In the most recent quarter, this stock increased by nearly 64% with liquidity of more than 71,000 units/session. Especially in the 2 sessions of February 6-7, 2025, VRC increased to the ceiling with a sudden trading volume of 104,800 and 308,500 units, respectively.

VRC unexpectedly increased to the ceiling for 2 consecutive sessions, strong fluctuations in shareholder structure

In the most recent quarter, this stock increased by nearly 64% with liquidity of more than 71,000 units/session. Especially in the 2 sessions of February 6-7, 2025, VRC increased to the ceiling with a sudden trading volume of 104,800 and 308,500 units, respectively.

The sharp increase of VRC of VRC Real Estate and Investment Joint Stock Company has attracted attention in the market, in the context of the general market being sluggish in liquidity and fluctuating strongly. In the 2 sessions of VRC's ceiling increase, the matched volume has increased sharply, while in the last 3 sessions, it was only a few thousand to a few tens of thousands/unit.

VRC's price increase occurred during a period of significant shareholder fluctuations from October 2024 to present when a series of senior leaders sold shares.

Most recently, on the last session of the year on December 30, 2024 , Ms. Tran Thi Van, a major shareholder of VRC, sold nearly 5.3 million shares for personal reasons, thereby reducing her ownership ratio from 24.17% to 13.6%. This is the first time Ms. Van has sold VRC shares after continuously buying and becoming a major shareholder of the company in October 2024.

On the other hand, on the same session of December 30, 2024, Saigon - Hanoi Securities Corporation (stock code SHS) reported that it had purchased nearly 5.3 million VRC shares, equal to the number of shares that Ms. Van reported selling. Thereby, SHS officially became a major shareholder of VRC with its ownership ratio increasing from 3.97% (nearly 2 million shares) to 14.54% (7.3 million shares).

Data shows that VRC shares had negotiated transactions on December 30, exactly equal to the volume that Ms. Van sold and SHS bought. Thus, it is highly likely that Ms. Van transferred shares to SHS.

The total transaction value was recorded at more than 60.2 billion VND, equivalent to 11,400 VND/share, while the closing price was 11,550 VND/share.

This is the first time Ms. Van has sold VRC shares after becoming a major shareholder of VRC in October 2024. Specifically, Ms. Van bought more than 3.7 million shares in the session of October 14, increasing her ownership ratio at the Company from 4% (2 million shares) to 11.44% (5.72 million shares). In the following 4 consecutive sessions (October 15-18), she bought a total of nearly 6.4 million VRC shares.

From the time Ms. Van became a major shareholder until the start of divestment (October 14 - December 30, 2024), VRC's stock price increased by nearly 47%.

Ms. Van's trading movements are similar in time to the change in senior leadership of VRC. Specifically, in October 2024 , Mr. Tu Nhu Quynh, former Chairman of the Board of Directors, also sold all 6.27 million VRC shares and submitted his resignation on October 31; Mr. Phan Van Tuong, member of the Board of Directors of VRC, who assumed the position of Chairman of the Board of Directors of the company (the Decision takes effect from October 31, 2024) also sold all more than 7 million VRC shares.

At the time Ms. Van withdrew capital, VRC also held an extraordinary General Meeting of Shareholders to elect additional members of the Board of Directors.

Specifically, at the end of December 2024 , all 4 members of the Board of Directors, including Chairman and Board Member Mr. Phan Van Tuong - less than 2 months in the Chairman position, and 3 other members of the Board of Directors, Mr. Tran Tuan Anh, Mr. Tu Nhu Quynh (also member of the Audit Committee) and Mr. Nguyen Quoc Phong (also Chairman of the Audit Committee) all resigned from their positions.

After the Congress, the Board of Directors of the Company elected Mr. Nguyen Huy Do, Ms. Nguyen Ngoc Quynh Nhu and Mr. Dhananjay Vidyasagar to hold the positions of Board Members. In which, the new Chairman is Mr. Dhananjay Vidyasagar and the General Director is Ms. Nguyen Ngoc Quynh Nhu.

|

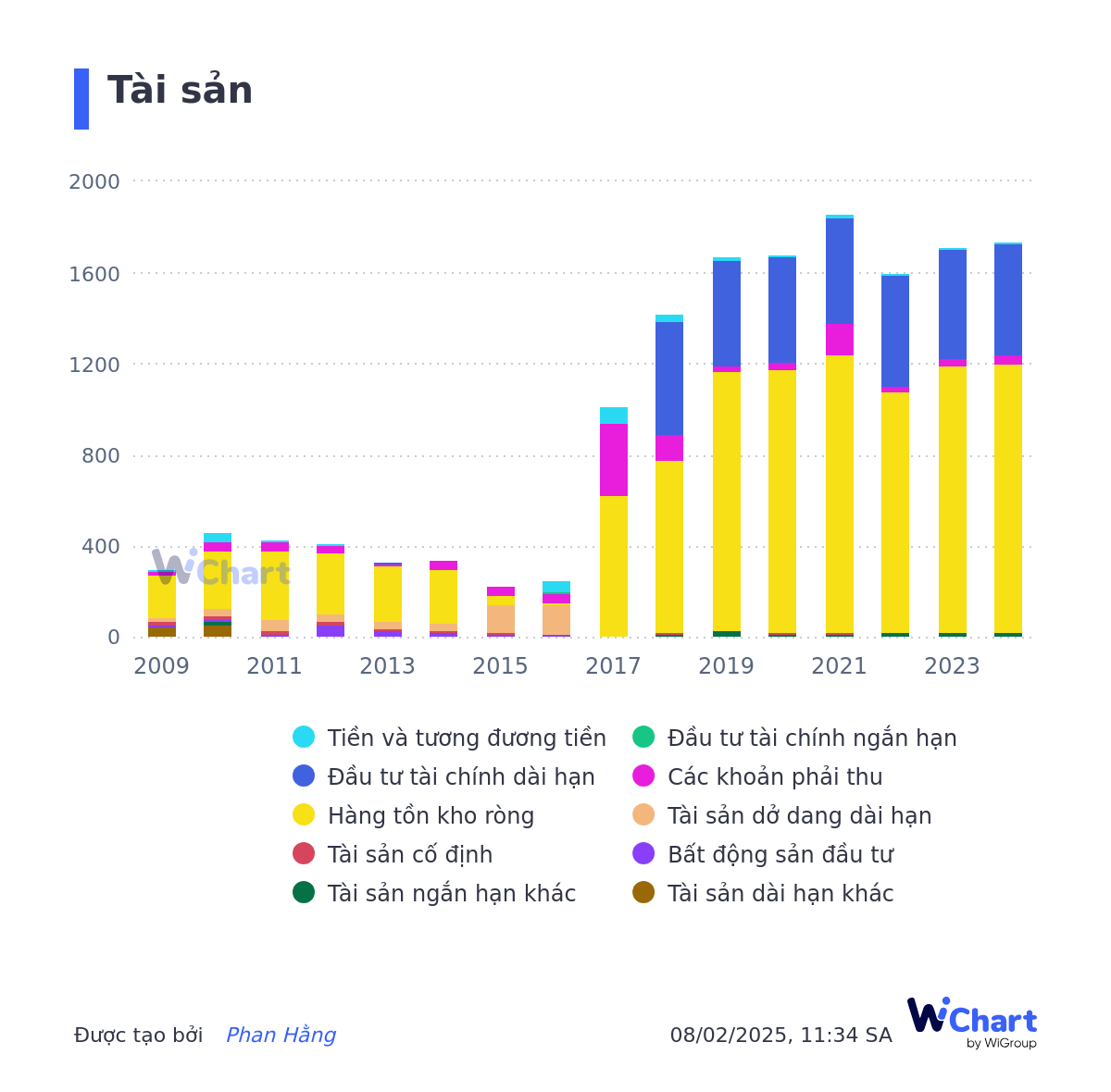

| Source: Wichart.vn VRC's inventory value skyrocketed after "acquiring" ADEC |

Currently, VRC is implementing many real estate projects on the "golden land" of Ho Chi Minh City, Ba Ria - Vung Tau and Long An, such as the Phu Thuan Ward Residential Area project (District 7, Ho Chi Minh City), the Babylon Garden project (District 7, Ho Chi Minh City), and the high-class hotel - apartment complex project (Vung Tau City).

VRC's project land fund mainly comes from the acquisition of ADEC JSC - a company with a state-owned origin. VRC invested in this enterprise in 2017 and owns 60.06% of the capital with an investment value of nearly VND 320 billion.

At the end of 2024, VRC's asset size was VND 1,739 billion, mainly inventory with VND 1,185 billion (equivalent to 68%), allocated to Nhon Duc Residential Area project, Phuoc Loc - Nha Be (VND 785 billion), ADC Phu My Residential Area project (VND 370 billion) and Long An Residential Area project (VND 30 billion).

VRC's business results are not very positive. In the period 2020-2023, revenue was recorded at less than 10 billion VND, profit was thin at less than 500 million VND per year. In 2024, revenue increased nearly 4 times to 15 billion VND, profit after tax reached 1.5 billion VND, an increase of 275% compared to the previous year.

Source: https://baodautu.vn/bat-ngo-vrc-tang-kich-tran-2-phien-lien-tiep-bien-dong-manh-co-cau-co-dong-d244834.html

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)