In the first 9 months of this year, Sacombank's after-tax profit was nearly 6,500 billion VND. Accumulated undistributed consolidated profit up to the end of September this year reached 24,830 billion VND.

STB is handling 32.5% of its equity, which is the collateral for the bad debt of the former board of directors, currently held by VAMC - Photo: STB

Sacombank has not yet paid dividends, but said it is implementing a post-merger restructuring plan. The final issue is related to how to handle Mr. Tram Be's shares.

Meanwhile, many shareholders holding this stock are waiting for the day to "reap the sweet fruit" from dividends.

A foreign fund holds the most Sacombank shares in its portfolio.

Pyn Elite Fund - one of the largest foreign funds in the Vietnamese stock market, has just updated its performance report for October this year.

The report shows that in the fund's top 10 portfolios, Sacombank's STB shares account for 1/5 of the portfolio, equivalent to a proportion of 20%.

According to Pyn Elite Fund experts, the VN-Index fell nearly 2% in October due to weakening market sentiment as the USD strengthened, and the fund's net assets also fell more than 1.7% compared to the previous month.

But with many growth stocks, including STB, the Finnish fund's cumulative investment performance through October reached 18.5% while the VN-Index increased by 11.9%.

According to Sacombank's 2023 annual report, the bank's major shareholders only hold 6.73% of shares, equivalent to more than 126.7 million STB shares, while the remaining small shareholders hold 93.27%, equivalent to more than 1.75 billion shares.

If divided by individual and organizational criteria, at the end of 2023, STB has more than 67.5% individual shareholders, the rest are held by organizations.

Among the individuals holding STB shares, Mr. Duong Cong Minh - Chairman of STB - holds more than 62.56 million units, equivalent to 3.32% of the bank's capital, according to the management report for the first 6 months of 2024.

Ms. Nguyen Duc Thach Diem - General Director of Sacombank, only holds 76,320 shares, equivalent to 0.004% of this bank's capital.

In the annual report published earlier this year, Ms. Diem said: "Sacombank understands that the prolonged failure to pay dividends has more or less created an unhappy sentiment among shareholders."

However, according to Ms. Diem, in reality, Sacombank is a restructuring bank, so dividend distribution, regardless of form, must be approved by the State Bank of Vietnam (SBV).

So when can dividends be paid?

According to the third quarter 2024 financial report, Sacombank's after-tax profit in the first 9 months of this year reached VND6,489 billion, an increase of nearly 19% over the same period last year.

Without paying dividends for a long time, Sacombank's accumulated undistributed profit up to September this year reached VND24,830 billion, up nearly 22% compared to the beginning of the year.

Before 2015, Sacombank was known for its fairly stable dividend policy. After the merger, Sacombank entered a challenging restructuring phase.

According to the minutes of this year’s shareholders’ meeting, Sacombank’s leadership said it is implementing a post-merger restructuring plan, with the final issue related to the handling of Mr. Tram Be’s shares. The bank has submitted a detailed plan to the State Bank and is awaiting approval.

Sacombank also said that although dividends have not been paid, STB's market price has increased quite strongly recently, partly compensating shareholders.

Speaking with Tuoi Tre Online , the leader of a securities company in Ho Chi Minh City said that so far the bank has not announced the auction of shares of Mr. Tram Be and related people.

The number of shares related to Mr. Tram Be is "not small", so the question of "who to sell to" and "what price to sell" is raised, according to the stock expert.

Mr. Truong Thai Dat, director of analysis at DSC Securities, also said that STB is handling 32.5% of its equity, which is the collateral for the bad debt of the former management board, currently held by VAMC.

Specifically, 32.5% of this equity was pledged by Mr. Tram Be (former vice chairman of the bank) for a debt of VND 10,000 billion. The bank said it had submitted a plan to the State Bank to proactively handle it through auction from 2023.

These debts have been fully provisioned, so a successful auction will help STB record a sudden profit from provision reversal. This will directly and positively impact the bank's capital adequacy ratio.

According to DSC experts, STB's current capital adequacy ratio (CAR) is relatively modest compared to the general trend and banks of the same size. As of the end of June, STB's CAR was 8.42%, meeting the minimum requirement of the State Bank (8%) but much lower than other banks.

Source: https://tuoitre.vn/9-nam-khong-chia-co-tuc-loi-nhuan-giu-lai-sacombank-tien-gan-1-ti-usd-20241110152844602.htm

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

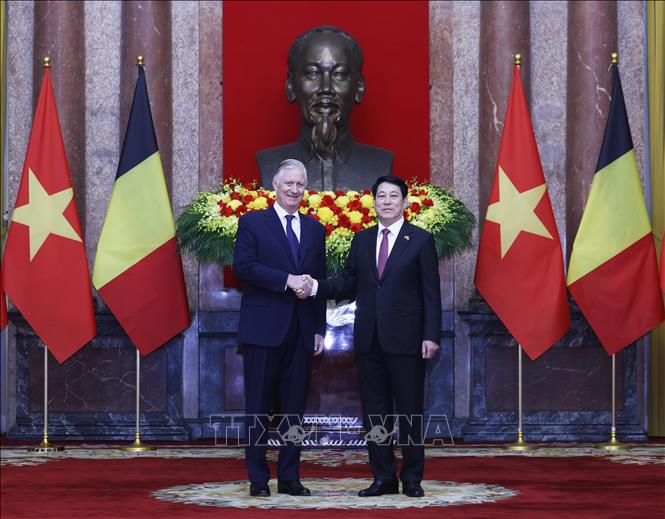

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

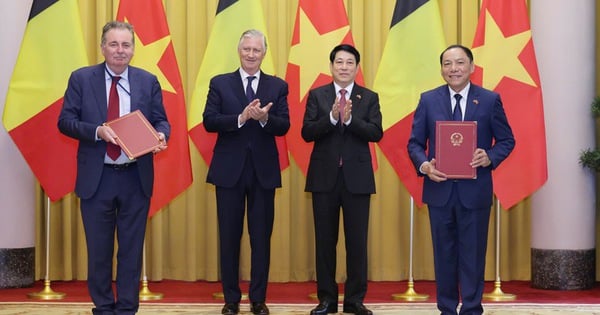

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

Comment (0)