After the fastest inventory decline in more than 10 years from major importers, Vietnam's exports rebounded in January 2024, raising expectations of improved turnover in the coming time.

|

| Vietnam's export orders rebounded in January 2024. |

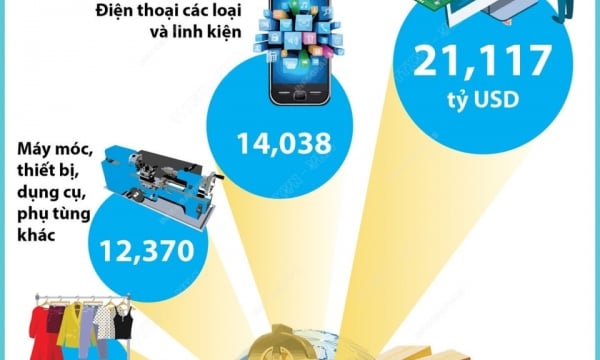

Phone exports increased by 16% year-on-year in January 2024

According to Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research at VinaCapital, US companies over-ordered “Made in Vietnam” products during the COVID-19 supply chain disruptions and had to cut orders for these products last year to reduce inventory. However, after the fastest inventory reduction in more than 10 years, Vietnam’s export orders rebounded in January 2024.

The same was true in China, where new orders improved significantly last month (although orders continued to fall, but at a slower pace).

VinaCapital expects Vietnam's export orders to continue to rise in the coming months thanks to the surprisingly strong US economy, reflected in US consumer confidence reaching its highest level since the post-COVID-19 reopening boom.

Vietnam’s strong export growth in January 2024 was driven by a nearly 60% year-on-year increase in computer and electronics exports. Global PC (personal computer) industry revenue fell 30% year-on-year in early 2023, but rebounded late last year, partly due to users upgrading to higher-end machines to handle AI (artificial intelligence).

Global smartphone sales also returned to growth in late 2023 for the first time in two years, although the recovery was not as pronounced as in computers as new products lacked compelling enough features to spur users to upgrade. Vietnam’s smartphone exports rose 16% year-on-year in January 2024, helped by the launch of the new Samsung S24 model during the month.

Finally, another reason for Vietnam's strong export growth in January 2024 is that this month has 25% more working days than January 2023 (due to the Lunar New Year 2023 taking place on January 21-27, 2023).

This simple calculation shows that exports should actually increase by 25% in January 2024 based on the calculation based on more working days, so the 42% growth in exports in January is impressive even when taking into account the Tet holiday.

Support the economy

Manufacturing grew by 19.3% year-on-year in January 2024, so export growth outpaced production growth. That means manufacturers’ inventories fell last month (Vietnam’s January 2024 PMI also confirmed a decline in finished goods stocks). The combination of falling inventories and rising new orders means that Vietnam’s factories will need to ramp up production to meet the rising demand for “Made in Vietnam” products.

Manufacturing accounts for nearly 25% of Vietnam’s GDP, so boosting manufacturing activity will boost GDP growth. In addition, nearly 10% of Vietnam’s workforce is employed by FDI companies with relatively high salaries.

FDI companies have cut jobs since early 2023, which is also one reason why Vietnam's GDP grew by only 3.3% in the first quarter of 2023, according to the General Statistics Office, but manufacturing employment has recovered after last year's cuts. Factory wages have also recovered by 5-7% after hitting rock bottom last year.

The economy will therefore be boosted by increased manufacturing activity and higher consumption this year, supported by increased manufacturing employment. Consumer confidence and domestic demand, which were weak in 2023 due to layoffs and property sector problems, will recover.

"While we do not expect consumer spending to grow strongly in the first quarter, we still expect consumer spending and domestic demand to be stronger in the latter part of the year," said Michael Kokalari.

Stock market support

VinaCapital expects domestic investors to pour more money into Vietnam’s stock market in the first quarter and this year as bank deposit interest rates in Vietnam are near their lowest levels. In addition, a broad-based economic recovery will boost corporate profits, especially in the banking sector and consumer companies.

Market valuations are very attractive. The VN-Index is trading at 10x, nearly two standard deviations below the 5-year average P/E and 25% below the valuations of regional emerging markets.

In addition, the recovery of the real estate industry in Vietnam will take more time because measures to solve market problems are still being implemented. Therefore, the stock market is currently the most attractive channel for people to invest in the coming period.

Not every stock will be a winner, and some companies don’t have a positive outlook, according to Michael Kokalari. VinaCapital’s fund managers and analysts are focusing on companies with earnings growth prospects of more than 20% this year, noting that many of these companies are currently trading at very low valuations.

Source link

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)