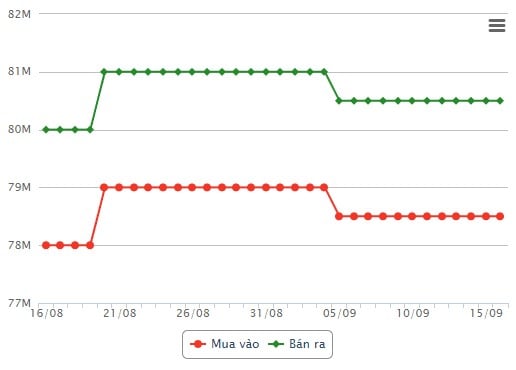

SJC gold bar price

As of 9:45 a.m., the price of SJC gold bars listed by DOJI Group was at 78.5 - 80.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 78.5 - 80.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 78-79.2 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions.

Saigon Jewelry Company listed the price of gold rings at 77.9-79.2 million VND/tael (buy - sell); unchanged.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 9:45 a.m., the world gold price listed on Kitco was at 2,584 USD/ounce, up 7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased amid a decrease in the USD index. Recorded at 9:45 a.m. on September 16, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 101.120 points (down 0.14%).

Gold prices are expected to continue to break the peak in the context of investors predicting that the US Federal Reserve (FED) will reduce the basic interest rate for the first time on September 18, possibly by 25 or 50 basis points (ie 0.25% or 0.5%).

Not only the FED, other central banks such as the European Central Bank (ECB), Bank of England (BoE), Bank of Canada, and Swiss National Bank have also started their easing cycle.

Last week, the ECB cut interest rates for the second time, and analysts predict more cuts to come.

As global interest rates fall, global real yields are also falling, which is weighing on gold prices. Last week’s gold rally actually started against the euro, right after the ECB cut interest rates.

Mark Leibovit, an expert at VR Metals/Resource Letter, predicts that gold prices will increase in the coming days and he believes that prices will peak around the time of the FED meeting.

Meanwhile, senior commodities broker Daniel Pavilonis of RJO Futures said that gold prices may decline slightly ahead of the Fed's policy meeting due to profit-taking pressure. The precious metal will maintain the price range as in recent weeks to wait for the next move of the US Central Bank.

The latest Kitco News weekly gold survey shows that industry professionals and retail investors are both bullish on gold’s upside potential, but remain skeptical and more cautious than in recent weeks.

Thirteen analysts participated in the Kitco News gold survey this week. The majority of experts remain bullish on gold. Eight experts expect gold prices to rise this week.

While three other analysts believe gold will trade lower this week, the remaining two experts predict the precious metal will trade sideways.

Meanwhile, 189 votes were cast in Kitco's online poll, with 107 traders expecting gold prices to rise this week.

While 47 people expect the precious metal to fall. The remaining 35 respondents predict gold prices to move sideways this week.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-169-vang-nhan-tang-cao-pha-ky-luc-moi-1394035.ldo

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

Comment (0)