VN-Index continuously in red; Dividend payment schedule; Investors pay attention to the 1,200 point area...

VN-Index down 24 points

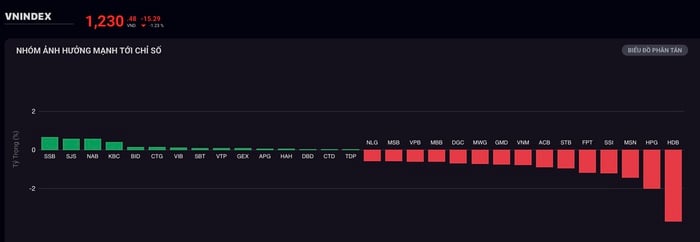

The market continued to end a trading week in red with selling pressure dominating, focusing on the VN30 group of stocks. VN-Index fell to 1,230 points, a total of 5 trading sessions, VN-Index fell 24 points, of which, in the last session of the week alone, the index fell more than 15 points.

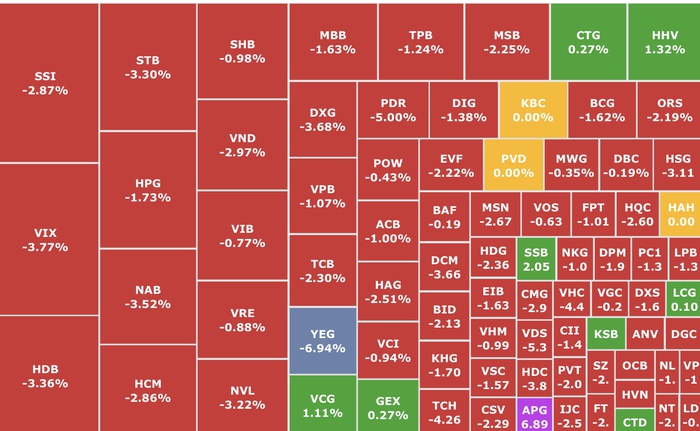

Weak liquidity with 12,900 billion VND on all 3 floors: HOSE, HNX and UPCoM, of which HOSE floor reached 11,235 billion VND with 338 codes decreasing (4 codes hitting the floor), 78 codes increasing (4 codes hitting the ceiling) and 40 codes going sideways.

VN30 basket with 27/30 stocks falling sharply. In addition, HAP stock (Hapaco, HOSE) also reversed to hit the floor, YEG (Yeah1, HOSE) continued to fall to the limit. Many mid- and large-cap stocks such as TCH Hoang Huy Finance, HOSE), PDR (Phat Dat Real Estate, HOSE), VIX (VIX Securities, HOSE), DXG (Dat Xanh Real Estate, HOSE),... fell by more than 3%.

The selling side dominated, causing the VN-Index to sink into red (Photo: SSI iBoard)

Notably, NVL (Novaland, HOSE) fell sharply by 3.2%, breaking the 10,000 VND/share mark, setting a historic bottom with liquidity of 8.7 million units.

Regarding foreign transactions, net buying appeared at the beginning of the week but quickly sold strongly. Over the past 5 sessions, foreign investors have sold 1,314 billion VND in the whole market.

Experts say that Vietnamese stocks are experiencing a poor trading week as investors' cautious sentiment has increased sharply, along with liquidity in many sessions reaching its lowest level in over a year, causing the main index to "break" the short-term bottom of 1,240 points.

Dabaco is expected to lead the business results in the fourth quarter of 2024 and the whole year of 2024.

According to an analysis report from FPT Securities (FPTS), Dabaco (DBC, HOSE) is the enterprise predicted to be the "champion" in profit growth in the fourth quarter of 2024. Accordingly, DBC's after-tax profit is forecast to increase by 3,557% (equivalent to 36 times). For the whole year of 2024, Dabaco can record 766 billion VND in after-tax profit, an increase of 2,964% over the same period.

Regarding some promising industry groups, FPTS believes that, in the banking group, VPBank (VPB, HOSE) will be the "star" in terms of pre-tax profit growth for Q4/2024 with an increase of 77%, reaching VND 4,800 billion. Next is MBBank ( MBB, HOSE) which also achieved impressive results, with profit growth possibly reaching 32% in Q4/2024.

In 2024, VPBank and MBBank's pre-tax profits are forecast to increase by 73% and 10% respectively.

For the Retail group, Mobile World (MWG, HOSE) is forecast to grow 1,566% in after-tax profit in the fourth quarter of 2024, this number will even increase to more than 2,500% for the whole year of 2024.

For the oil and gas industry, FPTS forecasts that the industry's profit growth will be differentiated. Names with positive growth include PV DRILLING (PVD, HOSE), Petrolimex (PLX, HOSE), PV TRANS (PVT, HOSE) with a slight increase of less than 10%. Meanwhile, the profits of many other enterprises in the oil and gas group "regressed" such as Vietnam Petroleum Services (PVS, HNX), PV GAS (GAS, HOSE).

Potential industries of the new era

In its strategic report titled "New Era", SSI Research assessed that reforms being implemented starting from the end of 2024, including streamlining the government apparatus, determination to accelerate public investment in infrastructure, and resolving outstanding issues in the real estate sector, if successful, will be three domestic factors that can help boost growth in 2025.

The policy environment is likely to remain favorable for the real estate industry as interest rates will not increase too much from current levels and credit growth will be boosted, promoting public investment in infrastructure projects, supporting real estate price increases.

Based on the above analysis, SSI Research has high expectations for the construction, construction materials, residential real estate and information technology industries this year. The retail industry remains the priority industry in 2025, with expectations that domestic consumption will gradually recover and grow in the long term.

At the same time, SSI Research expects the VN-Index to reach 1,450 points by the end of 2025.

SSI Research lists stocks with positive prospects in 2025: HPG (Hoa Phat Steel, HOSE), MWG (Mobile World, HOSE), FPT (FPT, HOSE), DPR (Dong Phu Rubber, HOSE), CTD (Cotecons, HOSE), NT2 (Nhon Trach 2 Oil, HOSE), CTG (VietinBank, HOSE), TCB (Techcombank, HOSE), ACV (Vietnam Airlines, HOSE) and KDH (Khang Dien House, HOSE).

Comments and recommendations

Mr. Pham Duy Hieu, investment consultant, Mirae Asset Securities, commented that VN-Index ended the week with a decrease of 24.11 points (-1.92%), closing at 1,230.48, the market reflected the cautious sentiment of investors in the context of the market continuously decreasing, foreign investors net selling again due to fluctuations from the stronger USD.

However, the market is still maintained within the safe range of 1,200 - 1,300 points, opening up attractive opportunities for investors with medium and long-term investment appetite.

In the short term, solid macro fundamentals will remain the basis for the stock market's rise, despite short-term downsides.

VN-Index under short-term pressure at 1,200 point area

Specifically, GDP in the fourth quarter of 2024 grew by 7.55%, the highest level of the year, confirming the clear recovery of the economy; Credit growth reached 15.08%, exceeding the State Bank's target, showing increased demand for loans, promoting economic turnover; FDI capital flows exploded: December 2024 recorded strong growth in FDI, especially capital flows into industrial park real estate (IP real estate).

However, the market is facing some pressures such as exchange rate pressure when the USD increases in value, along with the VND being under pressure to depreciate, leading to continued strong net withdrawal of foreign capital in December.

Therefore, in the short term, investors are recommended to observe the market at 1,200 points, this is an opportunity to increase stocks at discounted prices, prioritizing stocks with good fundamentals, good growth stories from within the enterprise with attractive valuations. Such as state-owned banks with high credit growth; good ability to control bad debt: CTG (VietinBank, HOSE), BID (BIDV, HOSE); Industrial real estate: Benefit from the FDI wave, focus on codes such as SIP (Saigon VRG, HOSE), BCM (Industrial Investment and Development, HOSE), IDC (IDICO, HNX).

BSC Securities recommends that in the coming trading sessions, the index is likely to continue to decrease to the support zone of 1,210 - 1,220 points or further to 1,200 - 1,205 points.

Phu Hung Securities assessed that, technically, the index is showing signs of a possible decline to the support zone of 1,200 - 1,220 points, which is also the target price zone of the double-top model. The company expects the index to bottom out again in this zone. The general strategy for investors is to keep the proportion at an average level and observe the signal at the support zone to consider re-entering when there are positive developments.

Dividend schedule this week

According to statistics, there are 8 enterprises that have dividend rights from January 13 to January 17, 2025, of which 4 enterprises pay in cash, 1 enterprise pays in shares, 2 enterprises issue additional shares and 1 enterprise rewards shares this week.

The highest rate is 150%, the lowest is 4%.

1 company pays by stock:

Lam Son Sugar Joint Stock Company (LSS, HOSE) , ex-right trading date January 14, rate 7%.

2 additional issuers:

Yeah1 Group Corporation (YEG, HOSE) , Ex-dividend date 17/1, rate 40%.

DIC Holdings Construction JSC - DIC Cons (DC4, HOSE) , ex-rights trading date January 14, rate 50%.

1 company rewards shares:

Viet Tri Chemical JSC (HVT, HNX) , ex-right trading date January 15, rate 150%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| TNG | HNX | 13/1 | 22/1 | 4% |

| LSS | HOSE | 14/1 | April 15 | 5% |

| SEB | HNX | 15/1 | 24/1 | 10% |

| NSC | HOSE | 17/1 | 19/2 | 20% |

Source: https://pnvnweb.dev.cnnd.vn/chung-khoan-tuan-13-1-17-1-vn-index-co-the-ve-vung-1200-diem-truoc-nhieu-ap-luc-20250113070436689.htm

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)