VN-Index dropped more than 22 points after 1 week of trading, a series of female leaders sold stocks heavily, the market is waiting for important signals, ACB shares are expected to increase by 28%, dividend payment schedule.

VN-Index decreased by 22.25 points

At the end of the last trading week, VN-Index decreased by 22.25 points (equivalent to a decrease of 1.75%) to 1,251.71 points.

Cash flow into the market was somewhat less vibrant, down 21.3% compared to the average transaction value, trading around 15,000 billion VND, even down to 10,000 billion VND in one session (September 12), the lowest in nearly a year.

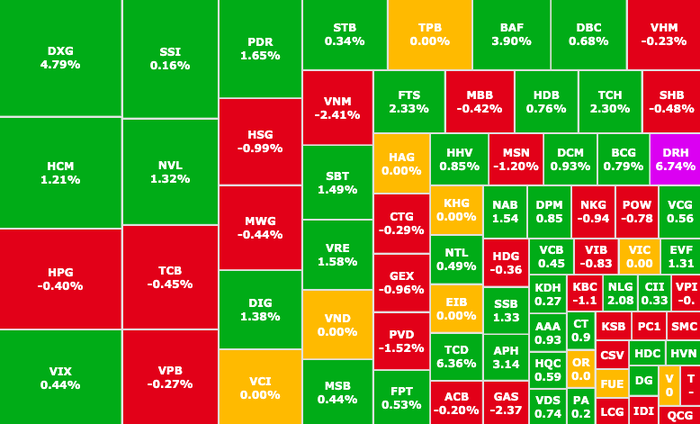

The group of "pillar" stocks turned around, with many "big" names appearing in the top stocks (cp) that had a negative impact on the VN-Index: SSB (SeABank, HOSE), TCB (Techcombank, HOSE), VNM (Vinamilk, HOSE), VIC (Vingroup, HOSE), NVL (Novaland, HOSE),...

A series of "pillar" stocks turned down last week (Photo: SSI iBoard)

Foreign investors also sold net again at the end of last week. On September 13 alone, foreign investors sold net more than VND189 billion worth of VHM (Vinhomes, HOSE) shares, and VND124.3 billion worth of MWG (Mobile World, HOSE) shares...

NVL stock nears historic bottom (Photo: SSI iBoard)

Real estate stocks have attracted attention as they have fallen sharply one after another. Typically, NVL (Novaland, HOSE) has decreased by more than 11% in value over the past week, down to VND11,500/share. The current price is only about VND1,500 away from the historical bottom.

"Bright spots" appeared in the agricultural stock group when many codes increased strongly against the market trend: AGM (An Giang Import Export, HOSE), DBC (Dabaco, HOSE), PAN (Pan Group, HOSE),...

Thus, from the first trading session of September until now, the VN-Index has dropped sharply by nearly 30 points with most sessions being less optimistic, "red" playing a dominant role in the market.

Female leader sells stocks heavily

Ms. Truong Nguyen Thien Kim reported selling 13.2 million VCI shares of Vietcap Securities Joint Stock Company. The transaction was conducted from September 4 to September 11 by order matching and/or negotiation.

It is estimated that at the closing price, Ms. Kim earned about 600 billion VND after completing the above transaction. After the transaction, Ms. Kim still holds more than 9.6 million VCI shares, equivalent to 2.18% of capital ownership.

Ms. Kim is the wife of General Director and Member of the Board of Directors of Vietcap To Hai. Currently, Mr. To Hai holds more than 99.1 million VCI shares (22.44%).

Two female leaders: Ms. Truong Nguyen Thien Kim (left) and Ms. Dang Huynh Uc My (right) simultaneously sold shares heavily (Photo: ST)

In addition, she is also known as the owner of Katinat and Phe La chains; Chairwoman of the Board of Directors and General Director of D1 Concepts JSC; Member of the Board of Supervisors of Mien Tay Bus Station JSC (WCS, HNX); Member of the Board of Directors of International Dairy Products JSC (IDP, UPCoM).

In the same move, Ms. Dang Huynh Uc My has also just registered to sell all 110,419 SCR shares (HOSE) of Saigon Thuong Tin Real Estate JSC - TTC Land, from September 18 to October 17. The purpose is to restructure the investment portfolio.

Currently, SCR is trading around VND5,390/share, less than half of its book value of VND12,314/share. Since the beginning of April, SCR has decreased by about 32%. Compared to the price at the beginning of 2022, SCR's market price has decreased by 78%.

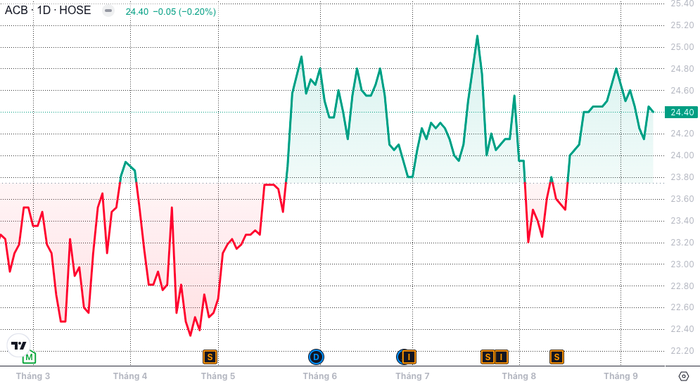

ACB bank shares expected to increase by 28%

According to SSI Securities, in the second quarter of 2024, ACB's credit growth (Asia Commercial Joint Stock Bank, HOSE) reached 12.8% compared to the beginning of the year, up to VND 550.2 trillion.

ACB's bad debt increased by 10.5% compared to the previous quarter, but the bad debt ratio was maintained at 1.48% thanks to stable credit growth.

ACB stock price movements on the stock exchange in the past 6 months (Photo: SSI iBoard)

Regarding card business, the proportion of active cards at ACB increased to 70% by the end of Q2/2024, with more than 5.5 million debit and credit cards. In addition, spending per card also increased by 8% compared to the previous quarter, to more than VND4 million after remaining stable for 3 consecutive quarters.

SSI believes that income from card fees and related services will continue to grow in the second half of 2024 at a time when consumer demand gradually recovers.

Based on the above factors, SSI forecasts that ACB's after-tax profit in 2024 and 2025 will be VND22 trillion (up 10% year-on-year) and VND26 trillion (up 17.8% year-on-year), respectively.

The company recommends Buy for ACB at a target price of VND 31,200/share, expected to increase 28% compared to the price on September 13.

Stocks "waiting for signal" from the Fed

Analysts believe that the “gloomy” trading last week was due to cautious sentiment in the face of important macroeconomic developments. Specifically, the market is waiting for a signal from the State Bank after the US Federal Reserve (Fed) cut interest rates.

The Fed's interest rate cut will be a supporting factor for the long-term growth cycle of the world stock market, and is expected to have positive impacts on the domestic stock market as well.

In September, Yuanta Securities commented that the Fed is likely to reduce interest rates, along with the cooling of the USD/VND exchange rate, which is a condition for the State Bank to maintain low interest rates to support the economy.

Cash flow may increase again after the Fed may start deciding to cut interest rates at its meeting next week.

Comments and recommendations

Mr. Do Thanh Son, Head of Investment Consulting, Mirae Asset Securities, assessed that the market is experiencing more sadness than joy in the first half of September, VN-Index has decreased by 2.5% since the beginning of the month, liquidity has "disappeared", making investors confused.

The market is having a bad September.

According to him, it seems that the market is no longer as cheap as investors often expect, in fact, manufacturing groups in particular and midcap group valuations are no longer cheap. Stocks need to show clearer signs in their business stories for investors to consider accepting a high valuation. In addition, the market is under pressure from foreign net selling, but the selling pressure is expected to decrease soon by the end of September thanks to capital flows showing signs of returning to the Southeast Asian region.

In general, the attractive story of the market is still largely "clinging" to the fundamentals and has an impact on the overall picture: Positive EPS growth in 2024 - 2025 will depend on the global recession; The general recovery of the Vietnamese economy, reflected in GDP (expected in 2024 at 6 - 6.5%; The Government's fiscal and monetary policy conditions still support investment and business production recovery.

In the long term, the market is still expected to not be too bad in the last months of the year, but we need to look forward to clearer signs of the economy.

VN-Index may not be able to escape the large amplitude of 1,200 - 1,300 points in the short term and investment opportunities will be diversified. Investors are recommended to consider choosing stocks that: (1) have a very unique story, (2) have supportive cash flow, (3) are still "attractive" in valuation. Among them, a few stocks can be considered: Real estate industry: PDR - AGG; Banking: CTG (VietinBank, HOSE); Essential retail: MSN (Masan, HOSE).

SSI Securities said the index is struggling in a narrow range of 1,248 - 1,255 points. Technical indicators show that the short-term decline continues. VN-Index is forecast to continue fluctuating in the range of 1,245 - 1,254 points.

DSC Securities assessed that the market still has a bright spot when it maintains the important support level of 1,250 points, low liquidity in the context of correction is not a bad signal. The important thing now is that the market needs to successfully test "supply" before moving on to test "demand" at the above resistance zone. Next week, the market will face many important events such as the Fed's policy meeting, derivatives maturity, and ETFs restructuring their portfolios. This will be a "test" to assess the real supply and demand of the market.

Dividend schedule this week

According to statistics, there are 31 enterprises that have fixed dividend rights from September 4-6, of which, 25 enterprises pay in cash, 2 enterprises pay in shares, 1 enterprise exercises the right to buy and 1 enterprise pays a combination.

The highest rate is 50%, the lowest is 1%.

2 companies pay by stock:

Ba Ria - Vung Tau House Development Corporation (HDC, HOSE), ex-right trading date is September 16, rate 15%.

Tan Cang Song Than ICD JSC (IST, UPCoM), ex-right trading date is September 19, rate 25%.

1 business exercising the right to purchase:

TNH Hospital Group Corporation (TNH, HOSE), ex-right trading date is September 17, rate 13.8%.

1 business pays combination:

Vietnam Export Import Commercial Joint Stock Bank (EIB, HOSE) pays dividends in cash and additional issuance, with the ex-dividend date being September 19, at a rate of 7%.

Cash dividend payment schedule

* Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| CKA | UPCOM | 16/9 | 3/10 | 50% |

| SAS | UPCOM | 16/9 | 9/27 | 6% |

| HMC | HOSE | 16/9 | 9/27 | 8% |

| ADP | HOSE | 16/9 | 3/10 | 7% |

| SVC | HOSE | 16/9 | 9/23 | 5% |

| SMB | HOSE | 17/9 | 3/10 | 20% |

| SRC | HOSE | 17/9 | 3/10 | 6% |

| CHS | UPCOM | 17/9 | 8/10 | 9.5% |

| TNW | UPCOM | 17/9 | 9/25 | 5.7% |

| HDW | UPCOM | 18/9 | September 30 | 7.9% |

| VGR | UPCOM | 18/9 | 3/10 | 20% |

| PSE | HNX | 18/9 | 10/16 | 8% |

| VLC | UPCOM | 19/9 | 10/22 | 6% |

| HTC | HNX | 19/9 | September 30 | 3% |

| EIB | HOSE | 19/9 | 4/10 | 3% |

| PVO | UPCOM | 19/9 | 10/15 | 1% |

| VTV | HNX | 19/9 | 10/24 | 1% |

| PTS | HNX | 19/9 | 4/10 | 2% |

| PVT | HOSE | 19/9 | 10/10 | 3% |

| PBT | UPCOM | 19/9 | 9/27 | 6.6% (2023) |

| PBT | UPCOM | 19/9 | 9/27 | 1.1% (2009) |

| NBP | HNX | 20/9 | 11/28 | 5% |

| ICG | HNX | 20/9 | 10/17 | 5% |

| SZL | HOSE | 20/9 | 2/10 | 20% |

| BTH | UPCOM | 20/9 | 10/21 | 7% (2023) |

| BTH | UPCOM | 20/9 | 10/21 | 10% (2024) |

| BAL | UPCOM | 20/9 | 10/23 | 7% |

| GH3 | UPCOM | 20/9 | 10/24 | 4.3% |

| HAT | HNX | 20/9 | 10/23 | 30% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-16-20-9-mot-so-nu-lanh-dao-ban-manh-co-phieu-20240916064308682.htm

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)