Comrade Nguyen Tuan Anh - Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee delivered a concluding speech at the Conference.

The conference was held in person and online at 9 locations in districts, towns and cities in the province.

Attending the conference at the Provincial People's Committee bridge were leaders of the Department of Finance, Department of Agriculture and Environment, Department of Construction. Leaders of the Tax Department of Region VIII, Customs Department of Region I; Leaders and experts of the Provincial People's Committee Office.

Leaders of the Provincial People's Committee chaired the Conference at the Provincial People's Committee bridge point.

Right from the beginning of the year, the Provincial People's Committee has focused on leading and directing functional departments, branches and localities to drastically implement solutions for budget collection in 2025, along with continuing to promptly and effectively organize the implementation of key solutions to improve the investment and business environment, improve the provincial competitiveness index, administrative reform index, create all favorable conditions to promote and improve the efficiency of production and business activities of enterprises, create stable and sustainable revenue sources for the state budget; at the same time, directing branches and localities to promote the allocation and disbursement of public investment capital to create momentum for economic recovery. Ensure the comprehensive completion of the state budget revenue estimate in the province in terms of both total amount and structure at each level, meeting sufficient resources to perform assigned tasks of spending on socio-economic development in the area.

Director of the Department of Finance Nguyen Thi Trang Nhung reported on the implementation of budget collection in the first 3 months of 2025.

The province has established a Working Group to guide, remove difficulties, and urge districts, towns, and cities in the 2025 budget collection work, headed by leaders of the Provincial People's Committee, and continue to effectively implement the Steering Committee and Standing Group to deploy the application of electronic invoices in Yen Bai province.

In the first 3 months of 2025, the total budget revenue in the area is estimated to be higher than the 3-month scenario and the same period, in which 12/16 revenue items increased compared to the same period and scenario, creating a premise to complete the budget revenue scenario for March and the second quarter of 2025.

Delegates attending the Conference at the bridge points

At the conference, leaders of districts, towns and cities reported on the progress of budget collection in the area; discussed and clarified difficulties and obstacles, and proposed solutions to ensure the budget collection plan for the second quarter and the whole year of 2025.

Comrade Nguyen Tuan Anh - Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee delivered a concluding speech at the Conference.

Concluding the Conference, Comrade Nguyen Tuan Anh - Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee acknowledged the efforts of sectors and localities in implementing budget collection in the first 3 months of 2025.

He suggested that immediately after the Conference, sectors and localities should focus on reviewing budget collection targets and proposing solutions to remove difficulties and obstacles in budget collection in the area. Urgently stabilize the organization and apparatus after reorganization to perform well the assigned tasks.

Chairman of the Provincial People's Committee Nguyen Tuan Anh requested that departments, branches and localities continue to synchronously and effectively implement tasks and solutions on socio-economic development in general and budget collection scenarios in particular according to the conclusions and directions of the Provincial Party Committee and the Provincial People's Committee.

Promote calling for and attracting investment; strengthen dialogue, resolve problems and make recommendations to proactively remove difficulties for businesses, especially in administrative procedures, taxes, investment and business environment, land, site clearance, access to capital, product consumption; improve the effectiveness of trade promotion, investment promotion, tourism promotion... to promote production and business development, creating sustainable revenue sources for the budget. Along with that, promote administrative reform, enhance digital transformation associated with the task of collecting budget in all areas.

The Tax Department coordinates with other sectors and localities to promptly grasp the production and business activities of business households in order to control the declaration and implementation of tax obligations of taxpayers. Review all revenue sources in the area, focusing on the inspection and exploitation of revenue from taxes, fees and charges; strengthen the management of revenue sources; continue to fully implement tasks and solutions on tax management, promote the implementation of electronic invoices, strengthen inspection, examination, combat smuggling, tax evasion and trade fraud; review and re-examine all revenues, handle and recover tax arrears, reduce tax arrears...

Regarding revenue from land use sources, continue to review the list of land funds with potential, favorable locations, great value, and many investors are interested in order to focus maximum time and human resources to speed up the completion of legal processes and procedures for bidding and auctioning land use fees; proactively coordinate to review and implement registration of adjustments and additions to land use planning and plans to implement land funds and coordinate to complete procedures for land funds with public assets for auction in 2025.

The Chairman of the Provincial People's Committee requested that sectors, units and localities regularly monitor changes in budget revenue, grasp revenue sources and the number of taxpayers in the area, proactively develop plans to compensate for sources affected by policies to ensure that the total revenue of each sector and locality is completed according to the scenario.

Source: https://yenbai.gov.vn/noidung/tintuc/Pages/chi-tiet-tin-tuc.aspx?ItemID=36229&l=Tintrongtinh

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

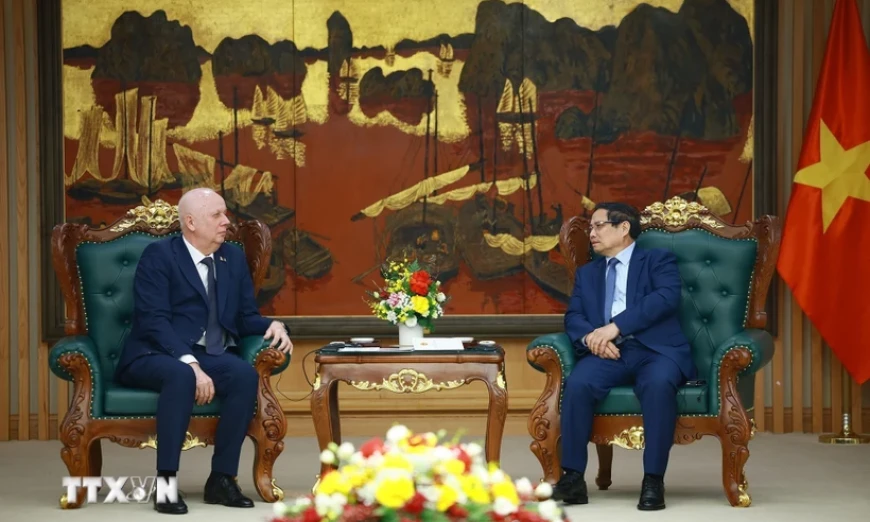

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

Comment (0)