| Coffee exports: What solutions to achieve a turnover of 4 billion USD in 2023? Prices continuously increase, coffee exports "aim" for 6 billion USD in 2030 |

Vietnam's cumulative coffee exports in the first 8 months of 2023 are estimated at about 1.2 million tons, down 4.9% compared to the total amount of coffee exported in the same period last year.

|

| Cumulative coffee exports in the first 8 months of 2023 are estimated at about 1.2 million tons. |

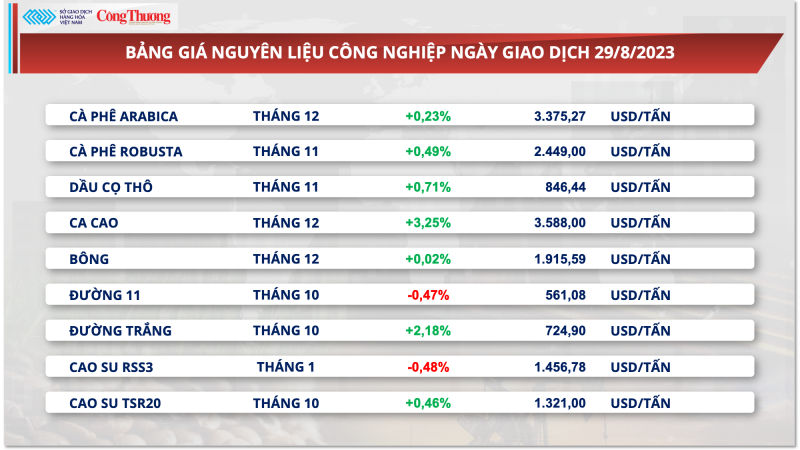

Despite the decline in volume, the export price of coffee, especially Robusta coffee - Vietnam's main coffee variety, has recorded strong growth in recent times. The Vietnam Commodity Exchange (MXV) reported that at the end of the trading session on August 29 (morning of August 30, Vietnam time), Robusta coffee prices also recorded an increase of 0.49% in yesterday's session, bringing the current price to 2,449 USD/ton. Vietnam's gloomy coffee exports have raised concerns about a global supply shortage.

|

| Coffee prices continued to increase in yesterday's trading session. |

Notably, the average coffee export price in the first 7 months of this year reached 2,828 USD/ton, an increase of more than 500 USD/ton compared to the same period last year. This is a record high in recent times.

In addition, Arabica coffee prices reversed and increased slightly by 0.23%. MXV said that the 0.51% decrease in the Dollar Index yesterday caused the USD/Brazil Real exchange rate to decrease by 0.43%. Thus, the exchange rate gap between the currencies of the two main importing and exporting countries has narrowed, causing Brazilian farmers to limit sales due to earning less Real.

Meanwhile, as of August 29, the inventory of qualified Arabica on the ICE has dropped sharply to 500,931 60kg bags, the lowest level in more than 9 months.

Regarding the Vietnamese coffee market, our country's coffee exports reached about 1.78 million tons, earning 4.06 billion USD in 2022, up 13.8% in volume and 32% in value compared to 2021. This is also the first year in history that coffee exports exceeded the 4 billion USD mark. According to data from the International Coffee Organization, Vietnam is the second country in the world in terms of coffee export market share (February 2021 - January 2022), second only to Brazil.

According to the Department of Crop Production - Ministry of Agriculture and Rural Development, the total coffee area of Vietnam by the end of 2022 reached 710.66 thousand hectares. Vietnamese coffee is grown in 19 provinces across the country but is mainly concentrated in 5 provinces of the Central Highlands, accounting for 91.2% of the total area of the country.

Compared to coffee producing countries in the world, Vietnam's coffee area ranks only 6th after Brazil with a total area of nearly 1.9 million hectares, Indonesia with a total area of over 1.2 million hectares, Colombia and Ethiopia with more than 800 thousand hectares, and Ivory Coast with nearly 800 thousand hectares.

According to the Vietnam Coffee and Cocoa Association (VICOFA), the recent continuous increase in coffee prices is due to supply not meeting demand, of which weather is one of the main reasons. It is forecasted that from now until the end of the year, coffee exports will still be favorable as demand increases while supply does not improve.

Vietnam's coffee industry is targeting export turnover of 6 billion USD by 2030.

To develop sustainable coffee material areas, the Launching Ceremony of the construction and installation of component 5 "Investment in infrastructure to support cooperatives in developing high-quality coffee material areas in the Central Highlands" has just taken place in Gia Lai province.

The project's objective is to invest in forming a concentrated, modern, commodity-scale coffee material production area, applying advanced technology on the basis of sustainable linkages between cooperatives and processing and exporting enterprises to promote the rapid, effective and sustainable restructuring of the agricultural sector and new rural construction of Gia Lai and Dak Lak provinces; develop and enhance the role and operational efficiency of agricultural cooperatives in the coffee value chain; meet quality requirements and reduce the cost of coffee material products for processing and export; increase income to contribute to improving the lives of local people.

Source link

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)