VCCI proposes many policies to help businesses quickly rebuild after storms and floods

VCCI proposed to exempt water surface rent, fees and charges... for industries, fields and localities that suffered the most damage from storm Yagi.

Today, September 18, the Vietnam Federation of Commerce and Industry (VCCI) sent the Prime Minister a proposal for policies to support businesses in recovering production and business after Typhoon Yagi.

Reporting to the Prime Minister, VCCI stated that the damage to assets and production and business activities of many enterprises was very severe, estimated at thousands of billions of VND. Many valuable assets of many enterprises were damaged such as factories, ships, means of transport, machinery, equipment, goods, etc. This is information compiled from enterprises and business associations.

|

| The level of damage to assets and production and business activities of many enterprises is very severe, estimated at thousands of billions of VND, according to VCCI. |

Most other businesses in the Northern provinces were indirectly affected by having to close, stop production and business or reduce productivity and sales during storms and floods because workers could not go to work, goods could not be transported or customers could not be reached.

"The restoration of production and business of many enterprises is currently facing many difficulties, seriously affecting economic growth and the livelihoods of many people and workers. This is a time when appropriate economic policies are urgently needed for enterprises in the Northern provinces to quickly rebuild and restore production and business, contributing to reducing long-term damage from the storm and ensuring livelihoods for people," VCCI recommended to the Prime Minister.

Exemption of water surface rent for aquaculture facilities until the end of 2025

Specifically, 15 policy groups to support businesses in the Northern provinces to quickly rebuild and restore production and business after storms and floods have just been sent to the Prime Minister by VCCI, divided into 2 groups.

Group 1 is for industries, fields, and localities that suffered the most damage from storm Yagi, including fishing boats, tourist boats, and aquaculture cages on the sea, rivers, streams, and lakes.

Proposed solutions include support based on actual damage, as reported by the commune-level People's Committee and ship owners. Support proposals include exemptions from water surface rent, fees, and charges, as well as proposals to exempt or reduce recommended taxes.

In particular, VCCI proposed proposed solutions including damage support according to Decree 02/2017/ND-CP on mechanisms and policies to support agricultural production to restore production in areas damaged by natural disasters and epidemics, which are also applicable to aquaculture enterprises. Currently, enterprises are not eligible for support under Decree 02/2017/ND-CP and the Draft Decree amending Decree 02/2017/ND-CP.

Consider reducing value added tax, extending tax payment deadline

The proposal to include enterprises in the group of beneficiaries of agricultural production support policies to restore production in areas damaged by natural disasters and epidemics was also proposed by VCCI to be applied to other industries and fields in localities affected by storms and floods.

Regarding policies for this group, VCCI proposed that the Prime Minister consider reducing the value-added tax on gasoline from 10% to 8% from September to December 2024 for gasoline retail establishments in localities affected by storms and floods, especially in the northern mountainous regions.

For electricity customers in localities affected by storms and floods, VCCI recommends that the Prime Minister consider reducing the value-added tax on electricity from 8% to 6%.

VCCI proposed to continue extending the deadline for paying VAT, corporate income tax and land rent for businesses in localities affected by storms and floods until 2025; and extending the deadline for paying social insurance contributions from 4 to 6 months for businesses in localities affected by storms and floods.

In particular, VCCI continues to propose a 50% reduction in union fees paid to the grassroots level for businesses in provinces affected by storms and floods until the end of December 2024 and an extension of the payment deadline until 2025.

Along with that, VCCI also proposed to continue to extend the implementation of the policy of restructuring debt repayment terms and maintaining the debt group in Circular 02/2023/TT-NHNN and Circular 06/2024/TT-NHNN applicable to debt repayment obligations from now until June 2025 for loans of customers producing and doing business in areas affected by Typhoon Yagi.

In addition, VCCI proposed that the Prime Minister direct the disbursement of the Natural Disaster Prevention Fund to provide relief and overcome the consequences of Typhoon Yagi. This is a Fund contributed by businesses and employees, but by 2023, there will still be a surplus of nearly 2,000 billion VND.

Policy proposals to support industries, sectors, and localities that suffered the most damage from Typhoon Yagi, including fishing vessels, tourist boats, and aquaculture cages on the sea, rivers, streams, and lakes:

+ Support actual damage to aquaculture cages according to Decree 02/2017/ND-CP, it is recommended to consider increasing the support amount and apply it to aquaculture enterprises.

+ Support for actual damage to fishing boats and tourist boats. Support measures: according to the norm. Commune-level People's Committee and boat owners count the damage.

+ Exemption of water surface rental fees for aquaculture facilities until the end of 2025

+ Exemption from related fees and charges such as seaport and inland waterway port entrance fees, and anchorage usage fees for a period of 6 months to 1 year.

+ The State supports 50% - 70% of insurance costs for fishing boats and tourist boats until the end of 2025.

+ Consider exempting or reducing 50% of value added tax, corporate income tax, and personal income tax payable for this group for about 4 to 6 months.

+ Consider reducing social security payments for about 4 to 6 months

+ Consider exempting the union fee portion submitted to the grassroots level for about 4 to 6 months.

Source: https://baodautu.vn/vcci-de-xuat-nhieu-chinh-sach-de-doanh-nghiep-nhanh-chong-tai-thiet-sau-bao-lu-d225288.html

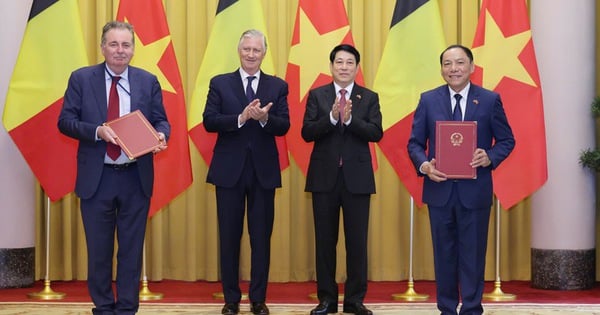

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

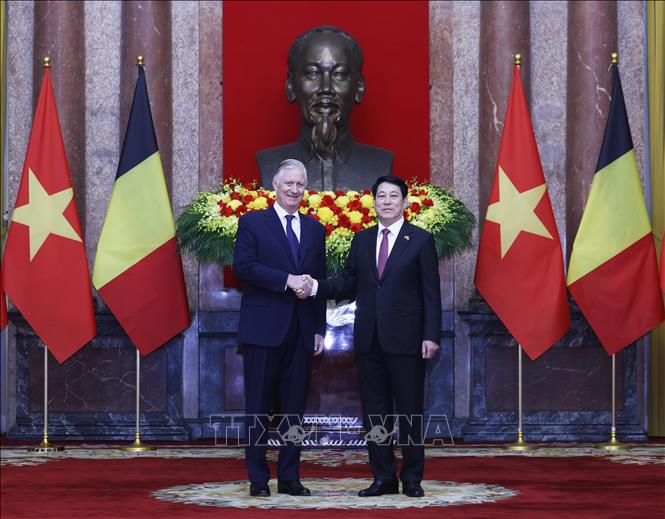

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Infographic] 10 factors to consider when deciding to buy or rent a house](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d6e87dce074b455d95231a4c3e22353a)

Comment (0)