In the context of the exchange rate facing many pressures, the attractiveness of the Vietnamese stock market is unlikely to break out. As of April 10, foreign investors net sold VND14,500 billion on the HoSE.

|

Foreign investors are net sellers.

Although there have been a few net disbursement sessions in the long chain of about 20 recent selling sessions, the net selling trend is still overwhelming. As of April 10, foreign investors have earned nearly VND 14,500 billion after net selling stocks since the beginning of the year, equivalent to nearly 66% of the net selling value of this group in the whole of 2023. In March 2024 alone, foreign investors net sold VND 11,275 billion.

The selling trend has increased significantly since mid-March and shows no signs of stopping, despite the market's positive recovery. Despite the recent sharp correction, by mid-April 2024, the VN-Index had still increased by more than 11% compared to the beginning of the year, at times surpassing the peak recorded in 2023 (1,293.9 points). In addition, thanks to domestic investors, the cash flow into the market has continuously increased, with the average liquidity in March exceeding VND 30,000 billion/session.

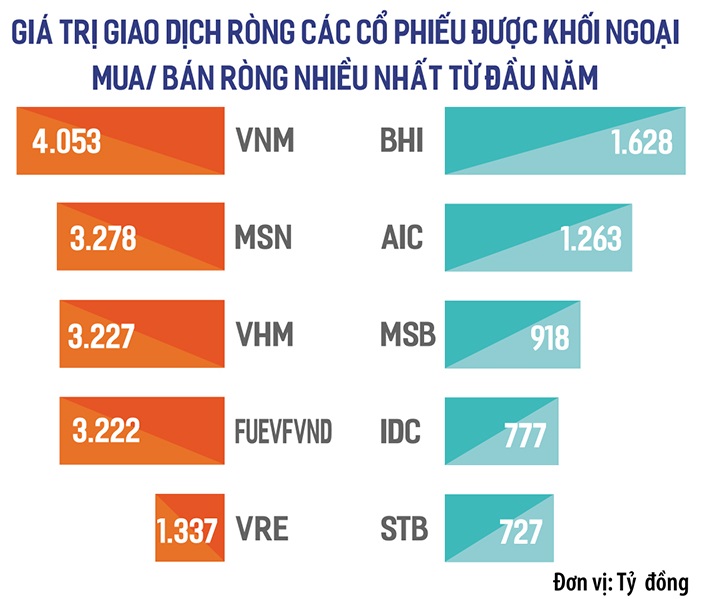

Among the group of stocks that have been sold strongly by foreign investors since the beginning of the year, there are many stocks from large enterprises in the industry. Topping the list of net sales is VNM stock of Vietnam Dairy Products Joint Stock Company (Vinamilk). The ownership ratio of foreign investors in the "giant" of the dairy industry has continuously decreased over the years, from 69% at the end of 2017 to 46.1% now, according to the latest updated figures.

Foreign money is not interested in VNM shares partly because Vinamilk is having difficulty with the growth problem. Even in 2023, when profits increase again above the low comparison base, VNM shares still decrease by 14%, while the VN-Index increases by 8%. Two ETF certificates based on the VNDiamond portfolio basket (FUEVFVND) and VNFinLead (FUESSVFL) are both in the top 10 net sellers of foreign investors.

Meanwhile, the two stocks that foreign investors bought the most were both related to mergers and acquisitions (M&A) deals that foreign investors had prepared for half a year ago. DB Insurance Co., Ltd (Korea) disbursed a total of VND1,890 billion, thereby owning 75% of the equity capital of the Aviation Insurance Corporation and Saigon - Hanoi Insurance Corporation. If not counting the two large transactions conducted through the above negotiation method, the net selling volume of foreign investors in the first months of the year was much larger.

Why?

Regarding the trend of international capital flows, according to Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities Company, major markets such as Japan, Thailand, Taiwan, etc. have all been strongly withdrawn in the past 2-3 weeks. Right in the trading session last Friday (April 5), most Asian stock exchanges were "on fire" after the message from officials of the US Federal Reserve (Fed).

The possibility that “there is no need to cut interest rates this year if inflation remains stable” was mentioned by Minneapolis Fed President Neel Kashkari in his mid-week speech. Meanwhile, Fed Chairman Jerome Powell said that the Fed needs more evidence that inflation is moving towards the 2% target in a sustainable manner before cutting interest rates. That is also the reason why the DXY Index has increased so much in recent days. The increase in the value of the USD continues to attract investment capital to the US.

Regarding the development of global investment capital flows, statistics from the Center for Analysis and Investment Consulting, SSI Securities Corporation (SSI Research) show that ETF fund capital withdrawals reached a record of VND 4,810 billion in March 2024, equivalent to nearly 5.9% of total asset size. Most ETF funds are in a net selling state, of which DCVFM VNDiamond is under record selling pressure (VND 2,800 billion), raising the net withdrawal value from March 2023 to VND 8,600 billion. Active funds also suffered a strong net withdrawal of more than VND 1,800 billion in the month.

Experts from SSI Research maintain the view that the attractiveness of the Vietnamese stock market is unlikely to improve, especially in the context of the exchange rate facing many pressures, unless solutions to help upgrade the Vietnamese stock market are implemented more drastically. In addition, investment cash flow into the Vietnamese market may have more positive developments in the second half of the year, when benefiting from cash flow shifting to developing markets after the Fed started cutting interest rates.

However, expectations of lower interest rates also need to be carefully monitored. External factors such as the solid growth of the US economy, strong figures on the labor market, or the unpredictable factor of conflicts in many countries that can affect oil prices and inflation variables can all prevent global capital flows from turning around as expected.

In terms of internal factors, Mr. Le Anh Tuan, Investment Director of Dragon Capital Fund Management Company, emphasized that an inherent cause that has not been overcome is the lack of diversity when the market does not have many choices of "goods". For example, with the appetite for investment in the new technology sector, Vietnamese securities have almost no stocks. Some large technology enterprises such as FPT soon ran out of foreign room...

However, Mr. Tuan also emphasized that Vietnamese securities are still among the markets that foreign investors are very interested in, especially thanks to the upgrade story. In a letter to investors at the end of March 2024, Mr. Petri Deryng, Director of PYN Elite Fund, also expected that the market will bring good results in the next 9 months.

Source

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)