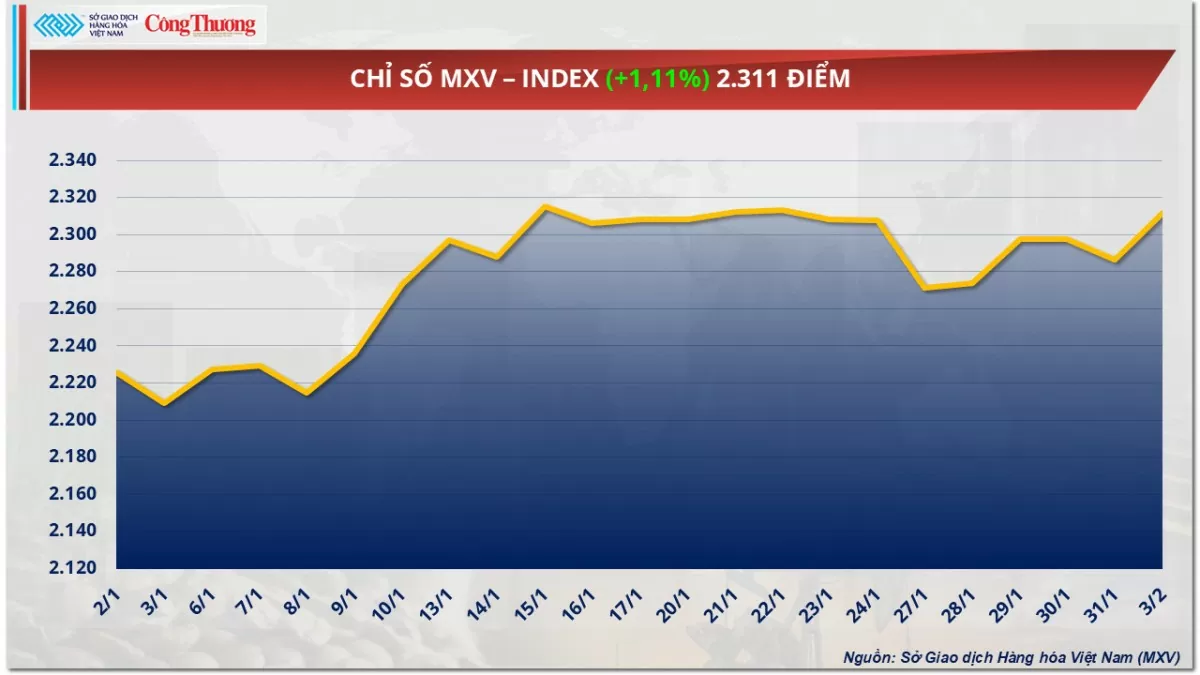

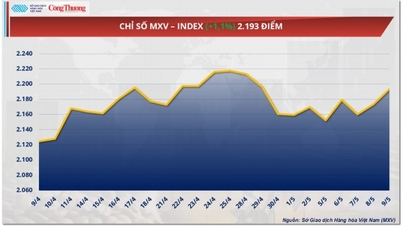

According to the Vietnam Commodity Exchange (MXV), the world raw material market fluctuated strongly in the first trading session of the week (February 3). Notably, the agricultural product market saw 6 out of 7 commodities increase in price. In addition, the energy price list, the price of two crude oil commodities increased slightly, while the price of gas skyrocketed by more than 10%. Closing, the overwhelming buying force pulled the MXV-Index up 1.11% to 2,311 points.

|

| MXV Index - Index |

Soybean prices rebound

Soybean prices closed the first trading session of February up more than 1.5% to $388/ton, erasing the previous session’s losses. Prices were supported by adverse weather in South America and changes in President Donald Trump’s tariff policies.

|

| Agricultural product price list |

US President Donald Trump announced on February 3 that he would suspend tariffs on Mexican imports for one month after speaking with his Mexican counterpart Claudia Sheinbaum. Trump said that the US and Mexico would use the month-long suspension to engage in further negotiations. Trump's decision to postpone tariffs on Mexico and Canada shows Washington's more cautious, flexible and accommodating tariff policy at the moment, thereby raising hopes in the market that negotiations with China will take place soon. If the Trump administration also takes a softer approach to China, trade tensions between the two countries may be avoided. This is good news for US soybean exports, helping to support prices.

Meanwhile, the weather in South America is clearly diverging, with Argentina experiencing drought and Brazil experiencing wet weather. Brazilian farmers are still struggling as wet conditions slow the soybean harvest. Meanwhile, crops in Argentina continue to be affected by drought. The recent rains have not been enough to improve the situation and the country will need more rain in the coming time. The bad weather in South America also boosted buying in the market yesterday.

Yesterday’s Export Inspections report showed that in the week ending January 30, US soybean deliveries reached 1.01 million tonnes, up from 738,000 tonnes the previous week. The US has delivered a total of 34 million tonnes of soybeans since the beginning of the 2024-2025 crop year, up from 29 million tonnes in the previous crop year. This shows that US export activities are relatively positive.

On the price chart, two finished soybean products, soybean meal and soybean oil, fluctuated in opposite directions. Soybean oil closed at its highest level in more than two months due to the US decision to postpone the imposition of tariffs on Mexico.

Natural gas prices spike more than 10%

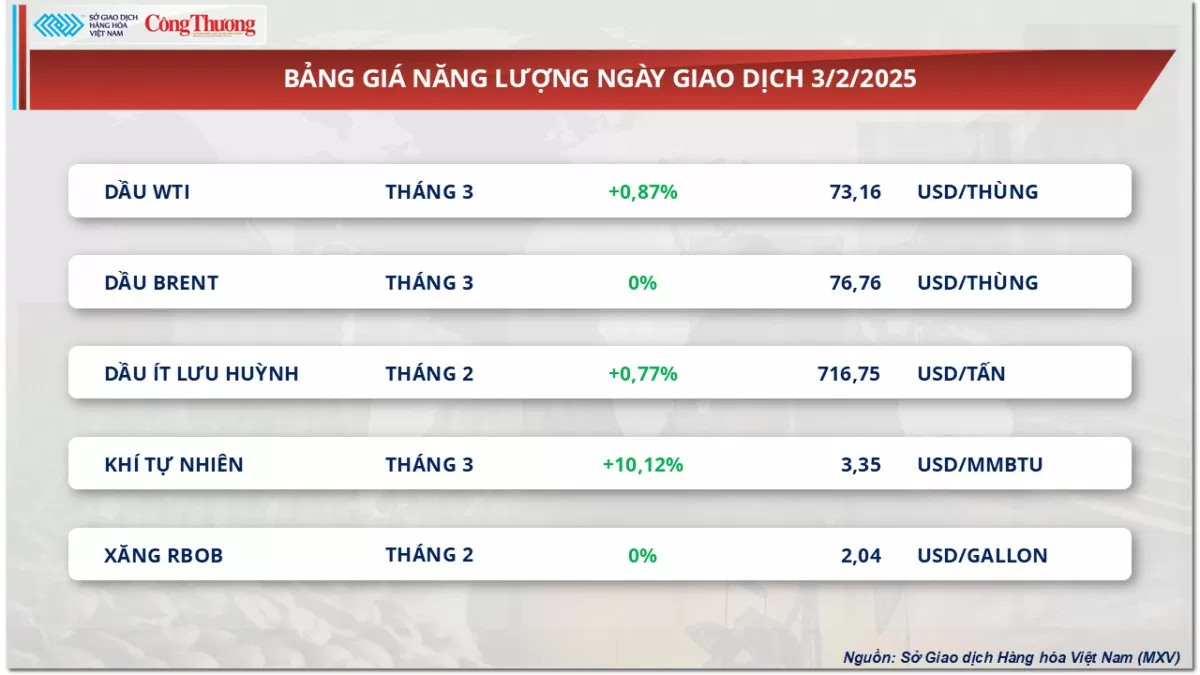

According to MXV, the energy market closed yesterday with green. Notably, the prices of two crude oil products increased slightly but remained at their lowest levels in the past month. Meanwhile, natural gas prices skyrocketed amid the still severe weather in the US.

Specifically, WTI crude oil prices edged up 0.87% to $73.16/barrel; Brent crude oil prices were stable at $76.76/barrel. Natural gas prices jumped 0.31 cents, or about 10.12%, to $3.35/MMBtu.

|

| Energy price list |

Oil prices rose more than $1 a barrel during the session before Mr. Trump suspended new tariffs on Mexico for a month after Mexico agreed to beef up security at its northern border to ease the problem of fentanyl and illegal immigration into the United States. Exports from Canada and Mexico account for about a quarter of the oil that U.S. refiners convert into fuels like gasoline and heating oil, according to the U.S. Department of Energy.

US manufacturing activity grew for the first time in more than two years in January, according to a survey by the Institute for Supply Management. The manufacturing purchasing managers index (PMI) rose to 50.9, the highest since September 2022 and 1.7 higher than the reading in December 2024. However, these recoveries may not last long as Mr. Trump’s tariffs could increase raw material prices and disrupt supply chains.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed yesterday to maintain a policy of gradually increasing oil output from April and to remove the US Energy Information Administration from the sources used to monitor output and compliance with oil supply pacts.

The Federal Reserve recently expressed concern about the impact of Trump's tariff policies on inflation, so the Fed did not adjust interest rates for the next operating period. At the same time, it warned that higher inflation could prompt the Fed to raise interest rates to counter rising prices. That could reduce energy demand by increasing borrowing costs and slowing economic growth.

Natural gas prices have surged to a seven-day high on forecasts for colder temperatures in the United States, boosting demand for natural gas for heating. Tightening U.S. natural gas supplies have also supported prices. The EIA inventory report showed that U.S. natural gas inventories as of January 24 were 4.1% below the five-year average for the same period, the first time in two years that supplies have been below the five-year average.

In Europe, gas storage was only 55% full as of January 28, below the five-year seasonal average of 62%. This has pushed European natural gas prices to their highest level in 15 months.

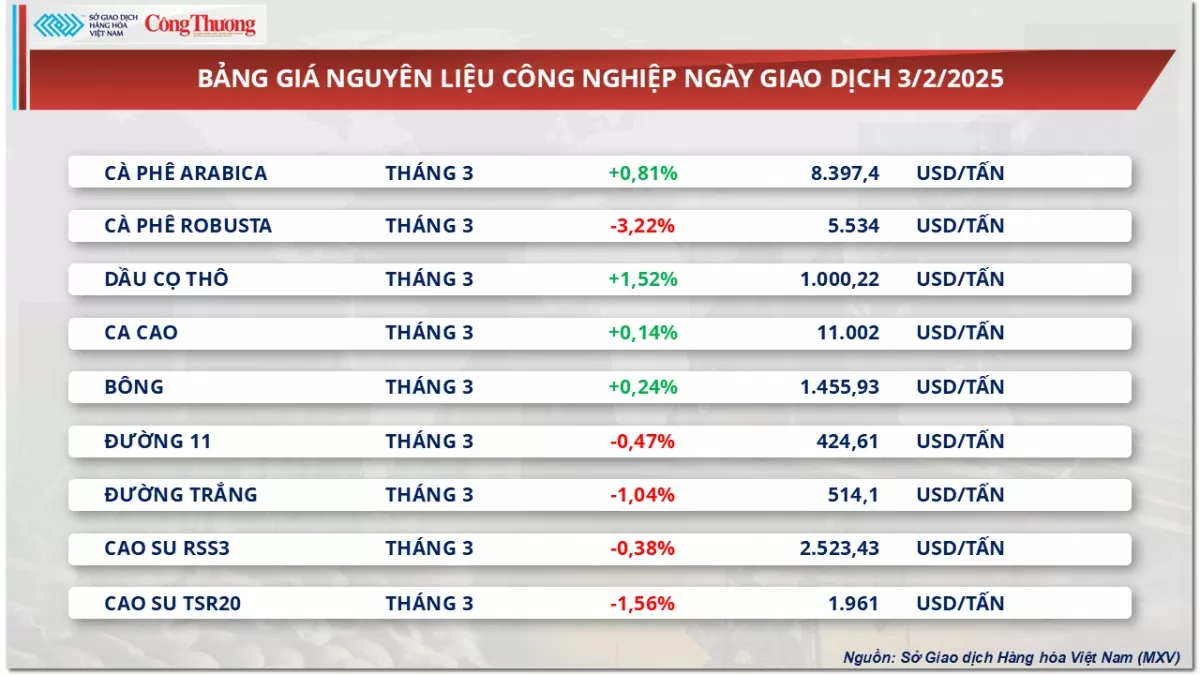

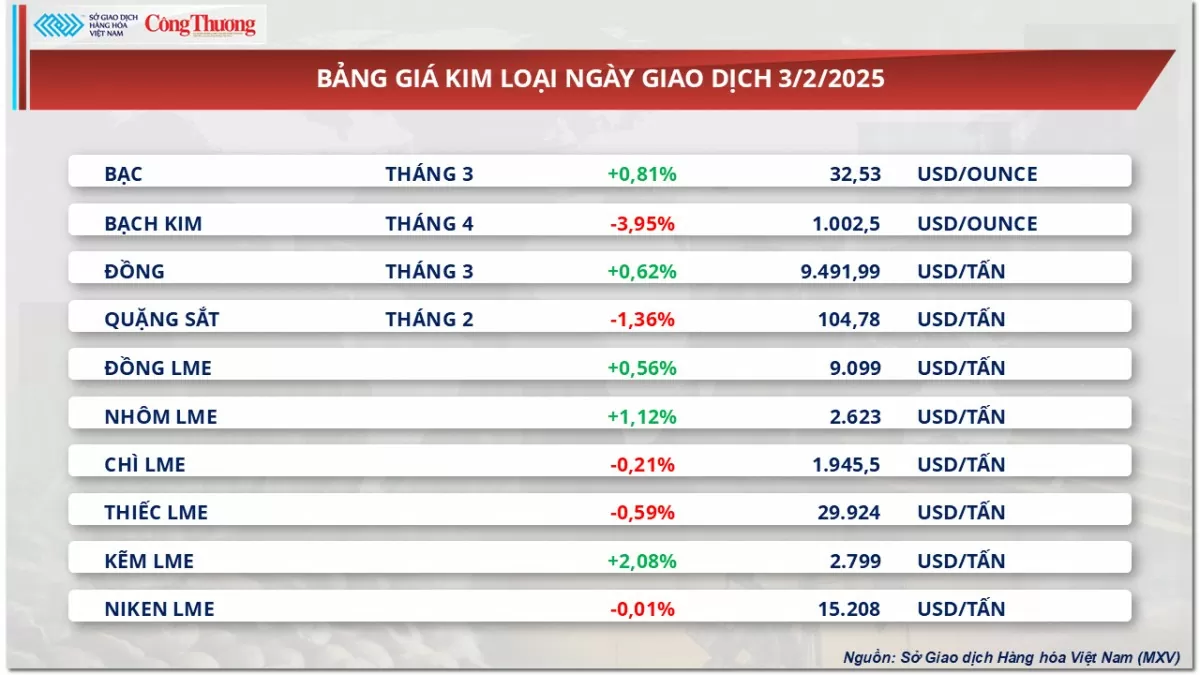

Prices of some other goods

|

| Industrial raw material price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-42-gia-dau-tuong-phuc-hoi-tro-lai-372133.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)