Recently, Vietnam Prosperity Joint Stock Commercial Bank (VPBank – HoSE: VPB) announced the resolution of the Board of Directors on approving the plan to offer shares to foreign strategic investors.

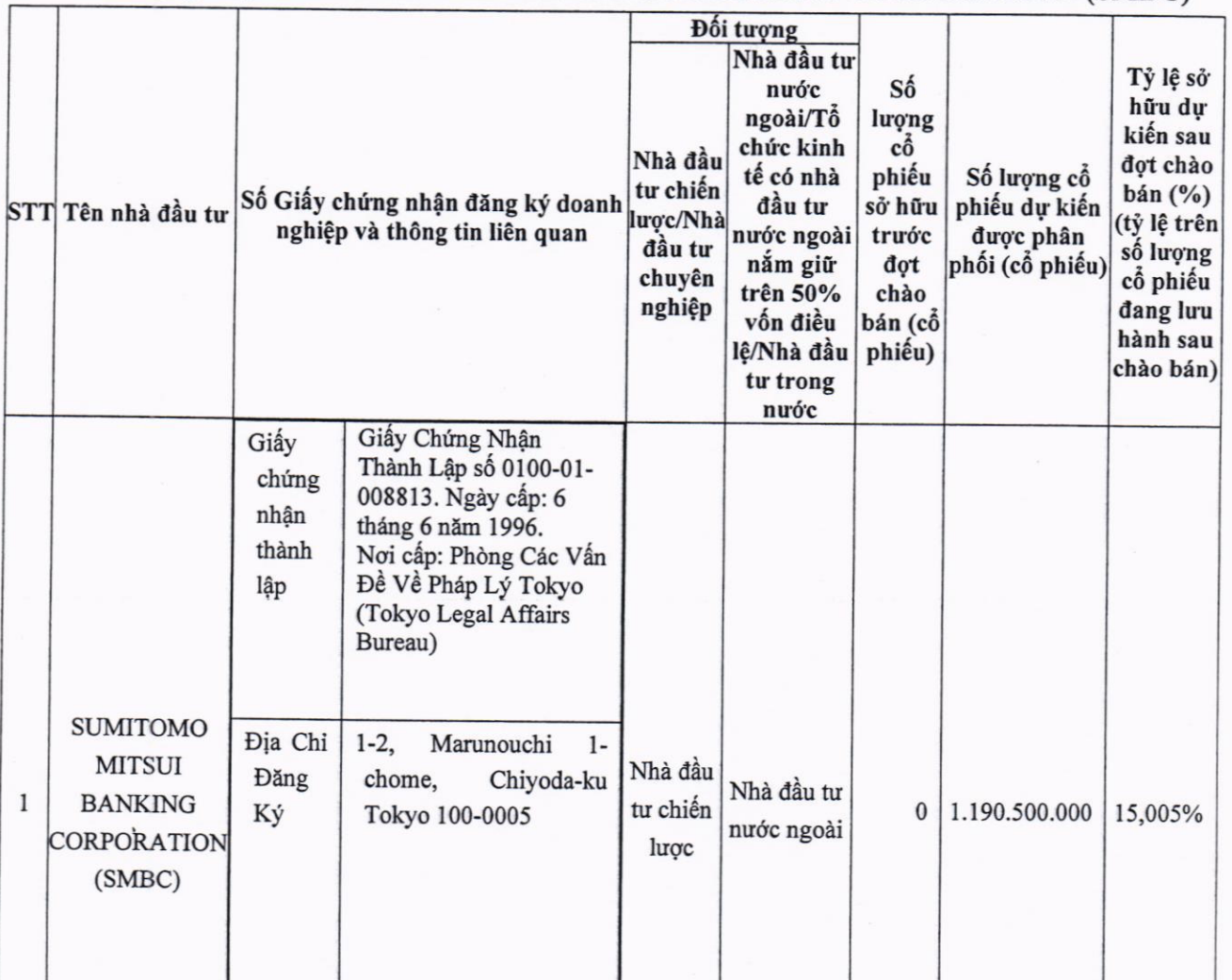

Accordingly, this bank will issue more than 1.19 billion shares for private offering to Sumimoto Mitsui Banking Corp (SMBC), with an expected price of VND30,159/share, equivalent to a total value of more than VND35,900 billion. The above number of shares is equivalent to 17.73% of VPBank's outstanding shares and equal to 15% of the outstanding shares after the successful offering.

The expected offering time will be in the third - fourth quarter of 2023, after the State Bank approves SMBC to buy shares at VPBank and the State Securities Commission announces receipt of a complete application for private offering of shares.

At the same time, all of these shares will be restricted from transfer within 5 years from the date of registration of additional shares at the Vietnam Securities Depository Center.

For the unsold shares, the Board of Directors decided not to continue offering the unsold shares and recorded the actual number of shares offered. With the total proceeds of more than VND 35,900 billion, VPBank is expected to record an increase in charter capital of VND 11,905 billion and a surplus of equity capital of over VND 23,999 billion.

Regarding the capital usage plan, VPBank will use VND 34,999 billion to supplement medium and long-term capital to serve the lending/credit needs of customers; the remaining VND 905 billion will be invested in infrastructure, facilities, system development, etc.

VPBank offers private shares to foreign investors.

Also in this resolution, VPBank's Board of Directors approved increasing the maximum foreign ownership ratio to 30% of charter capital to ensure the implementation of the private offering plan.

VPBank said that Sumitomo Mitsui Banking Corporation (SMBC) is a Japanese bank (part of the SMFG financial group). SMBC is not an existing shareholder of VPBank and does not have a parent-child relationship with the bank under the Enterprise Law and has no relationship with members of the Board of Directors, Supervisory Board and General Director of VPBank.

Previously, at the end of March, VPBank held a signing ceremony for an agreement to privately issue 15% of charter capital to SMBC Bank. This agreement officially made SMBC Group a strategic investor of VPBank.

This investment agreement is part of the capital increase plan that VPBank has been implementing since 2022 to strengthen long-term financial capacity and achieve the bank's 5-year growth target .

Source

Comment (0)