On the afternoon of January 7, the State Bank of Vietnam (SBV) Bac Giang branch held a conference to deploy the banking sector's tasks in 2025. Attending and directing the conference was Vice Chairman of the Provincial People's Committee Phan The Tuan.

According to the report at the conference, in 2024, capital mobilization and credit activities in the area achieved positive results. Total mobilized capital as of December 31, 2024 reached more than 121.8 trillion VND, an increase of 14.7 trillion VND, an increase of 13.8% compared to 2023. Total outstanding loans reached 113 trillion VND, an increase of 17 trillion VND, an increase of 17.8% compared to 2023, higher than the national credit growth. Credit quality is guaranteed, bad debt is controlled. Commercial banks focus on improving credit quality. Bad debt reached 673 billion VND, accounting for 0.42% of total outstanding loans (less than 1%), down 0.13% compared to 2023.

The State Bank of Vietnam, Bac Giang province branch, directed commercial banks to focus on lending to the production and business sectors of enterprises; the credit structure was shifted according to the direction of the State Bank of Vietnam and the economic development orientation of the province. Actively implementing Bank - Enterprise Connection Programs; proactively approaching and removing difficulties for customers , promptly meeting the production and business needs of people and enterprises. In particular, credit institutions (CIs) proactively and urgently reviewed and synthesized the damages of customers who are borrowing capital affected by storm No. 3 to promptly apply support measures and remove difficulties for customers.

In 2025, based on the direction and policy of the State Bank of Vietnam and the socio-economic development orientation of the province, the banking system of Bac Giang province sets a target of capital mobilization increasing by about 12-14%; outstanding loans increasing by about 14-16%; bad debt below 2%. Implement well the state management of monetary and banking in the area, ensuring the safe, effective and sustainable development of banking activities.

Speaking at the conference, Vice Chairman of the Provincial People's Committee Phan The Tuan acknowledged and commended the positive results achieved by the banking sector in 2024, making an important contribution to the socio-economic development of the province.

Emphasizing that 2025 is the year of breakthrough in achieving the goals of the Resolution of the 19th Provincial Party Congress, the Vice Chairman of the Provincial People's Committee requested the Provincial State Bank to proactively study and direct credit institutions to seriously implement monetary, credit and banking solutions of the Government, the State Bank of Vietnam, and policies to support socio-economic development. Monitor and grasp the socio-economic situation and banking activities to promptly handle difficulties and problems in the implementation process. Report and propose to local Party committees, authorities and the Governor of the State Bank on measures to manage credit institution activities, on inadequacies of mechanisms and policies that need to be amended and supplemented.

Direct credit institutions to expand credit, focus capital on production and business sectors, and strictly control credit risks in potentially risky sectors. Strengthen inspection and supervision of credit institutions, detect and handle violations of laws on currency and banking activities within their authority. Promote the application of technology and digital transformation. Promote connections between banks and economic sectors and fields. Proactively follow the direction of the State Bank of Vietnam in implementing Resolution No. 18-NQ/TW of the Central Executive Committee on restructuring and streamlining the apparatus.

Credit institutions strictly comply with the regulations of the State Bank of Vietnam on currency and banking activities. Implement effective credit growth solutions along with credit quality control, focus on lending to production, business, and priority sectors, strictly control credit for potentially risky sectors, and strengthen risk management for consumer credit. Resolutely, practically, and effectively implement solutions to support customers.

Actively implement solutions to handle bad debts. Coordinate in the process of recovering bad debts and handling secured assets. Continue to prevent and combat violations of the law in the monetary and banking sector, contributing to monetary and financial stability. Strictly comply with regulations and perform well treasury services, non-cash payments, ensure security and safety of information technology operations, electronic payments, and card payments./.

Thao My

Source: https://bacgiang.gov.vn/chi-tiet-tin-tuc/-/asset_publisher/St1DaeZNsp94/content/bac-giang-trien-khai-nhiem-vu-nganh-ngan-hang-nam-2025

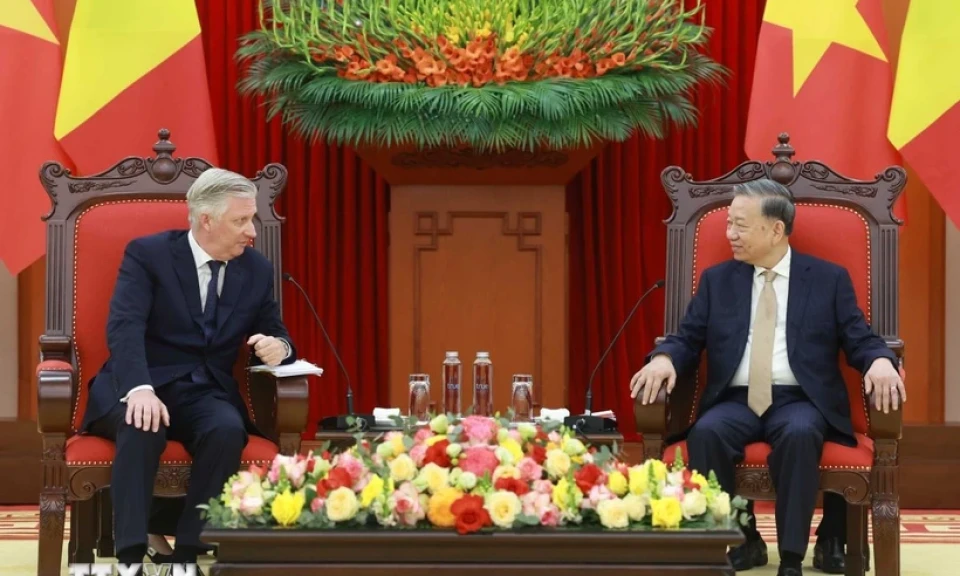

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

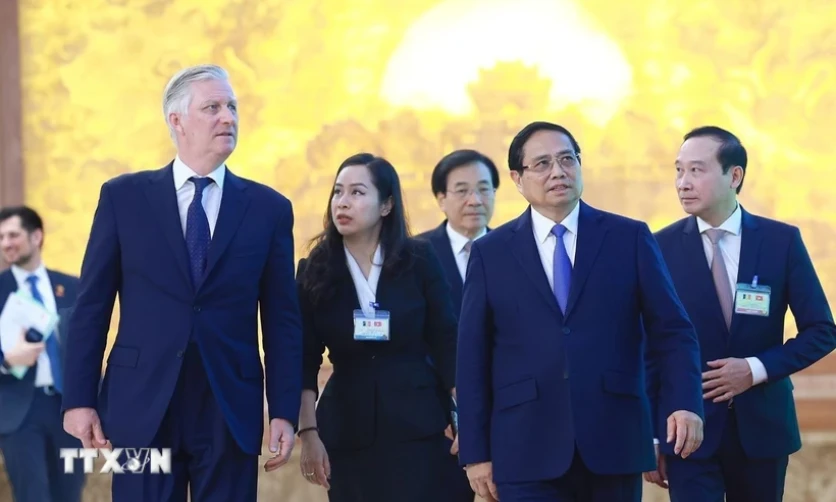

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)