The cooperation between VNPAY and Agribank Insurance not only brings convenient and smart digital insurance solutions to customers but also plays a pioneering role in shaping and developing the digital insurance market in Vietnam.

On the afternoon of October 14, in Hanoi, Vietnam Payment Solutions Joint Stock Company ( VNPAY ) and Agribank Insurance Joint Stock Company ( Agribank Insurance) officially signed a strategic cooperation agreement, marking an important step in the digitalization of the insurance industry. This is a pioneering step by both parties in shaping and developing the digital insurance market in Vietnam, bringing smart and convenient insurance solutions to customers.

Through this cooperation, Agribank Insurance's digital insurance products will be integrated into VNPAY's digital ecosystem. From here, customers can use digital insurance products that suit their needs right on the familiar platform on banking apps and e-wallets.

VNPAY and Agribank Insurance officially signed a strategic cooperation agreement.

With just one tap when performing daily transactions, customers can easily add insurance to their journey or purchase other digital insurance products without going through many complicated steps. Customers can present insurance certificates directly on the application platforms without having to store paper copies. This provides a seamless, time-saving experience that suits the busy lifestyle of modern customers.

Speaking at the signing ceremony, Mr. Nguyen Tien Hai, Chairman of the Board of Directors of Agribank Insurance shared: “Cooperating with VNPAY - one of the leading units in the field of digital payments - will help us bring convenient and easy-to-use insurance solutions to people across the country. This is especially important in the context of customers increasingly needing to experience digital services, from travel insurance products, passenger accident insurance, to other non-life insurance products”.

With a commitment to putting customer information safety and security first, VNPAY and Agribank Insurance ensure that all digital insurance transactions strictly comply with data security regulations, helping customers feel secure when using the service. With a diverse ecosystem, VNPAY and Agribank Insurance can also cross-sell products, easily introducing suitable insurance packages to customers using related services.

In the coming time, VNPAY and Agribank Insurance will continue to expand many new insurance products, meeting the diverse and increasing needs of customers.

VNPAY and Agribank Insurance are committed to giving top priority to information security.

Shaping and promoting digital insurance in Vietnam

With an advanced technology platform and diverse service ecosystem, VNPAY accompanies Agribank Insurance in effectively approaching and serving customers. This cooperation marks an important step forward, not only helping Agribank Insurance optimize operations but also increasing competitiveness, contributing to shaping the future of the digital insurance industry in Vietnam.

At the ceremony, Mr. Tran Manh Nam - Director of VNPAY Enterprise Division shared: “VNPAY is on a journey of strong transformation in the digital transformation process. With a large distribution channel system including more than 40 banks and 250,000 businesses, VNPAY is proud to bring consumers optimal technology and payment solutions. Cooperating with Agribank Insurance is a testament to our strategy of expanding the digital ecosystem, aiming to bring more value to customers.”

VNPAY has always been a pioneer in maximizing the effectiveness of cooperation between businesses, bringing convenient solutions and superior experiences to users. The cooperation agreement with Agribank Insurance is a testament to this vision, contributing to bringing digital insurance products closer to Vietnamese consumers.

After the signing event, both parties expect to continue to expand their partner network and increase the number of customers using Digital Insurance services. VNPAY and Agribank Insurance are committed to building a strong Digital Insurance ecosystem together, contributing to creating sustainable value for customers and partners.

About VNPAY

VNPAY is known as the leading Fintech in Vietnam. Currently, it is cooperating with more than 40 domestic and international banks and payment organizations to develop a variety of payment services. Typical services include Mobile Banking - mobile banking application for individuals and businesses, eKYC - online identification solution, authentication technology using Soft OTP, biometric technology - Biometrics and many other solutions to meet the transaction needs of more than 50 million customers.

VNPAY connects with thousands of businesses and suppliers to develop a service ecosystem on banking applications and VNPAY wallets, meeting customers' daily needs from shopping, traveling to entertainment.

VNPAY cooperates with more than 250,000 businesses, providing typical payment solutions and services such as: Electronic payment gateway, VNPAY-QR, VNPAY-POS, VNPAY-SoftPOS, VNPAY B2B, VNPAY- Invoice...

About Agribank Insurance

As a subsidiary in which Agribank holds controlling shares, Agribank Insurance is proud to be a pioneer in providing non-life insurance products, creating a solid financial shield, accompanying Agribank in serving the Agriculture - Farmers - Rural areas.

Choosing its own path and making a difference, Agribank Insurance has taken advantage of the Agribank system to build a Bancassurance distribution channel with 171 General Agents - Agribank branches, 2,300 transaction points and more than 30,000 agents nationwide. Agribank Insurance's Bancassurance channel is considered the most successful in Vietnam, thereby creating a trend for developing a Bancassurance distribution channel for the Non-life insurance market.

Agribank Insurance commits to accompany the Agribank system to contribute to the sustainable economic development of society through compliance with the law, ensuring customer benefits, shareholder benefits, employee benefits, training and development of people and the country. Agribank Insurance focuses on implementing social security work, fulfilling the responsibility of the enterprise to the community, especially in rural areas.

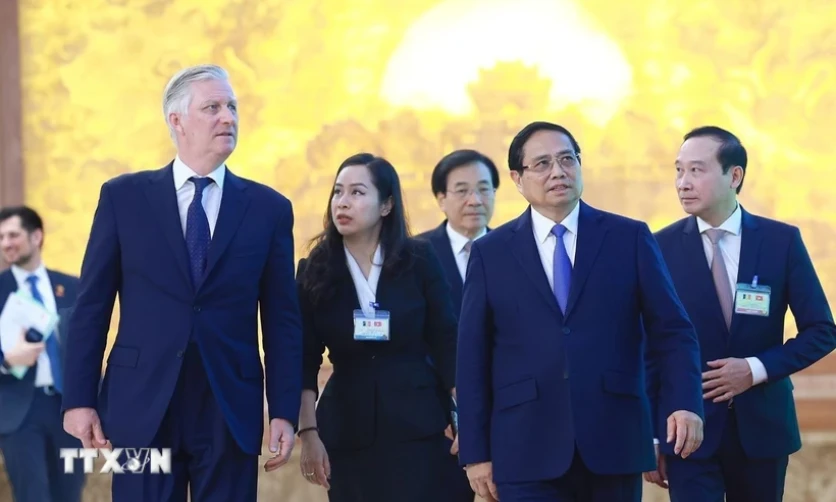

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

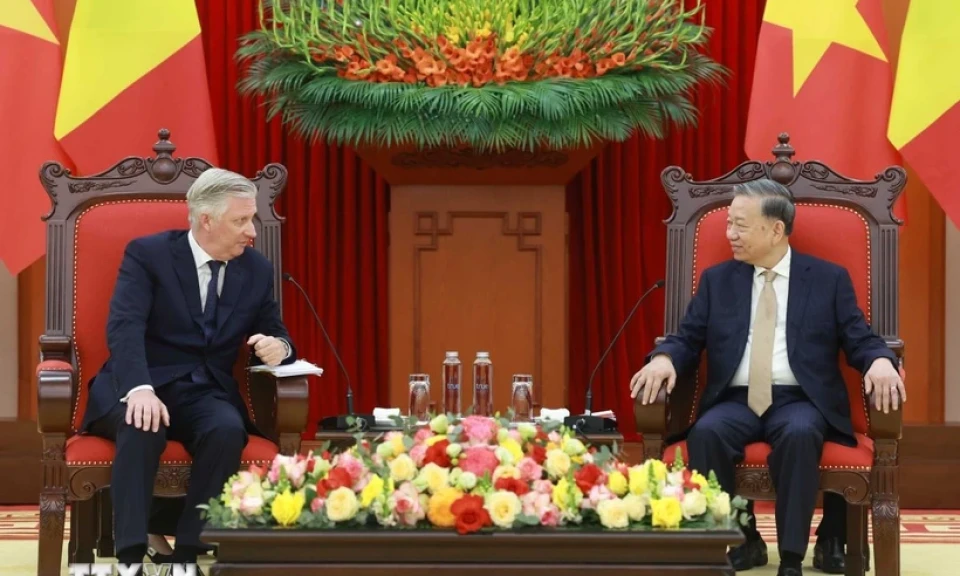

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)