Cash flow into VN-Index is showing an upward trend again while many female investors are expressing their expectations for a bright stock market this year.

Continuously increasing

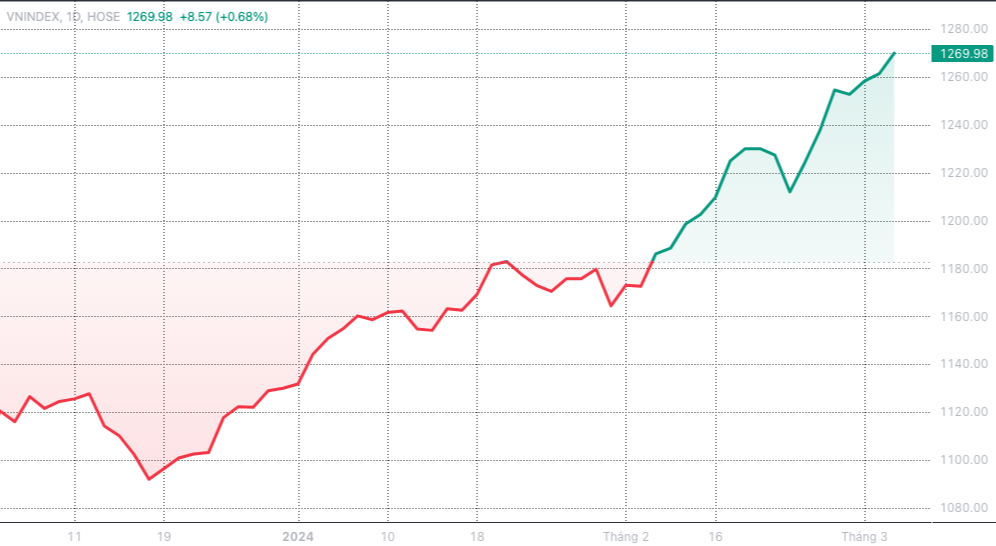

The stock market is returning to a vibrant state, continuously increasing strongly from last week until now, increasing more than 50 points from last week until now. VN-Index closed the session on March 5 at 1,269.98 points, approaching the 1,270 point mark.

The market has been soaring since last week (Source: SSI iBoard)

While real estate is still quite gloomy, gold prices are too high and have many potential risks, and savings interest rates have hit rock bottom, Ms. Nguyen Thi Nga (47 years old, Thanh Xuan District, Hanoi) said that the stock market is her top investment channel this year.

"After disbursing real estate projects, I decided to participate in the stock market and save money since last year. But now, interest rates are too low, stocks are going up, I decided to withdraw all my savings to put more capital into the stock market, so about 40% of my assets are in the stock market," Ms. Nga shared.

In fact, the cash flow into the market is showing signs of a strong comeback. On the HOSE floor alone, liquidity was maintained at VND19,000 - 22,000 billion, returning to the level before September 22, 2023. In fact, on March 5, the cash flow at HOSE increased significantly, reaching nearly VND26,000 billion.

According to securities companies, this shows that investors' sentiment towards stocks has become more positive and they have more confidence in the market.

At VN-Index, positive developments were evenly distributed across industry groups, taking turns leading the market, such as: securities, banking, steel, real estate, chemicals, and seafood.

Group of stocks strongly affecting the index

The bullish force has dominated the past 7 sessions (Source: SSI iBoard)

Having intended to withdraw from the market last year, after thinking it over, Ms. Thanh Huong (29 years old, Hanoi) still decided to stay: "For me, other investment channels are currently not as potential as stocks. Although there are risks, I am always careful and have a clear strategy, grasp macroeconomic information, and monitor market fluctuations. These things have helped me overcome a volatile year in the stock market."

Like Ms. Nga, Ms. Huong has invested more capital in stocks after the market continuously "flew high" last week. With 5 years of experience in investing in stocks, she believes that the market is showing positive signs and expects the VN-Index to improve this year, especially with stocks in the steel, real estate, and banking groups.

The stock market is attractive, investors still need to pay attention when trading

Assessing current investment channels, Associate Professor Dr. Nguyen Huu Huan, Head of the Financial Market Department, Ho Chi Minh City University of Economics, said that the gold market is fraught with policy risks, and savings interest rates are at record lows.

Therefore, with idle money, investors can consider the real estate market to catch the price wave at the bottom, but this is a market that requires a large amount of capital. As for the most reasonable and suitable, the stock market is an attractive investment channel, especially this year's developments have been more positive.

For stocks, investors should choose stocks with good and stable foundations, not just look at short-term strong growth.

VN-Index is in a fairly long growth phase with breakthrough increases and stable high liquidity.

However, SSI Securities said the report showed that the margin was not tight, meaning that investors had not used all their purchasing power. Moreover, the amount of savings deposits was still high despite low interest rates. It can be seen that investors need time to observe how the support policies will be absorbed.

In addition, many experts believe that there is a possibility of a correction or tug-of-war session, but the main trend will still be an upward trend. Investors are advised to be cautious in trading, taking advantage of the correction session to collect stocks with potential, good business foundations at reasonable prices or disburse stocks with potential risks.

Source

Comment (0)