(NLDO) – In the days leading up to Tet, some banks announced system upgrades at the end of the day, making it impossible for customers to transfer money or make online payments.

Taking advantage of selling online during the days before Tet, Ms. Ngoc Huynh (living in Binh Chanh district, Ho Chi Minh City) said that the digital banking application of a state-owned commercial bank sometimes has problems, the transfer reports errors or has to be done many times.

"Customers buy Tet specialty products online and then transfer money, I also have to pay for the goods to my partners, but in the past few days, the transactions have not been as fast and smooth as before. Some customers who use bank accounts and e-wallets to pay also complain similarly" - Ms. Huynh said.

In the days leading up to Tet, some banks announced system upgrades at the end of the day, making it impossible for customers to transfer money or make online payments.

Mr. Hoang Minh (residing in Thu Duc City, Ho Chi Minh City) said that in the days before Tet, he needed to transfer money to pay for goods and services to partners; pay debts... but the bank where he opened his account announced a system upgrade at the end of the day, causing many transactions to fail.

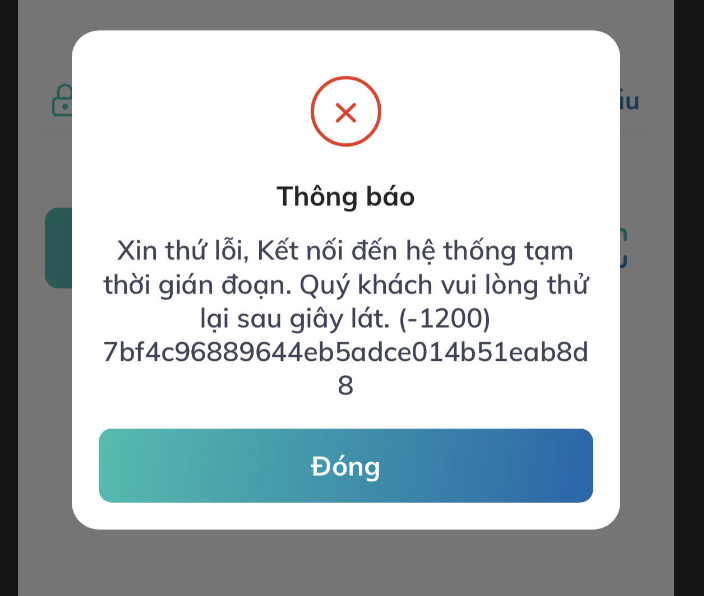

A bank's digital banking application reports an error, unable to transfer money

Data from the National Payment Corporation of Vietnam (NAPAS) shows that in the first two weeks of 2025, the system recorded an average increase of about 3% in the number of transactions compared to December 2024 and an increase of 13% -15% compared to the same period last year. The trend of people switching from using cash to electronic payment methods is increasing.

In 2024, NAPAS processed 9.56 billion transactions, an increase of about 30% in quantity and 14.4% in value compared to 2023. NAPAS 247 fast money transfer service also recorded an increase of 33.5% in the number of transactions.

NAPAS representatives said they have prepared systems and resources, backup plans for important information systems, and increased 24/7 staff to support member organizations and businesses during the Lunar New Year period.

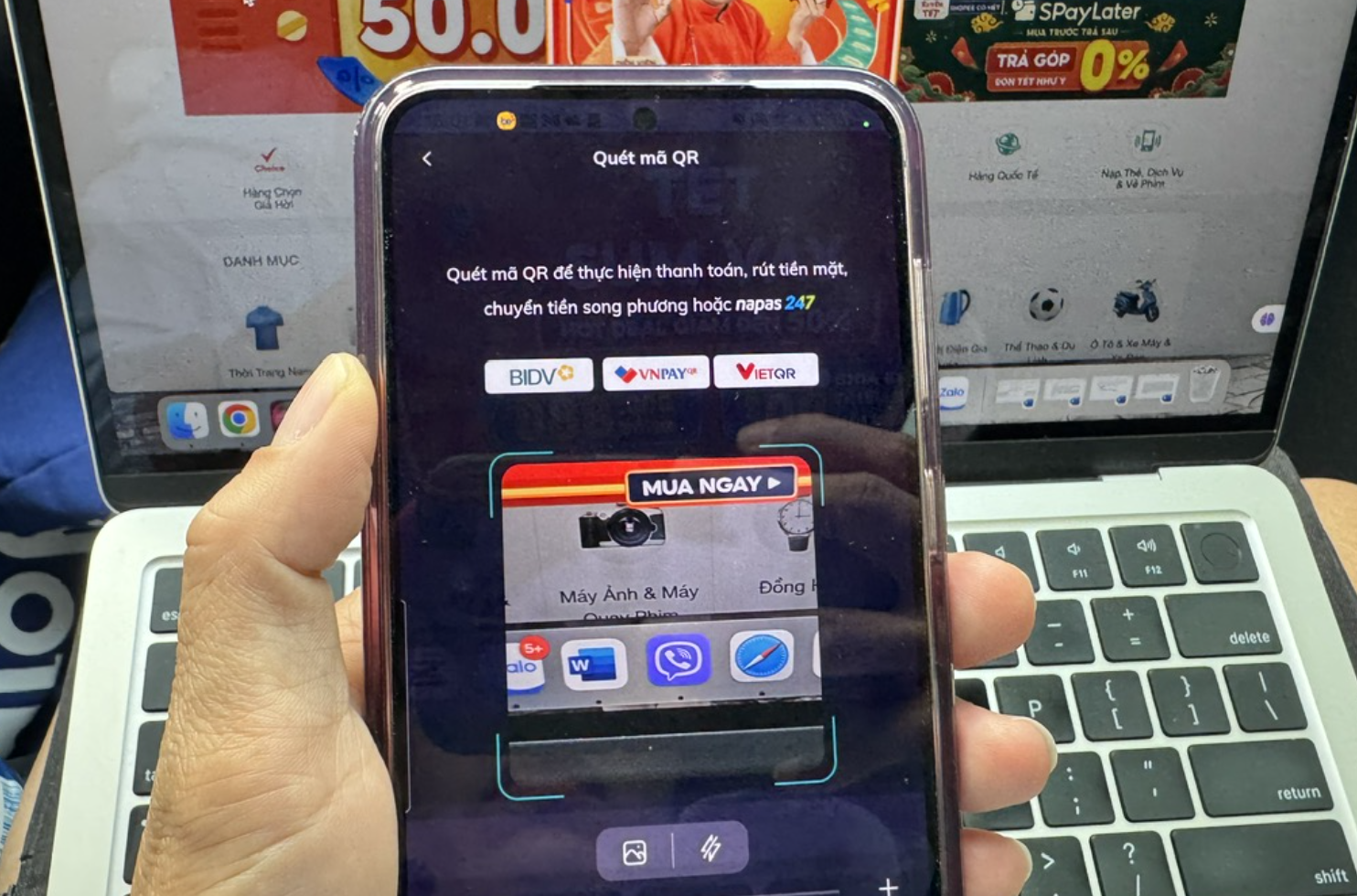

Users can transfer money via account number, scan QR code with VietQR, VNPay between banks, e-wallets when paying for goods and services.

Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam, Ho Chi Minh City Branch, commented that the demand for non-cash payment services has increased significantly in both the number of transactions and transaction value at the end of the year. In particular, the large number and value of payments are associated with the need to pay salaries, Tet bonuses, and the need for consumer shopping of businesses and people. However, the payment system through banks is still stable and meets the best needs.

"Some problems, mainly due to objective factors and related to payment waiting time, due to the large number of money transfer payment orders, were all handled promptly. These are objective technical difficulties. In general, the interbank payment system and payment of credit institutions operate well, meeting the increasing payment needs of the economy," said Mr. Lenh.

To avoid problems that may occur when making electronic payments during Tet, commercial banks and e-wallets said that in addition to transferring money online in the usual way, users can transfer money via VietQR code; swipe ATM cards; credit cards at POS machines or pay via wallets such as MoMo, Zalopay or Samsung Pay, Apple Pay, etc.

During the days when bank counters are closed for Tet, customers can continue to use services at automated digital banking transaction points. For example, at Nam A Bank, this bank said that customers can deposit or withdraw money from accounts of all Vietnamese banks using QRCode at the OneBank 365+ automated digital transaction point.

"Only here can customers deposit money into a different Nam A Bank payment account for corporate customers. Customers can also open their own accounts, issue ATM cards, make online savings deposits, and register for quick loans right at OneBank 365+" - said a representative of Nam A Bank.

Instead of going to the counter, customers can make deposits, withdrawals, and savings during Tet at digital banking transaction points of many banks.

Source: https://nld.com.vn/can-tet-khach-than-chuyen-khoan-thanh-toan-online-truc-trac-196250125160954639.htm

Comment (0)