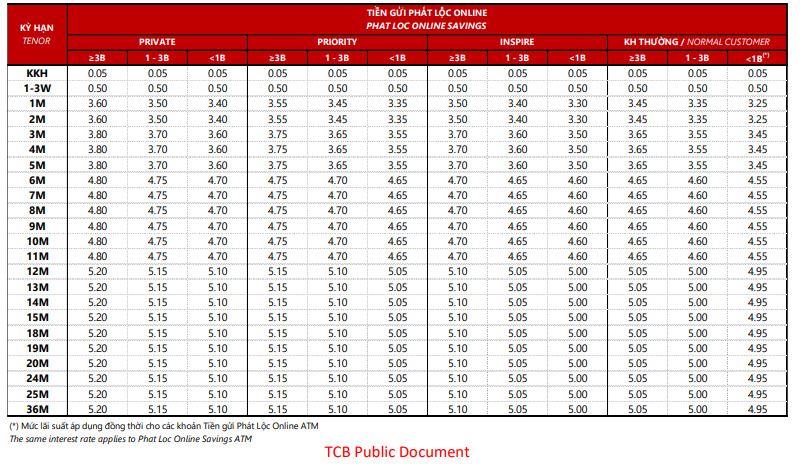

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) has just adjusted its deposit interest rate up by 0.2%/year for 1-5 month term and 0.3%/year for 6-11 month term. This is the second time this August that the bank has increased its interest rate.

According to the online interest rate schedule applied to deposit accounts under 1 billion VND, the term of 1-2 months increases to 3.25%/year, the term of 3-5 months increases to 3.45%/year, the term of 6-11 months increases to 4.55%/year.

Currently, the highest interest rate at Techcombank is 5.05%/year, applied for a term of 12-36 months with an amount of 3 billion VND or more.

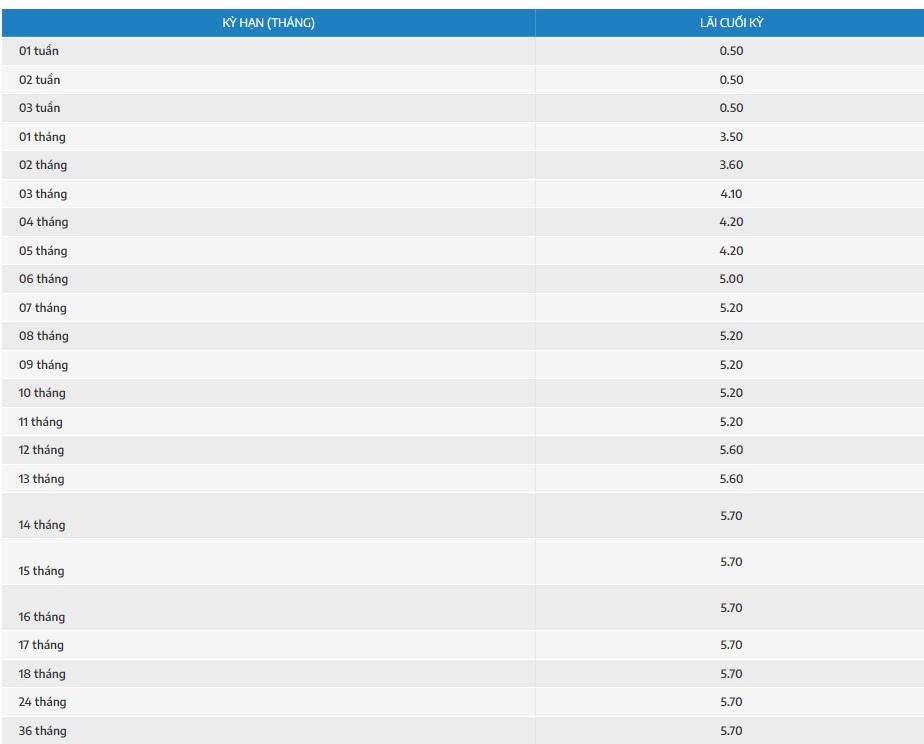

Nam A Commercial Joint Stock Bank (Nam A Bank) also increased the interest rate for deposits with terms from 1 to 17 months with the highest rate of 0.5%/year. This is the first time in 3 months that this bank has changed the interest rate.

Accordingly, the 1-month term increased by 0.4%/year to 3.5%/year, the 2-month term increased sharply by 0.5%/year to 3.6%/year; the 3-month term increased by 0.3%/year to 4.1%/year, the 4-5-month term increased by 0.2%/year to 4.2%/year.

Nam A Bank adjusted the interest rate for deposits with terms of 6 months to 5%/year after many months of interest rates for these terms always being below 5%/year.

Currently, Nam A Bank is listing the highest interest rate at 5.7% for terms of 14 to 36 months.

According to statistics, from the beginning of August until now, 15 banks have increased deposit interest rates, including: Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, DongA Bank, VPBank, Techcombank, VietBank, SHB, PVCombank, and Nam A Bank.

Source: https://laodong.vn/kinh-doanh/2-ngan-hang-tang-manh-lai-suat-cuoi-thang-8-1385695.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

Comment (0)