Net selling of 2.43 billion USD on the stock exchange, foreign investors exceeded the record in 2021

The net selling value of foreign investors as of July 15 reached VND61,338 billion, equivalent to USD2.43 billion. The recent net selling momentum has also officially pushed the net selling value beyond the record of VND60,685 billion recorded in the whole year of 2021.

Another strong discharge session

In the first trading session of the week on July 15, foreign investors continued to record overwhelming net selling pressure when they only disbursed VND973 billion, but net sold up to VND2,541 billion. Foreign net selling caused great pressure in the context of domestic investors being relatively cautious in trading, causing liquidity to drop deeply.

This is the fourth consecutive session that VN-Index has declined, at the same time, the trading value on the Ho Chi Minh City Stock Exchange (HoSE) has also continued to decline. On the 15th of July, a total of 474 million shares were transferred, worth VND11,305 billion. Thus, just counting the selling side, foreign investors accounted for 22.4%, meaning that for every VND100 traded, more than VND22 "went into the pocket" of foreign investors.

Foreign investors' net selling value in the first session of the week reached VND1,670 billion on the HoSE and approximately VND1,855 billion on all three exchanges. Since the beginning of the year, foreign investors have net sold VND61,338 billion, equivalent to USD2.43 billion. The number of net selling sessions was overwhelming with only about a dozen rare sessions in which foreign investors returned to net buying.

However, not only in Vietnam, the net selling trend of foreign investors also occurred in many countries. For example, in Thailand, the figure soon exceeded 3 billion USD. The SET index of the Stock Exchange of Thailand at one point fell below 1,300 points, the lowest in the past four years.

Money flows into the US thanks to the long-term high interest rate of the dollar, while the currencies of many countries are devaluing. Some funds change their strategies to invest in less risky markets with greater opportunities in the short term. According to SSI Research, the net cash flow into equity funds in the first 6 months of the year reached 225.5 billion USD. Of which, in June alone, the net inflow value reached 49.7 billion VND. The cash flow to the US market in June accounted for the majority, reaching 29.5 billion USD.

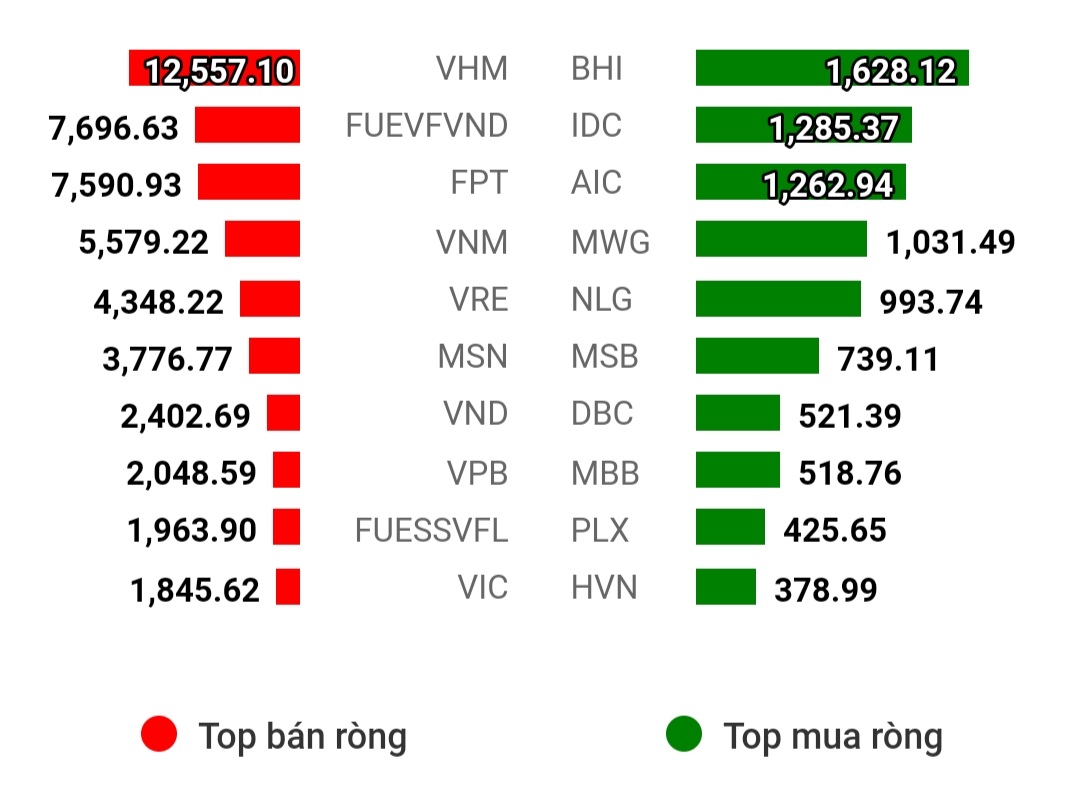

The focus of net selling is VHM, fund certificates FUEVFVND, FPT, VNM, VRE

The net selling value of foreign investors is large, and at the same time, it is also highly concentrated. The top 10 stocks that foreign investors sold the most had a total net selling value of VND48,681 billion. The remaining nearly VND11,480 billion of net selling was spread across other stocks.

Vinhomes shares topped the net selling value with a revenue of approximately half a billion USD (12,559 billion VND). VHM shares set a record low in price in the last days of June (37,500 VND/share) and are still trading around the bottom with the closing price on July 15 at 38,000 VND/share.

Meanwhile, FPT shares have been mostly sold heavily recently. In the first half of July alone, the net selling value of foreign investors was approximately VND2,235 billion, equivalent to nearly 30% of the total net selling value. Although it is the stock that has been "sold" the most by foreign investors during this time, FPT shares are still moving sideways around the peak, unable to break out but still quite stable around VND130,000/share. With a positive increase since the beginning of the year (58%), FPT shares are still in the "sights" of foreign investors taking profits.

Vinamilk shares were also net sold for a total of VND5,583 billion in the past six and a half months. The ownership ratio of foreign investors in the dairy giant, which was once close to 69% at the end of 2017, has now dropped to around 50%. Unlike the strong growth before 2018, VNM's share price in the past three years has been trading in the range of VND60,000 - 80,000/share. In 2023, when profits increased again above the low comparison base, VNM shares still decreased by 14% while the general VN-Index increased by 8%. Shares of the leading dairy company traded in a narrow range in the second quarter.

|

| Top stocks with net buying and selling from the beginning of the year to July 15. Source: VietstockFinance |

In addition to the leading stocks, foreign investors also withdrew a lot of capital (nearly 7,700 billion VND) from the ETF fund certificate product based on the VNDiamond portfolio basket (FUEVFVND). This was also a "hot" stock code that foreign investors sought after.

However, in the Thai stock market, in the past month, the number of DR FUEVFVND01 depository certificates has increased by about 5.5 million units since June 19. This is a depository certificate based on the DCVFM VNDiamond ETF fund certificate (code FUEVFVND) issued by Bualuang Securities and IPO in early March 2022. The conversion ratio of DR and VNDiamond ETF certificates is 1:1.

From September 2023 to now, this fund has also tended to expand, increasing by 25 million fund certificates. Thereby, the total volume of DR FUEVFVND01 fund certificates is at its highest level in the past year (over 181 million units). The disbursement value is not large but also reflects an indirect capital flow invested in the Vietnamese market through depository certificate products. The policy of imposing additional personal income tax on foreign investment, effective from the beginning of the year, is part of the reason for limiting Thai investors, but the cash flow from this country still has other ways to indirectly invest in Vietnam.

According to Mr. Nguyen Ba Huy, CFA - Investment Director - SSI Fund Management Company Limited (SSIAM), foreign capital flows through domestic funds are also one of the sources of support to balance the net selling flow from foreign investors. At the same time, although many banks have increased interest rates in June, Mr. Huy expects the low interest rate environment to remain stable in the coming time. Domestic capital flows may return more when investors realize that interest rates are unlikely to increase much.

Although the contribution to the total trading value on July 15 increased, there were not many sessions with such sudden changes. In a recent report by SSI Research, this securities company stated that foreign net selling has not shown any pressure as the contribution of foreign investors is still only around 9.6% in the first half of 2024. Domestic individual investors are trading actively in the context of low deposit interest rates, which will absorb the supply from foreign investors well.

Source: https://baodautu.vn/ban-rong-243-ty-usd-tren-san-chung-khoan-khoi-ngoai-vuot-ky-luc-nam-2021-d220082.html

Comment (0)