Important resources to implement National Target Programs

On the afternoon of March 31, Deputy Prime Minister Tran Hong Ha and Deputy Prime Minister Mai Van Chinh chaired a direct and online meeting with ministries, branches and localities on the situation and results of the implementation of three national target programs: New rural construction, sustainable poverty reduction, and socio-economic development in ethnic minority and mountainous areas.

Reporting at the meeting, SBV Deputy Governor Dao Minh Tu said that based on the Resolutions of the National Assembly and the Decisions of the Prime Minister approving the National Target Programs, the SBV has researched, reviewed, issued/submitted for issuance of mechanisms and policies to implement the National Target Programs. At the same time, the SBV has drastically implemented many solutions to contribute to improving the business environment, supporting people and businesses to access bank credit capital, thereby contributing to the implementation of the National Target Programs for the period 2021-2025.

|

| Deputy Governor Dao Minh Tu (second from right) speaks at the meeting – Photo: VGP/Minh Khoi |

Deputy Governor Dao Minh Tu said that the SBV has implemented many solutions to contribute to stabilizing the macro economy and supporting the country's socio-economic development, such as perfecting the system of legal documents on currency and banking activities, ensuring safe operations, closely following practical requirements, and promptly meeting international standards and practices; actively contributing to the country's socio-economic development.

The proactive, flexible, and synchronous management of monetary policy tools by the State Bank, in close and harmonious coordination with fiscal policy and other macroeconomic policies, has contributed to controlling inflation, stabilizing the macro-economy, creating a favorable environment for production and business, and supporting economic development.

Along with credit management in line with the economy's capital absorption capacity, promptly meeting capital for production and business, the State Bank directs credit institutions to direct credit to production, business and priority sectors according to the Government's policy, while implementing specific credit programs to support economic sectors and fields such as the credit program for forestry and fishery with a scale of VND 100,000 billion to date, policy credit programs for poor households and other policy subjects at the Vietnam Bank for Social Policies to contribute to sustainable poverty reduction.

|

| Deputy Governor Dao Minh Tu speaks at the meeting – Photo: VGP/Minh Khoi |

In addition, there are solutions to expand credit coverage, improve people's access to banking products and services, especially in agricultural, rural, remote and isolated areas such as developing non-cash payments on a modern technology platform associated with ensuring security and safety of payment activities in the economy; promoting digital transformation in banking activities; creating conditions for credit institutions to expand their operating networks, providing banking products and services in rural, remote and isolated areas. Strengthening the communication of mechanisms and policies for sectors and fields under the direction of the Government and the Prime Minister, especially monetary, credit and banking policies, contributing to the implementation of the National Target Programs for the period 2021-2025.

At the same time, the SBV effectively implemented the tasks and solutions assigned by the Central Steering Committee. Specifically, the SBV urgently researched and coordinated with relevant ministries and branches to submit to the Government for promulgation Decree No. 28/2022/ND-CP dated April 26, 2022 on preferential credit policies to implement the National Target Program on socio-economic development in ethnic minority and mountainous areas for the period 2021-2025. With 6 preferential credit policies specifically for ethnic minority and mountainous areas, it has met the tasks and solutions set forth by the National Assembly in Resolution No. 88/2019/QH14, Resolution No. 120/2020/QH14 on "Innovating and expanding the credit policy of the Vietnam Bank for Social Policies in the direction of increasing the limit, expanding the borrowing subjects for production and business projects, creating livelihoods for ethnic minorities".

The State Bank of Vietnam has issued many documents directing the State Bank branches in provinces and cities and credit institutions to implement the tasks of the banking sector in the National Target Program on New Rural Development, in which the Directors of the State Bank branches in provinces and cities are assigned to monitor and grasp the lending situation for new rural development of credit institutions to promptly support the resolution of difficulties and problems in credit relations between credit institutions and borrowers in the area. At the same time, the State Bank of Vietnam has actively responded to a number of recommendations and proposals of relevant localities, ministries and branches in the process of implementing the National Target Programs and Resolution 111/2024/QH15 of the National Assembly.

Members of the Central Steering Committee for National Target Programs under the State Bank of Vietnam have been monitoring and inspecting the progress of the implementation of National Target Programs in the provinces assigned to them according to the annual work program of the Steering Committee. In 2022, members of the Steering Committee under the State Bank of Vietnam were assigned to monitor, monitor and inspect 4 provinces: Lam Dong, Tay Ninh, Binh Phuoc, Kon Tum; from 2023 to present, 3 provinces: Lam Dong, Tay Ninh, Binh Phuoc.

With the synchronous implementation of monetary and banking policy solutions, along with the tasks of the banking sector in the National Target Programs, credit capital has become an important resource to implement the goals set out in the National Target Programs. Currently, there are more than 10 million customers enjoying credit programs and products of the banking sector with outstanding credit balance in communes nationwide reaching over 2.2 million billion VND, with outstanding loans mostly from individuals and households engaged in agricultural, forestry, fishery and salt production, exceeding the plan set for the entire period of 2021-2025 of about 1,790,000 billion VND (according to Decision No. 263/QD-TTg, credit capital); outstanding policy credit balance contributing to the implementation of the National Target Programs reached over 376 trillion VND, with about 6.8 million customers with outstanding loans; Outstanding preferential credit policy for ethnic minority and mountainous areas according to Decree No. 28/2022/ND-CP of the Government reached over 2.4 trillion VND, with over 49 thousand customers still having outstanding loans.

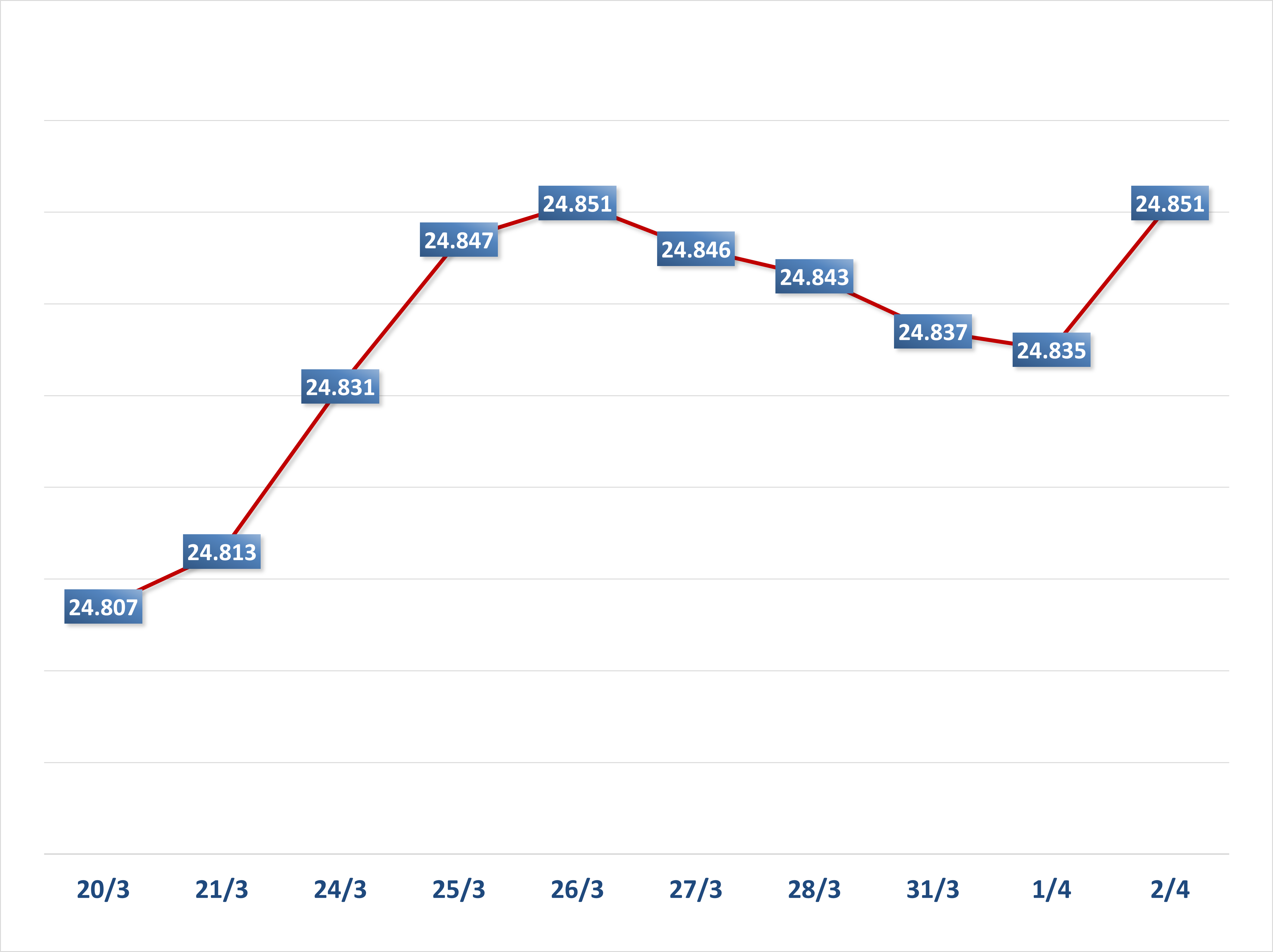

Credit capital contributing to the implementation of the Sustainable Poverty Reduction Program has achieved the targets assigned by the National Assembly and the Government. The multidimensional poverty rate by 2024 is 1.93%; the poverty rate in poor districts is 24.86%; the poverty rate of ethnic minority households is 12.55% (down 3.95%).

By March 2025, the New Rural Development Program achieved the following results: The rate of communes meeting new rural standards was 77.9% (the target for the 2021-2025 period was 80%); the rate of districts meeting new rural standards was 47.6% (the target was 50%); 6 provinces completed the task of building new rural areas (the target was 15 provinces).

6/9 target groups of the Socio-Economic Development Program for Ethnic Minority and Mountainous Areas have been basically completed and exceeded: Poverty reduction rate for ethnic minorities; average income; education; vocationally trained labor; preservation and development of traditional cultural values and identities; and strengthening healthcare.

To not be left behind

In addition to the achieved results, Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that the implementation of the National Target Programs still faces some difficulties and obstacles. For example, credit policies for the agricultural and rural sectors always have potential risks due to natural disasters and epidemics, but there is currently a lack of preventive measures and tools to limit risks. The restructuring process of the agricultural sector is still slow and uneven among regions. Chain-linked production activities, application of high technology, and deep processing have not really been effective in forming concentrated commodity production areas according to the strengths of each locality; agricultural production has not yet adapted to changes in climate and markets.

The implementation of preferential credit policies to implement the National Target Program on socio-economic development in ethnic minority and mountainous areas according to Decree No. 28/2022/ND-CP is low (only reaching 2,317/9,000 billion VND (25.7%) in the 2022-2023 period; reaching 2,401/19,727 billion VND in the 2021-2025 period). The reason is that the completion of documents of ministries and branches is still slow (until September 2022, the Ethnic Committee and the Ministry of Health have just completed the documents guiding/amending and supplementing the implementation of the Decree, leading to slow progress in confirming and approving the list of people receiving policies from localities, affecting the disbursement of the VBSP (by the end of 2023, 44/49 localities had announced the list).

In addition, the VBSP has not yet been allocated capital for loans in the 2024-2025 period. According to Decree 28/2022/ND-CP, the Ministry of Finance is responsible for reporting to competent authorities to allocate VND 10,727 billion for the VBSP to lend to the program, but by the end of the first quarter of 2025, the VBSP has not yet been allocated capital. In order to promptly have capital to disburse to ethnic minorities and mountainous areas, the VBSP branches in the provinces have advised localities to use local budgets to entrust the VBSP to lend. However, the amount is very small. To date, 14 localities have entrusted VND 159.5 billion because it depends on the financial capacity of each locality.

The disbursement of loans by the VBSP is still difficult because in some localities, there is no more or no land fund for residential land/production land to allocate to households or the land is mainly agricultural land, has not been converted, and has not been granted land use right certificates to people, affecting the disbursement of the VBSP. The outstanding value chain loans are low (VND 4.9 billion) and have not been disbursed for precious medicinal plant growing areas, because in some localities, regulations on application forms, procedures for project selection according to the provisions of Decree No. 27/2022/ND-CP and Decree No. 38/2023/ND-CP of the Government have not been issued, specific investment projects have not been formed; investment projects eligible for loan policies have not been approved, so the VBSP has no basis for disbursing loans. To date, only 1 locality (Lao Cai) has generated value chain loans; 1 locality (Quang Ngai) has approved a project on precious medicinal herbs, which has generated a need for credit. However, because the 2024-2025 period has not yet been allocated capital, the VBSP has not yet provided loans for the project.

In order for the banking sector's credit policy to be truly effective, put into practice, and contribute to the successful implementation of the goals of the National Target Programs for the 2021-2025 period, Deputy Governor Dao Minh Tu said that the SBV will continue to review and propose amendments and supplements to Decree 55/2015/ND-CP on credit policy for agricultural and rural development to further facilitate people and businesses to access capital (waiting for the official appraisal document of the Ministry of Justice to soon submit to the Government), and at the same time review, amend, supplement, and perfect the provisions of Decree 28/2022/ND-CP after the Prime Minister issues a Decision approving the amendments and supplements to Decision 1719/QD-TTg.

Regarding ministries, branches and localities, Deputy Governor Dao Minh Tu requested the Ministry of Finance and the Ministry of Ethnic Minorities and Religions (the agency in charge of the National Target Program) to urgently advise and report to the Government for consideration and allocation of capital for the Vietnam Bank for Social Policies to implement preferential credit policies according to Decree No. 28/2022/ND-CP for the period 2024-2025, ensuring the feasibility of the policy for ethnic minority and mountainous households.

The Ministry of Ethnic Minorities and Religions shall promptly review the capital borrowing needs of localities to continue to supplement, amend and replace preferential credit policies for ethnic minority and mountainous areas in the period of 2026-2030 in accordance with the needs of ethnic minorities and the objectives of the Program; at the same time, propose to fully allocate capital from public investment sources to implement the Program, avoiding the issuance of policies but not promptly allocating capital for the VBSP to deploy preferential credit policies for ethnic minority and mountainous areas as in the current period.

The Deputy Governor also requested local Party committees and authorities to pay attention to and arrange residential land and production land funds to implement housing, residential land and production land support policies according to Decree No. 28/2022/ND-CP of the Government; facilitate investment procedures, promptly approve production development projects according to value chains, projects to develop precious medicinal herb areas for the VBSP to lend according to regulations; continue to pay attention to directing relevant units to allocate a part of the capital from the local budget entrusted through the VBSP to supplement capital for lending to poor households and social policy beneficiaries in the area, including beneficiaries of preferential credit policies according to Decree No. 28/2022/ND-CP of the Government.

Source: https://thoibaonganhang.vn/bo-tri-nguon-luc-quan-tam-thoa-dang-thuc-hien-cac-chuong-trinh-muc-tieu-quoc-gia-162082.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)