According to the Vietnam Federation of Commerce and Industry (VCCI), the policy of reducing value-added tax (VAT) from 10% to 8% in recent times has contributed to stimulating domestic demand, bringing positive impacts to the economy. In the context that the Government sets a target of GDP growth of 8% or more by 2026 and achieving double-digit growth in the 2026-2030 period, VCCI fully supports the continued implementation of this policy and agrees with the proposal to expand the beneficiaries of tax incentives in the Draft, in order to support production, business and stimulate domestic consumption.

However, according to VCCI, the Ministry of Finance should consider allowing VAT reduction on metal products.

Because metal products play an important role, metal products are inputs for the production of many essential goods, from household appliances to building materials, serving industries, construction and for consumer purposes.

Not reducing VAT on this item will affect the manufacturing and construction industries and the goal of stimulating consumption. Furthermore, mineral products such as coal are also subject to tax reduction, so it is unclear why these products are excluded.

In addition, according to businesses, classifying metal products (10%) with non-metal products (8%) or products manufactured and processed from metal (8%) is difficult in many cases. The difficulty is due to the different physical and chemical properties of the products in each specific case or because the agencies (customs/tax) have different views, even after 5 years of implementing this policy.

Meanwhile, state agencies only provide general answers for reference purposes and cannot be used as a basis for implementation. This creates the risk of tax arrears for businesses in the future.

Source: https://baodaknong.vn/vcci-de-xuat-can-nhac-giam-thue-gia-tri-gia-tang-voi-san-pham-kim-loai-249147.html

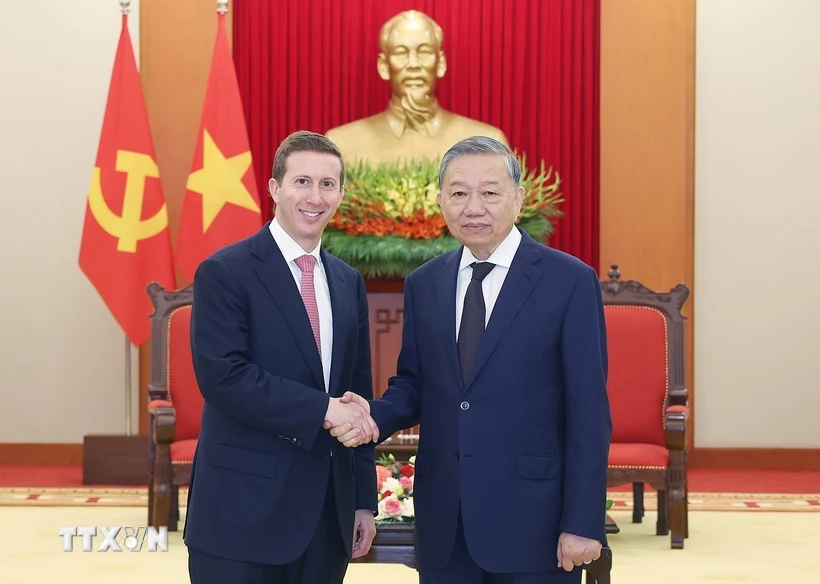

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)