Domestic gold price today April 2, 2025

At the time of survey at 4:30 a.m. on April 2, 2025, domestic gold prices increased rapidly, breaking the record of surpassing 102 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 99.4-102.1 million VND/tael (buy - sell), a decrease of 100 thousand VND/tael in buying - an increase of 300 thousand VND/tael in selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 99.4-102.1 million VND/tael (buy - sell), down 100 thousand VND/tael in buying - up 300 thousand VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 100-101.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 700 thousand VND/tael for buying and 500 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 99.4-102.1 million VND/tael (buying - selling, down 100 thousand VND/tael in buying - up 300 thousand VND/tael in selling compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 99.4-102.1 million VND/tael (buy - sell), gold price increased by 200 thousand VND/tael for buying - increased by 300 thousand VND/tael for selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 99.6-102.1 million VND/tael (buy - sell); an increase of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 99.8-102.3 million VND/tael (buy - sell); increased 200 thousand VND/tael for buying - increased 400 thousand VND/tael for selling.

The latest gold price list today, April 2, 2025 is as follows:

| Gold price today | April 2, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 99.4 | 102.1 | -100 | +300 |

| DOJI Group | 99.4 | 102.1 | -100 | +300 |

| Red Eyelashes | 100 | 101.5 | +700 | +500 |

| PNJ | 99.4 | 102.1 | -100 | +300 |

| Vietinbank Gold | 102.1 | +300 | ||

| Bao Tin Minh Chau | 99.4 | 102.1 | -100 | +300 |

| Phu Quy | 99.4 | 102.1 | +200 | +300 |

| 1. DOJI - Updated: April 2, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 99,400 ▼100K | 102,100 ▲300K |

| AVPL/SJC HCM | 99,400 ▼100K | 102,100 ▲300K |

| AVPL/SJC DN | 99,400 ▼100K | 102,100 ▲300K |

| Raw material 9999 - HN | 99,400 ▲400K | 101,200 ▲40K |

| Raw material 999 - HN | 99,300 ▲400K | 101,100 ▲40K |

| 2. PNJ - Updated: April 2, 2025 04:30 - Time of website supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,400 ▼100K | 102,100 ▲300K |

| HCMC - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Hanoi - PNJ | 99,400 ▼100K | 102,100 ▲300K |

| Hanoi - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Da Nang - PNJ | 99,400 ▼100K | 102,100 ▲300K |

| Da Nang - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Western Region - PNJ | 99,400 ▼100K | 102,100 ▲300K |

| Western Region - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Jewelry gold price - PNJ | 99,400 ▼100K | 102,100 ▲300K |

| Jewelry gold price - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Jewelry gold price - Southeast | PNJ | 99,400 ▼100K |

| Jewelry gold price - SJC | 99,400 ▼100K | 102,100 ▲300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,400 ▼100K |

| Jewelry gold price - Jewelry gold 999.9 | 99,400 ▲200K | 101,900 ▲200K |

| Jewelry gold price - Jewelry gold 999 | 99,300 ▲200K | 101,800 ▲200K |

| Jewelry gold price - Jewelry gold 99 | 98,480 ▲200K | 100,980 ▲200K |

| Jewelry gold price - 916 gold (22K) | 90,940 ▲180K | 93,440 ▲180K |

| Jewelry gold price - 750 gold (18K) | 74,080 ▲150K | 76,580 ▲150K |

| Jewelry gold price - 680 gold (16.3K) | 66,940 ▲130K | 69,440 ▲130K |

| Jewelry gold price - 650 gold (15.6K) | 63,890 ▲130K | 66,390 ▲130K |

| Jewelry gold price - 610 gold (14.6K) | 59,810 ▲120K | 62,310 ▲120K |

| Jewelry gold price - 585 gold (14K) | 57,260 ▲110K | 59,760 ▲110K |

| Jewelry gold price - 416 gold (10K) | 40,040 ▲80K | 42,540 ▲80K |

| Jewelry gold price - 375 gold (9K) | 35,860 ▲70K | 38,360 ▲70K |

| Jewelry gold price - 333 gold (8K) | 31,280 ▲70K | 33,780 ▲70K |

| 3. SJC - Updated: 4/2/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,400 ▼100K | 102,100 ▲300K |

| SJC gold 5 chi | 99,400 ▼100K | 102,120 ▲300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,400 ▼100K | 102,130 ▲300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,200 ▲200K | 101,500 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,200 ▲200K | 101,600 ▲300K |

| Jewelry 99.99% | 99,200 ▲200K | 101,200 ▲300K |

| Jewelry 99% | 97,198 ▲298K | 100,198 ▲298K |

| Jewelry 68% | 65,972 ▲204K | 68,972 ▲204K |

| Jewelry 41.7% | 39,354 ▲125K | 42,354 ▲125K |

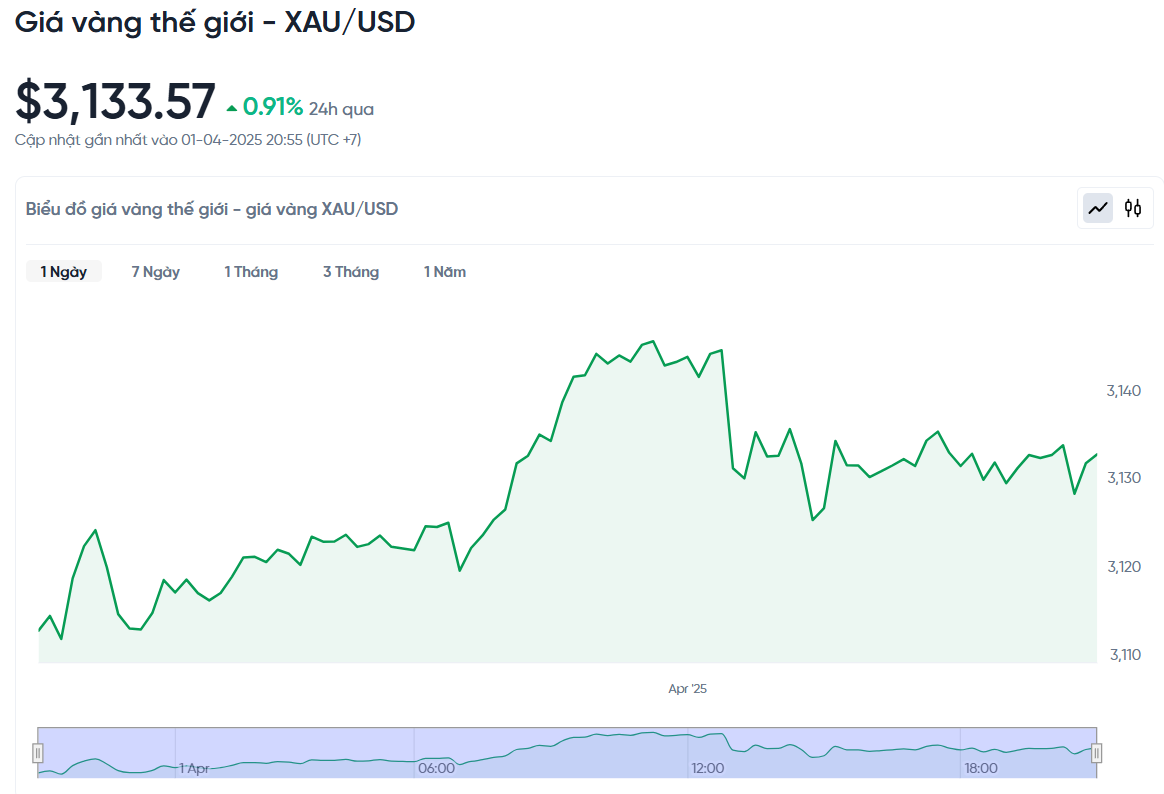

World gold price today April 2, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,133.57 USD/ounce. Today's gold price increased by 28.31 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,960 VND/USD), the world gold price is about 99.14 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 2.96 million VND/tael higher than the international gold price.

Gold prices continued to rise sharply, breaking a new record high as investors rushed to seek safe assets ahead of US President Donald Trump's upcoming announcement of tariffs on many countries. US gold futures rose 0.4% to $3,161.60.

Trump’s tariff rhetoric and his volatile stance on the Russia-Ukraine war are creating chaos in the market, pushing gold prices higher than they were during the COVID-19 pandemic five years ago, according to Adrian Ash, an analyst at BullionVault. Trump said the new tariffs would target all countries, not just the 10-15 countries with the largest trade deficits.

Goldman Sachs recently raised the probability of a US recession from 20% to 35%, and predicted that the Federal Reserve will continue to cut interest rates. This is beneficial for gold prices because this precious metal usually increases in price in a low interest rate environment.

According to Carsten Menke, an analyst at Julius Baer, the recent strong rise in gold prices has come from two main factors: strong buying demand from central banks since 2022 and the return of Western investors looking for safe havens this year.

In addition, the unstable geopolitical situation in the Middle East and Europe, along with the flow of money into ETFs (exchange-traded funds) with gold as collateral, also contributed to pushing up gold prices.

The world gold price ended the first quarter of 2025 with the strongest increase since 1986 and surpassed the 3,100 USD/ounce mark, marking one of the strongest price increases in history. However, the RSI (Relative Strength Index) is currently above 70, indicating that gold is in an overbought state and may soon correct downwards.

"I expect a correction to the downside before gold reaches its target of $3,300. The correction will only become more serious if prices fall below $2,955," said Ole Hansen, commodity strategist at Saxo Bank.

Meanwhile, investors are awaiting US employment data, including Tuesday's jobs openings report and Friday's non-farm payrolls report.

Unlike gold, silver prices fell 0.7% to $33.85 an ounce, while platinum also fell 0.8% to $984.51. Palladium prices were steady at $982.36.

Gold Price Forecast

Technically, June gold futures are in a strong uptrend with the bulls in favor. The bulls’ next target is to push prices above the key resistance level at $3,200. Meanwhile, the bears are hoping to push prices below the support level at $3,031. The immediate resistance is currently at $3,177 (last night’s high), followed by $3,200. The immediate support is at $3,152.20 and then $3,125.

IG strategist Yeap Jun Rong said that concerns about retaliatory tariffs to be announced on April 2 are causing investors to shift to a defensive strategy. Many are withdrawing from risk assets and pouring money into gold as a way to protect their portfolios against upcoming volatility. He said the current uncertainty could continue to support gold's near-term rally, with a target of $3,200 an ounce.

Tim Waterer, chief analyst at KCM Trade, said the tariff tensions are unlikely to end after April 2, especially with tariffs on cars set to begin on April 3. Combined with the uncertain global economic outlook, this will keep investors looking to gold, even if prices fall slightly.

John Weyer, a hedger at Walsh Trading, said gold prices could rise sharply this week due to concerns about tariffs and inflation, two factors that are driving continued money into the gold market.

Adrian Day, chairman of Adrian Day Asset Management, also said that gold's upward momentum is still maintained thanks to strong demand from central banks, Chinese consumers and investors in North America.

FxPro expert Alex Kuptsikevich said that although gold is trading at unprecedented levels, the upward momentum is showing no signs of stopping. He predicted that gold will reach $3,180 in the coming weeks and could reach $3,400 by the end of the summer.

According to analysts from CPM Group, gold prices will continue to rise to $3,200/ounce. They recommend investors to hold gold for the long term or take advantage of corrections to buy more.

The fundamentals remain supportive of gold’s rise, said Max Layton, Citigroup’s global head of commodities research. Citigroup forecasts gold could hit $3,200 an ounce in the next few months and even $3,500 if the U.S. economy weakens sharply.

Mr. Layton emphasized that US trade policy, especially tariffs under President Trump, could be an important factor in boosting gold prices. If these measures are implemented, they could slow US economic growth, causing investors to seek gold as a safe haven.

Source: https://baonghean.vn/gia-vang-hom-nay-2-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-pha-dinh-19-lan-trong-nam-nay-10294243.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)