Robusta coffee prices set a historical record high, rising 2.9% to $5,817 per ton; Arabica coffee prices also increased 4.44% to $9,519 per ton.

According to the Vietnam Commodity Exchange (MXV), the global raw materials market experienced a tug-of-war during yesterday's trading session. In particular, in the industrial raw materials market, the prices of both coffee and other commodities reversed course and rose sharply amid concerns about supply. Conversely, the prices of both crude oil and other commodities came under pressure following the EIA report. At closing, the MXV-Index fell 0.1% to 2,342 points, ending a streak of four consecutive days of gains.

|

| MXV-Index |

Coffee prices are back on track to rise.

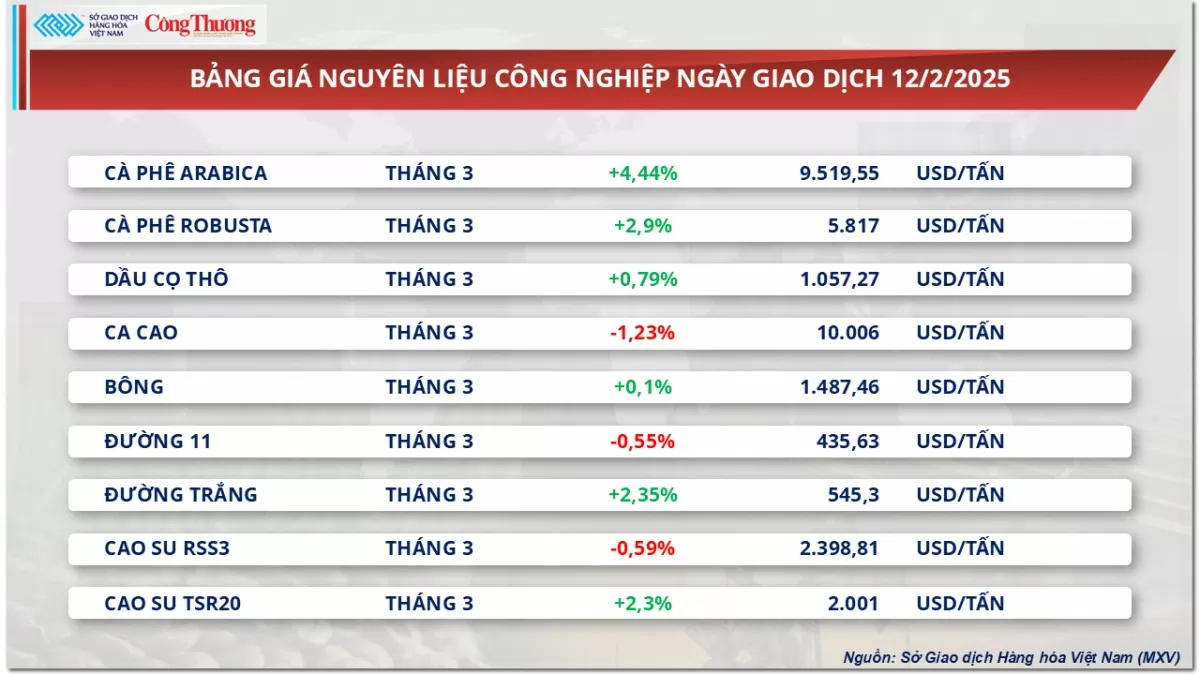

Strong buying pressure prevailed in the industrial raw materials market yesterday. Coffee continued to be the focus as prices surged after only one day of downward correction. Robusta coffee prices reached an all-time high, rising 2.9% to $5,817 per ton; Arabica coffee prices also jumped 4.44% to $9,519 per ton.

|

| Industrial raw material price list |

According to the latest figures from the Brazilian Coffee Exporters Association (Cecafe), Brazil's green coffee exports in January reached only 3.98 million bags, down 1.6% from the same period last year. This marks the second consecutive month of decline in exports from the world's largest supplier of Arabica beans.

Furthermore, analysts say that soaring transaction costs for Arabica coffee on the ICE exchange have exacerbated the price surge, which has pushed the price of raw, unroasted coffee beans to record highs for 14 consecutive sessions over the past three weeks.

In addition, the latest report from Somar Meteorologia shows that rainfall in Minas Gerais – Brazil's largest Arabica coffee growing region – reached only 53.9 mm last week, 15% lower than the historical average. This information further exacerbated concerns about the crop outlook in the world's leading Arabica coffee producer, thereby supporting coffee prices in yesterday's trading session.

Furthermore, according to the latest data, Robusta coffee inventories have fallen to their lowest level in 5 weeks, reaching only 4,348 lots in yesterday's trading session, after hitting a 4-month high of 4,603 lots on January 31st.

Similar trends were observed with Arabica coffee. According to reports from the ICE exchange, inventories of this type of coffee decreased from a two-and-a-half-year high of 993,562 bags recorded on January 6th to 841,795 bags, the lowest level in over three months.

The simultaneous decline in export supply and inventories signals a serious short-term shortage. This is even more worrying after Hedgepoint Global Markets recently lowered its forecast for Brazilian coffee production in the 2025-2026 season to 64.1 million bags. Notably, Arabica production – which accounts for 70% of total production – is projected to reach only 41.1 million bags, a 4.9% decrease compared to the previous season.

Oil prices halt a three-session winning streak.

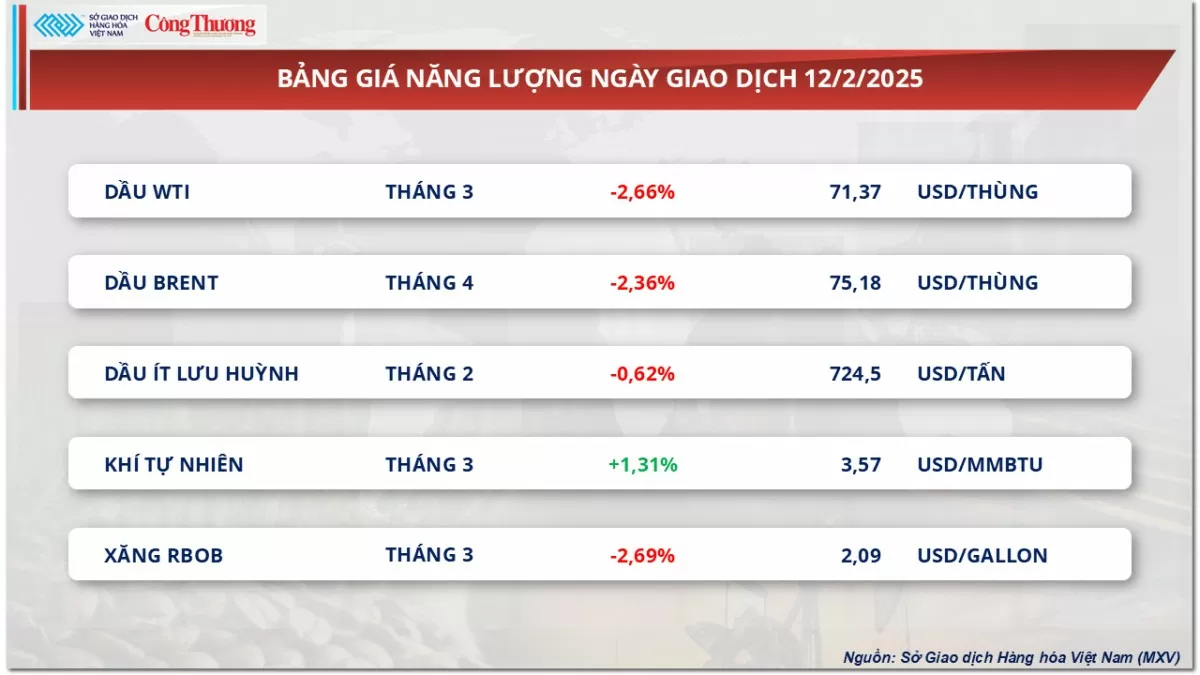

According to MXV, the energy market was awash in red during the February 12th trading session. In particular, on the global crude oil market, prices of both commodities plummeted by more than 2% following news of telephone calls between the presidents of the US, Russia, and Ukraine aimed at ending the conflict in Ukraine. In addition, data showing a significant increase in US oil inventories also put pressure on oil prices.

At the close of trading, Brent crude fell $1.82, or 2.36%, to $75.18 per barrel. WTI crude fell $1.95, or 2.66%, to $71.37 per barrel, ending a three-session winning streak.

|

| Energy price list |

Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee. During the hearing, Powell stated that the economy is in good shape and the Fed is not in a hurry to cut interest rates further.

In addition, consumer price data released by the U.S. Department of Labor showed that U.S. inflation rose surprisingly sharply in January, raising concerns that the economy is overheating and upcoming tariffs could dampen hopes of interest rate cuts. Higher interest rates could slow economic activity and reduce oil demand.

According to a report from the U.S. Energy Information Agency (EIA), U.S. crude oil inventories rose significantly more than market expectations last week. In addition, the EIA revised its forecast for U.S. crude oil production upwards to 13.59 million barrels per day in 2025, a slight increase from its previous forecast of 13.55 million barrels per day, while maintaining its forecast for demand.

In addition, the Organization of Petroleum Exporting Countries (OPEC) stated in its monthly report that global oil demand will increase by 1.45 million barrels per day (bpd) in 2025 and 1.43 million bpd in 2026. Both forecasts remained unchanged from the previous month.

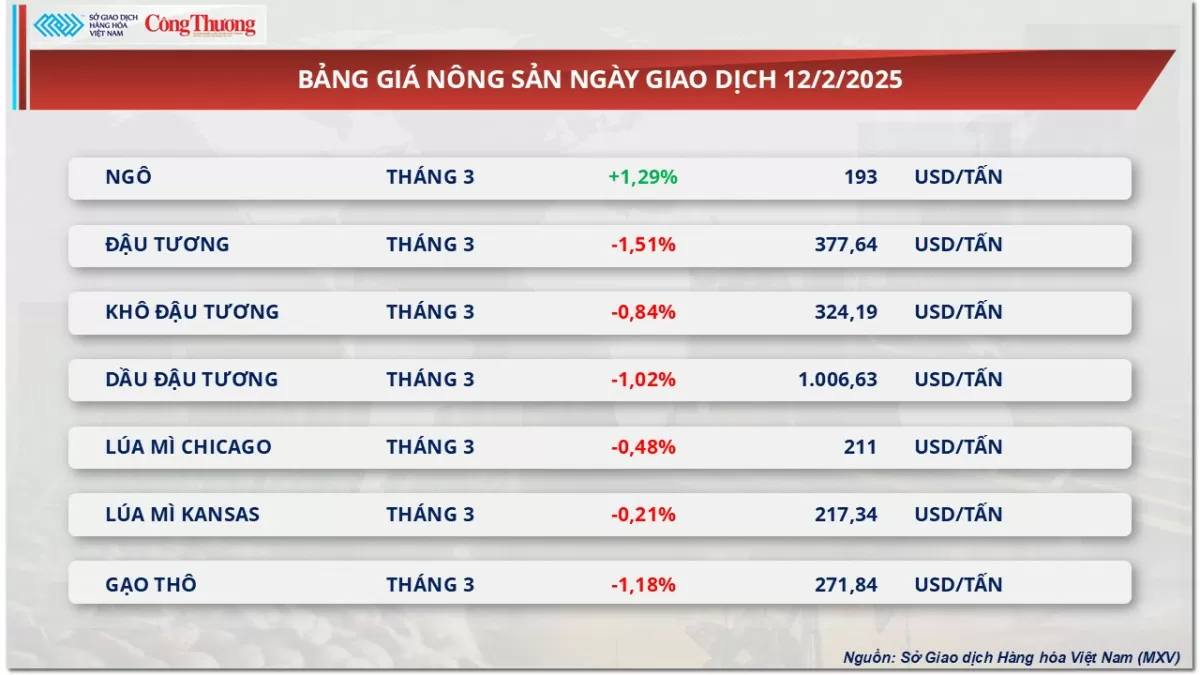

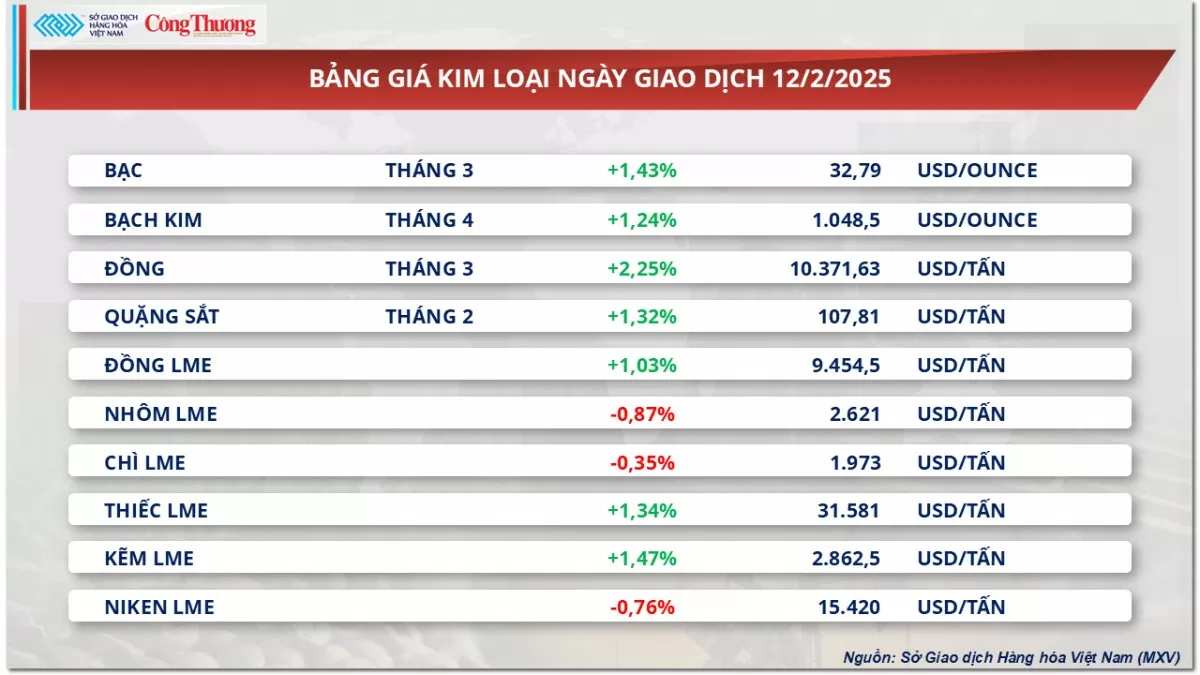

Prices of some other goods

|

| Agricultural product price list |

|

| Metal price list |

Source: https://congthuong.vn/gia-ca-phe-robusta-thiet-lap-muc-cao-ky-luc-373555.html

Comment (0)