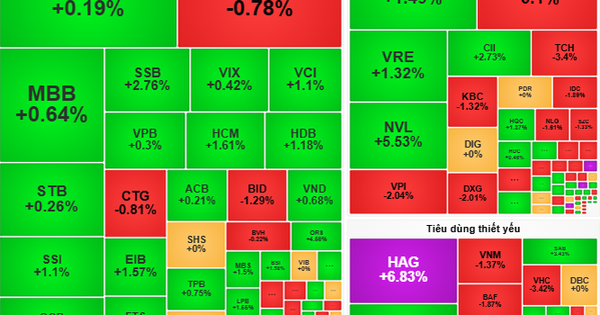

In contrast to the cautious and sluggish state at the beginning of the session, the market reversed positively towards the end of the day, when the pillar stocks increased sharply, pulling the VN-Index above the reference level and closing at the peak of the day, up 6.95 points, reaching 1,217.25 points. The VN30 index alone also recorded an increase of nearly 10 points, up to 1,303.03 points with 18 stocks increasing in price, including many stocks increasing by over 2% such as: VIC, VHM, LPB, GEX, DIG or HVN.

|

| Vingroup shares have increased nearly 70% in the past month or so. |

In particular, the pair VIC - VHM had a spectacular comeback. At 2:15 p.m., VHM decreased by 2.3% but by the end of the session, it turned around and increased by 0.53%. VIC even broke out strongly, ending the session up 4.57%. FPT, LPB, MSN also increased impressively by 1.39%, 2.91%, and 2.68%, respectively.

Analyst Le Huu Nghia - Tri Viet Securities Joint Stock Company said: "The strong reversal session at the end of the day shows that the market still has support from the pillar group, especially in the derivatives expiration session. However, it is worth noting that liquidity did not increase in proportion to the price, reflecting somewhat the reserve of domestic cash flow."

Market liquidity in the April 17 session increased slightly by 10.99% in value but decreased by 0.24% in volume compared to the previous session. The total trading value on HoSE reached VND21,614 billion, but most of the buying force came from efforts to maintain the pillar rather than widespread cash flow.

Notably, while the price level has clearly improved with 261 stocks increasing/174 stocks decreasing (compared to 156 stocks increasing/285 stocks decreasing at the bottom at 2:15 p.m.), the trading volume is still 25.3% lower than the average of 20 sessions. This situation shows the doubts of investors, especially in the context of the lack of new supporting information and the potential short-term profit-taking pressure.

Another notable point is the rather drastic net selling from the securities company's self-trading group - a group of professional investors who often play the role of "regulating" cash flow in the market. The total net selling value in the session reached 186 billion VND, mainly focusing on large stocks such as: FPT: The most heavily net sold with 79 billion VND - although this stock recorded a good increase of 1.39%. STB and E1VFVN30: Net sold 48 billion and 37 billion VND respectively. In addition, other codes such as KOS, GEX, PNJ, VIB were also divested by self-trading.

On the other hand, securities companies' self-trading only made modest net purchases at HPG (32 billion), FUEVFVND (12 billion) and some codes such as VIC, MBB, VHM. On HNX and UPCoM, self-trading transactions were quite limited, with a total net purchase value of less than 1 billion VND.

According to Mr. Nguyen Huy Phuong - Senior Manager of Analysis Center, Dragon Viet Securities (VDSC): "The strong net selling of stocks showing signs of recovery is unusual. This may be a periodic portfolio restructuring activity or a reflection of a cautious view of the current recovery. If this trend continues, the market will lack an important technical support."

Besides self-trading, foreign investors continued to be the "negative focus" when they net sold a total of VND4,585 billion - the highest level in recent weeks. Of which, VIC was suddenly net sold off VND4,446 billion through agreements. Other stocks were also under great pressure such as VNM (-120 billion), HPG (-98 billion), STB (-85 billion)...

On the buying side, FPT shares were the focus with a net buying value of VND117 billion - despite being sold by self-trading. In addition, VCI, MWG, VHM and HVN also attracted a fair amount of foreign buying.

The "uneven" behavior of foreign investors and self-employed traders compared to the rest of the market makes the cash flow picture more unpredictable. On the one hand, the late-session pullback shows the expectation of recovery; on the other hand, the selling pressure from institutional investors reflects the hesitation and lack of confidence in the new uptrend.

Technically, the VN-Index is still holding the important support zone of 1,200 points. The MACD indicator is gradually narrowing the gap with the signal line, indicating the possibility of a buy signal appearing again if the market maintains positive momentum in the next few sessions.

However, according to analyst Han Huu Hau of PVS Securities Joint Stock Company: "The market still has potential risks when the cash flow has not returned clearly, especially from foreign investors and self-employed traders. VN-Index needs a breakthrough session in both points and liquidity to confirm the short-term uptrend."

Although the market recorded an impressive recovery session thanks to the pull of bluechips, institutional cash flow - specifically securities companies' proprietary trading and foreign investors - still maintained a strong net selling position. This is a factor that hinders the index's sustainable recovery in the short term.

Investors should closely observe liquidity developments, domestic cash flow and the next actions from the pillar stocks. The fact that VN-Index maintains the 1,200-point mark and MACD confirms a buy signal will be an important basis for establishing a new trend in the coming time.

Source: https://thoibaonganhang.vn/dong-tien-noi-than-trong-giua-ky-vong-hoi-phuc-162950.html

![[Photo] Readers in Dong Nai are excited about the special supplement of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/82cdcb4471c7488aae5dbc55eb5e9224)

![[Photo] People lined up in the rain, eagerly receiving the special supplement of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ce2015509f6c468d9d38a86096987f23)

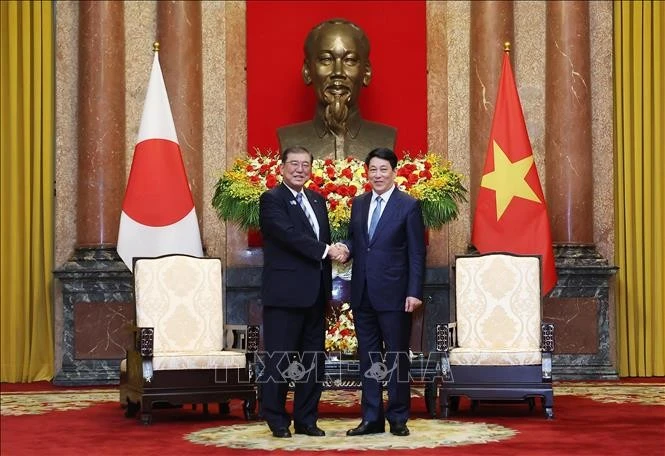

![[Photo] National Assembly Chairman Tran Thanh Man meets with Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/2517da8f7b414614b8ed22cd6c49c3f6)

![[Photo] Special supplement of Nhan Dan Newspaper spreads to readers nationwide](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/0d87e85f00bc48c1b2172e568c679017)

Comment (0)