Investor sentiment was pessimistic, causing strong selling pressure. Red covered the electronic board in the session of January 3. Liquidity also improved compared to the first session of the year.

Investor sentiment was pessimistic, causing strong selling pressure. Red covered the electronic board in the session of January 3. Liquidity also improved compared to the first session of the year.

After the first trading session of the year witnessed a slight increase of 0.23% with liquidity only equal to about 65% of the average level, VN-Index turned around and fell below the reference level as red dominated many stock groups. Investor sentiment was negatively affected by the USD Index (DXY) setting a new record when it surpassed 109 points. Selling pressure gradually increased. The electronic board was quickly flooded with red and buying power was not in a hurry to participate.

After the lunch break, the market fluctuated around the 1,260 point mark for about 2/3 of the afternoon trading time. At the end of the session, strong selling pressure continued to be pushed to a higher level and this caused a series of stock groups to fall sharply, so the indices also closed at the lowest level of the session.

At the end of the trading session, VN-Index decreased by 15.12 points (-1.19%) to 1,254.59 points. HNX-Index decreased by 2.03 points (-0.89%) to 225.66 points. UPCoM-Index decreased by 0.71 points (-0.75%) to 94.34 points. The whole market recorded 483 stocks decreasing in price, while 230 stocks increased and 829 stocks remained unchanged/no trading. However, the market still had 42 stocks hitting the ceiling and 20 stocks hitting the floor.

|

| Top 10 stocks affecting VN-Index. |

The biggest pressure in today's session belongs to large-cap stocks. In the VN30 group, only 3 stocks increased in price, namely PLX, SSB and VCB, while 24/30 stocks decreased in price, 3/30 stocks remained unchanged. Meanwhile, this group recorded 24 stocks decreasing in price. Stocks such as BVH, MWG or TCB all decreased by more than 3%.

In addition, VIB, HDB, STB, CTG... also decreased by over 2%. TCB was the stock that put the most pressure on the VN-Index when it took away 1.28 points. At the end of the session, TCB decreased by nearly 3.1%. Following that, CTG also decreased by 2.4% and took away 1.17 points. FPT ranked 3rd in the list of stocks that had the most negative impact on the VN-Index when it decreased by nearly 2%, when it was under strong selling pressure from foreign investors.

A series of stock groups such as retail, aviation, insurance, securities, steel... were also in red. In the steel group, HPG also decreased by nearly 1.5% and had quite negative impacts on this group. NKG decreased deeply by 2%, HSG decreased by 2.4%, VGS decreased by nearly 3%.

On the contrary, Viettel is a rare group of stocks that went against the general market in today's session. CTR increased by nearly 3.2% and was only behind VCB in the list of stocks with the most positive impact on the VN-Index. Viettel's family of stocks, VTK, VTP and VGI, all had green in today's session, but the increase was not too strong.

VCB only increased by 0.11% but was the most positive contributor to the VN-Index with 0.14 points. NVL also had a relatively positive trading session when it increased by 1.44%. This company has just announced the Board of Directors' Resolution approving the reduction of capital contribution at its subsidiary, Tan Kim Yen Real Estate Investment Company Limited (Tan Kim Yen). The value of the capital contribution at Tan Kim Yen before the reduction was VND 2,204.6 billion (equivalent to 99.993% of charter capital). The value of the company's capital contribution at Tan Kim Yen after the reduction was VND 204.8 billion (equivalent to 99.993% of charter capital).

In addition, Yeah1's YEG shares also caused a surprise when they were pulled back to the ceiling price of VND 19,550/share. YEG recently announced information about the completion of the transfer of all of the company's shares in ANA Entertainment Joint Stock Company and Care Group Joint Stock Company.

|

| Foreign investors strongly net sold FPT shares. |

The total trading volume reached over 560 million shares, equivalent to a trading value of VND1,727 billion (up 28% compared to the previous session), of which negotiated transactions contributed VND1,727 billion. The trading value on HNX and UPCoM reached VND844 billion and VND609 billion, respectively.

FPT topped the list of largest matched orders in the market with 651 billion VND. TCB and SSI followed after trading 417 billion VND and 412 billion VND respectively.

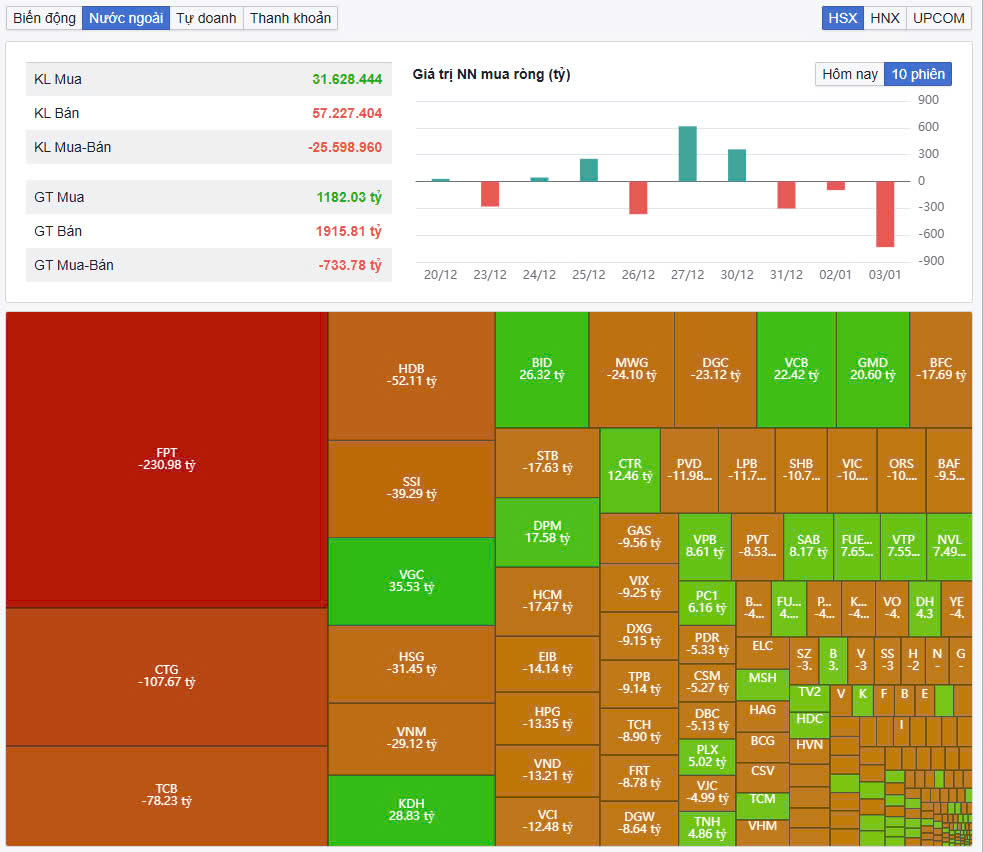

Foreign investors increased net selling by about 760 billion VND in the whole market. Of which, foreign investors sold the most FPT code with 230 billion VND. CTG and TCB were net sold by 108 billion VND and 78 billion VND respectively. Meanwhile, VGC was the most net bought with 36 billion VND. KDH was behind with a net buying value of 28.8 billion VND.

Source: https://baodautu.vn/ban-tren-dien-rong-vn-index-giam-hon-15-diem-d238315.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)