From 2025, bank and securities accounts without biometric authentication will not be able to make transactions.

According to the regulations in the circulars of the State Bank of Vietnam (SBV), from the beginning of 2025, payment account holders or bank card holders will not be able to perform transactions such as withdrawing money, transferring money, paying bills, depositing money online or making transactions at ATMs if they have not completed biometric authentication and updated their identification documents. Therefore, recently, commercial banks, e-wallets and securities companies have continuously sent notices reminding customers to quickly perform biometric authentication as the deadline of January 1, 2025 is approaching.

Banks rush to the finish line

Specifically, a series of banks such as Vietcombank, BIDV, Sacombank, Techcombank, Nam A Bank, VPBank, MB and ACB are encouraging users to quickly authenticate their biometrics. These banks have pre-installed reminder notifications every time users log in to the application to make payments. In particular, Vietcombank has opened transaction points outside of business hours since the end of November to support customers to quickly update biometric information and expired identification documents.

Meanwhile, MB, VPBank and Techcombank also organized gifts and cash for users who completed biometric authentication and updated their identification documents before the specified deadline.

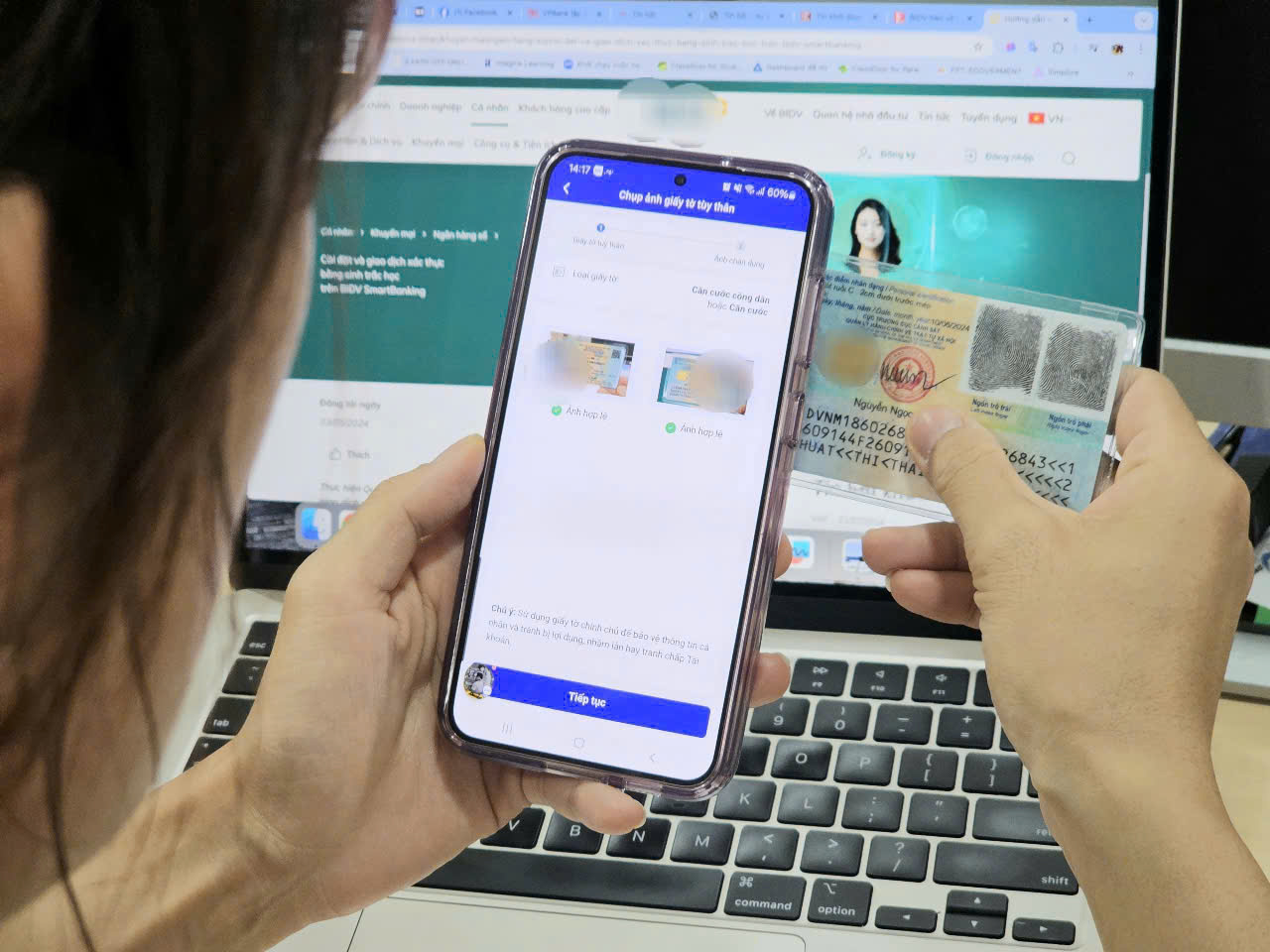

Banks, e-wallets, and securities companies are urgently encouraging users to use biometric authentication. Photo: LE TINH

MoMo is also implementing many activities to support users to promptly complete biometric authentication on the MoMo application, while expanding multi-channels to comply with Circular 40/2024/TT-NHNN of the State Bank of Vietnam.

Mr. Nguyen Ba Diep, co-founder of MoMo, said that since November 2024, MoMo has coordinated with the Ministry of Public Security to integrate electronic authentication services right on the VNeID application. MoMo users can conveniently and securely self-authenticate biometrically via VNeID without using NFC technology, helping to support users who have difficulty authenticating due to devices lacking NFC or not being familiar with the technology.

In particular, securities companies are also promoting the biometric update, because these companies had previously postponed the update from October 1, 2024 to January 1, 2025. Accordingly, in addition to sending reminder emails, the companies also notify investors via the application during each securities transaction. A representative of VPS Securities Company said that since the end of November 2024, the company has updated the NFC scanning feature on the citizen identification card (CCCD) when customers open a securities account, in order to limit counterfeiting and prevent the exploitation of customer information to open unauthorized accounts.

A representative of a joint stock bank said that users are encouraged to complete biometrics early to avoid overload, congestion, and even congestion as in the case of July 2024 (money transfer transactions over 10 million VND or total transactions over 20 million VND/day must be authenticated by biometrics).

Customers are still… leisurely

However, according to the reporter's records, many users and investors are still "taking their time" and are not in a hurry to update their biometrics. Mr. Minh Khanh (living in District 3, Ho Chi Minh City) said that he has a total of 5 bank accounts, 1 securities account and 2 e-wallet accounts. "Every time I update my biometrics, I have to get my ID card, take a portrait photo and read NFC, which takes time, so I'm not in a hurry," said Mr. Khanh.

Some older people who are not tech-savvy have to ask family members to help them update their biometrics or renew their expired identification documents… so they still cannot update.

According to the provisions of Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NHNN of the State Bank of Vietnam, from January 1, 2025, payment account holders/bank cardholders will not be able to conduct online transactions (withdrawal, money transfer, bill payment, deposit, etc.) and transfer/withdrawal transactions at ATMs if they have not updated their information. The information that needs to be updated includes: arguments, comparison of declarations and correct biometric information; updating and supplementing new information to replace expired identification documents (ID card, CCCD, passport, visa).

Deputy Governor of the State Bank of Vietnam Dao Minh Tu cited the latest statistics of the State Bank of Vietnam showing that about 38 million customers have successfully registered biometric information since July 1. From the beginning of 2025, all accounts that have not had their biometric information collected by commercial banks or payment intermediaries to verify their authenticity will only be provided with services at the counter, instead of online payments.

"Reports from credit institutions show that after implementing biometric authentication from July 1, 2024, the number of fraud cases has decreased by 50% compared to before. The number of accounts receiving fraudulent money has also decreased by more than 70% compared to the average of 7 months in 2024," Mr. Tu informed.

Along with the request of the State Bank, commercial banks have also proactively enhanced security solutions to deal with fraud and scams by technology criminals. MB is the first bank in Vietnam to deploy the feature to identify fraudulent account information.

After nearly 6 months of implementation, the latest updated data shows that MB has detected more than 4,200 accounts on the suspicious list. Specifically, when transferring money, customers will receive a warning in case the recipient is a potentially fraudulent account, helping to stop suspicious transactions to avoid losing money unjustly.

"The fraud detection and warning feature is the result of coordination between MB and the Department of Cyber Security and High-Tech Crime Prevention (A05) - Ministry of Public Security, updating the list of all accounts participating in or related to fraud nationwide. Before each customer's money transfer transaction, MB will quickly check to identify whether the account is on the suspicious list or not" - MB representative said.

VPBank said it is working with A05, in conjunction with NAPAS, to build a database system containing all fake accounts or accounts marked as fraudulent and deceptive. Every time a customer transfers money to these accounts, the bank issues a warning to let users know.

According to banks, in the near future, the database of accounts marked as fraudulent is expected to be expanded across inter-bank scope, which will help customers minimize the risk of being tricked into transferring money or mistakenly transferring money to fraudulent accounts.

Prevent buying and selling of bank accounts

According to BIDV, buying/selling/renting/borrowing accounts, accessing links of unknown origin, downloading fake applications, listening to advice from bad guys leads to the disclosure of personal information, electronic banking passwords, OTP codes, etc. These are the main reasons why many people have their money stolen from their accounts.

According to security experts, biometrics is considered a positive step to help reduce risks and protect users from fraud and scams. "For transactions requiring biometric authentication, in addition to the authentication method using Smart/SMS OTP code, customers must compare the actual facial image of the person performing the transaction to ensure it matches the data stored in the chip of the chip-embedded CCCD. Adding this biometric security layer will help minimize fraudulent impersonation, device access control or information theft to appropriate assets" - said a BIDV representative.

Source: https://nld.com.vn/chay-dua-xac-thuc-sinh-trac-hoc-196241204205441742.htm

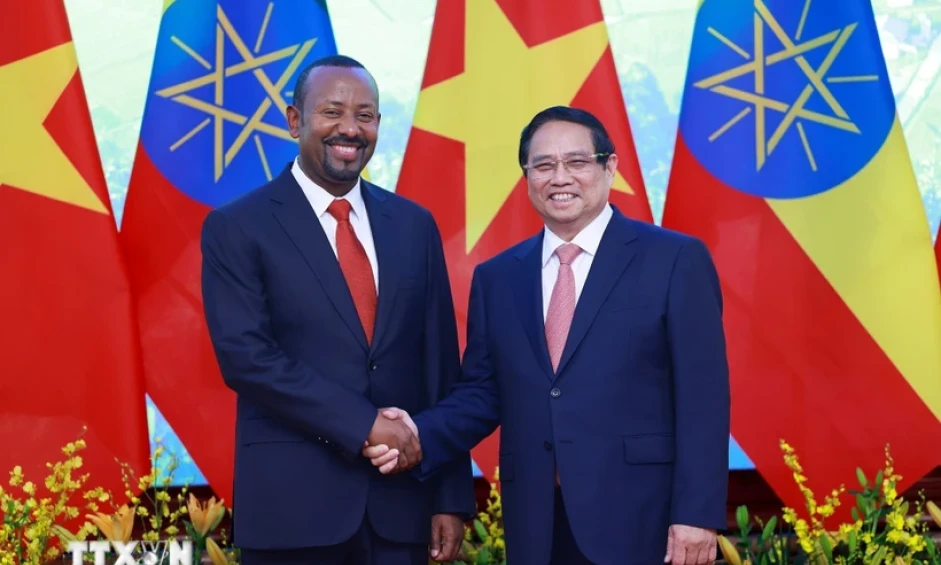

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)