|

On March 5, 2025, the Government issued Resolution No. 42/NQ-CP on the proposal to develop a National Assembly Resolution on financial centers in Vietnam. What is your assessment of this decision?

The establishment of a regional and international financial center in Vietnam is an important step forward, clearly demonstrating the strategic vision and major policy of the Party and Government in developing the financial market towards modernization and integration in the new era. Not only creating an institutional boost, the financial center also plays a key role in the process of transforming the growth model, improving the efficiency of mobilizing, allocating and using resources in the economy, thereby contributing to enhancing national competitiveness, expanding connectivity and participating more deeply in the global financial system.

According to you, does Vietnam have enough conditions to form an international financial center?

It can be said that Vietnam is converging many important fundamental factors. First is its strategic geographical location. Vietnam is located in the center of the Asia-Pacific region, which has the most dynamic development speed in the world. Ho Chi Minh City has a favorable location on international maritime and air trade routes, with a different time zone compared to 21 major financial centers around the world, which is an advantage in cross-time transactions. Meanwhile, Da Nang also has great potential with the advantage of regional connectivity, seaport infrastructure and modern urban development planning.

Second is the high level of economic integration. Vietnam has signed 17 FTAs with over 65 leading economies in the world; total import and export turnover of goods reached 786.3 billion VND (2024), about 1.7 times higher than GDP, making Vietnam one of the economies with high openness and trade relations with over 230 markets. The financial market is on the rise. The banking system is increasingly approaching Basel standards. The stock market has reached a capitalization equivalent to more than 70% of GDP, barriers to foreign investors are being removed. Ho Chi Minh City is currently the largest financial center in the country, contributing 15.5% of GDP, more than 25% of total budget revenue, and nearly 11.3% of export turnover. The city has also been ranked in the Global Financial Centers Index (GFCI) and tends to improve its ranking over the years.

Third, infrastructure has made important contributions to socio-economic development.

Fourth, in terms of institutional and legal framework, the business investment environment has improved significantly, contributing to the strong development of all types of enterprises and economic sectors, especially the private economic sector.

Fifth, the macro economy is maintained stable. The total GDP in 2024 is about 470 billion USD (ranked 33-34 in the world in terms of scale), GDP per capita is about 4,600-4,700 USD; inflation is well controlled; interest rates are stable; public debt and government debt decrease rapidly, creating confidence for the business community and society...

But to build a financial center, there will certainly be many challenges for Vietnam, madam?

Yes, the challenges are not small for Vietnam, both in terms of institutions, infrastructure and enforcement capacity. First of all, the challenge is in perfecting the legal and institutional framework to create a favorable environment for financial centers to develop in the context that the legal system on finance, investment and capital markets still has many points that need to be improved to better approach international standards. The current legal system has not fully caught up with the rapid development of the international financial sector, especially in issues of investor protection and cross-border financial transactions. In addition, regional competition is very strong. Singapore, Hong Kong, Shanghai... have all built financial centers with clear legal foundations, modern infrastructure, and advanced financial ecosystems and attractive investment attraction policies, requiring Vietnam to build specific mechanisms to create its own advantages to attract businesses and investment capital flows.

Among the biggest challenges facing Ho Chi Minh City are traffic congestion, environmental pollution and the lack of international-standard financial centers. These are barriers that need to be overcome. In addition, although Long Thanh International Airport is under construction, completing major infrastructure projects will require significant time and resources.

In addition, one of the conditions to become an international financial center is financial liberalization. The banking system still depends heavily on traditional credit products, and does not have many modern financial products like developed countries. In the stock market, although the Securities Law has been amended and the system has gradually developed, Vietnam has not yet been upgraded to the group of countries with emerging stock markets. Finally, limitations in technology and cybersecurity are also a major challenge in the context of cybercrime risks and security vulnerabilities in financial transactions, which also pose an urgent need to improve security and risk management capabilities in this area.

So what are the solutions to overcome those challenges and what do you expect for the future of financial centers in Vietnam?

Financial centers in Vietnam should combine modern, sustainable and flexible elements, making the most of existing potential of cities and meeting the requirements of regional competition.

One is to choose a suitable development model. If developing an international financial center according to a model associated with trade, industry, technology, capital market and ancillary services (semi-classical), the number one choice is Ho Chi Minh City. Meanwhile, Da Nang can implement a multi-component ecosystem model including development centers focusing on 3 service groups: payment, international trade, risk management and foreign exchange trading services, and green financial services.

Second, establish a flexible, modern legal framework in line with international standards to attract international financial institutions. Establishing a solid legal framework to ensure the integrity and stability of the financial market, especially regulations on investor protection, market conduct, capital requirements, risk management and information disclosure standards... Research allows testing of new business models in the financial sector such as Fintech, Insurtech, and digital trading platforms. Fast licensing processes and protection of investor rights need to be implemented...

Third, in terms of financial and technological infrastructure, an international financial center needs a modern payment system, connected to the global financial market, as well as high-tech infrastructure to support financial transactions, fintech and e-commerce. In addition, information technology infrastructure also plays a core role. Ho Chi Minh City needs to build a strong financial data system, integrating advanced technologies such as artificial intelligence (AI), Blockchain and Big Data to support financial activities. A digital financial zone can be established to concentrate Fintech companies, facilitating them to test new products and services. This will also be a place to encourage cooperation between technology startups and traditional financial institutions.

Fourth, there must be a tax incentive policy. Resolution No. 259/NQ-CP dated December 31, 2024 of the Government promulgating the Action Plan to implement Notice No. 47-TB/TW dated November 15, 2024 of the Party Central Committee on the conclusion of the Politburo on the construction of a regional and international financial center in Vietnam has assigned a number of tasks to the Ministry of Finance to preside over related to the tax sector: "Researching outstanding incentive mechanisms for green financial activities within the scope of the financial center; having incentive policies for foreign banks to establish branches or move their headquarters and representative offices to the financial center in Vietnam (such as tax and fee incentives, etc.)".

Fifth, continue to simplify licensing and business registration processes, as well as improve transparency and efficiency in state management. Reducing administrative barriers will help attract international investors and promote the development of financial centers.

Sixth, high-quality human resources are a key factor in the financial center model. Cooperation with universities, research institutes and international training organizations to improve the professional qualifications of the workforce in the financial sector is necessary. In-depth training programs in finance, risk management, data analysis and financial technology also need to be promoted. At the same time, it is necessary to implement policies to attract international talent, especially experts in the fields of banking, finance, and technology; along with special visa policies for financial experts, Fintech, and technology from abroad... to make the financial center an ideal destination for global talent.

I believe that with the right strategy, methodical approach and cooperation between the central government - local governments - enterprises, Vietnam can completely build one or several regional financial centers in the process of becoming a modern industrialized country with high average income by 2030 and a developed, high-income country by 2045.

As I said above, building and developing a regional and international financial center will help Vietnam connect to the global financial market, attract foreign financial institutions, create new resources, and strengthen existing resources.

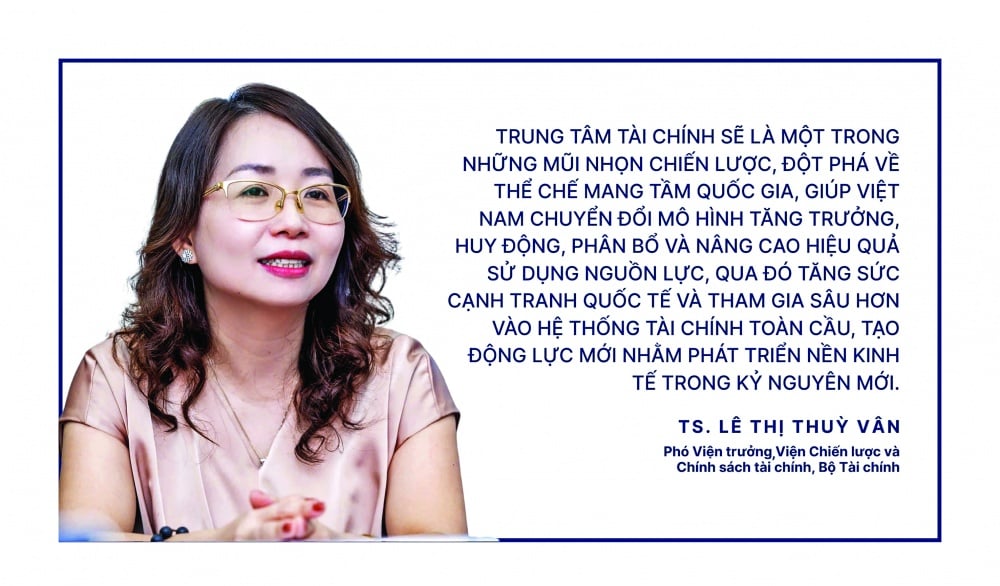

In addition, Vietnam can take advantage of the opportunity to shift international investment capital flows to develop the economy and society; promote the effective development of Vietnam's financial market according to international standards. The financial center will be one of the strategic spearheads, a national institutional breakthrough, helping Vietnam transform its growth model, mobilize, allocate and improve the efficiency of resource use, thereby increasing international competitiveness and participating more deeply in the global financial system, creating new momentum to develop the economy in the new era.

Thank you very much!

Upcoming Seminar "INTERNATIONAL Experience" In order to exchange experiences in building a financial center and clarify the role of the banking system in this process in Vietnam, with the consent of the leaders of the State Bank of Vietnam, on the morning of April 16, Banking Times will organize a seminar with the theme: "International experience and the role of the banking system in building a financial center". Attending the seminar are leading international experts on economic policy, financial sector development and investment strategy; Representatives of Leaders of relevant Ministries and branches... Together with representatives of Leaders of departments, agencies, units under the State Bank; some regional branches of the State Bank; Banking Association; credit institutions; international organizations, foreign banks in Vietnam... |

Source: https://thoibaonganhang.vn/xay-dung-trung-tam-tai-chinh-quoc-te-nang-tam-vi-the-viet-nam-162773.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)