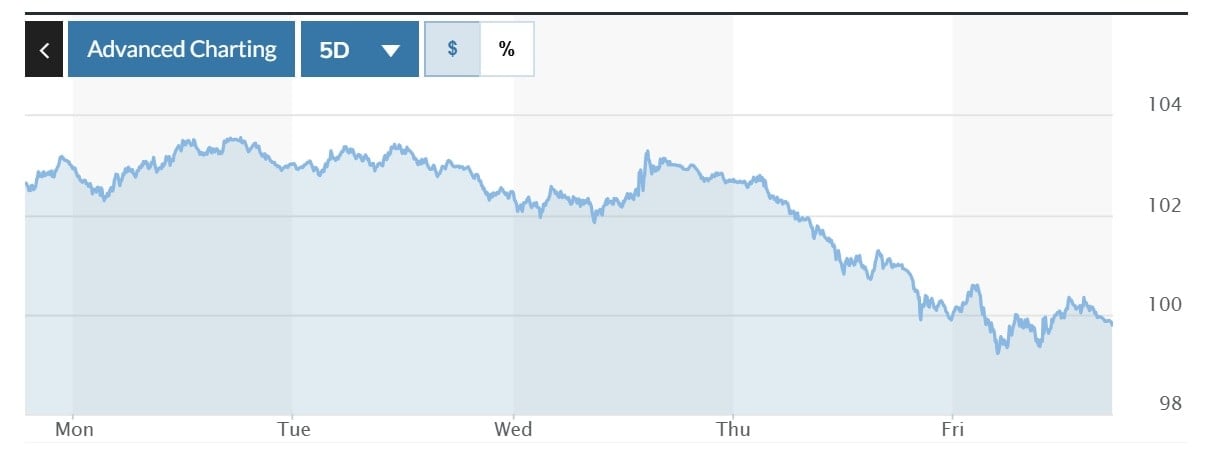

The USD Index (DXY), which measures the greenback's performance against six major currencies, fell 3.14% to 99.78 this week.

USD exchange rate in the world last week

The dollar rose 0.45% to 103.47 on Monday as fears of a global recession grew after US President Donald Trump imposed sweeping tariffs on trading partners. The European Commission, in turn, proposed imposing 25% tariffs on a range of US goods on April 7 in response to Trump's tariffs on steel and aluminium. Meanwhile, the pound hit a one-month low of $1.27125 and closed down 1.3% against the greenback. While the dollar is often seen as a safe haven, it has been losing ground amid the tariff row and concerns about its impact on US economic growth.

|

| Chart of DXY Index fluctuations over the past week. Photo: Marketwatch |

The greenback fell 0.35% to 102.91 on April 9 as investors focused on trade disputes following the US President's tariff policies. In addition, markets are also preparing for a trade war between the US and China. US Trade Representative Jamieson Greer told US senators that the Trump administration will not back down on its trade strategy in the near future.

After remaining flat on April 10, the DXY index continued to plummet as much as 1.99% to 100.91 as the market received the latest information from the US President on tariff policy. Accordingly, the US leader stunned the financial market by suspending high tariffs on trading partners that had come into effect less than 24 hours earlier. Mr. Trump issued a 90-day freeze on tariff policy, but maintained the general tariff of 10% for most countries. However, tariffs on imports from China were increased to 125% and took effect immediately after China retaliated against previous US tariffs with a tax of 84%. The total US tariffs on imports from China now stand at 145%, according to the White House.

The dollar ended the week down 1.08% at 99.78 as the tariff war rattled investors' confidence in the greenback's safety. Brad Bechtel, global head of FX at Jefferies, said the dollar's decline was partly due to a view that the U.S. economy was weakening - with a looming recession - and a flight from the dollar as a safe haven to the Japanese yen and Swiss franc. Data released on April 11 showed U.S. consumer sentiment worsened in April while 12-month inflation expectations jumped to their highest level since 1981 amid worries about trade tensions.

|

| USD exchange rate today, April 13: USD experienced a "fiery red" week. Illustration photo: Los Angeles Times |

Domestic USD exchange rate today

On the domestic market on April 13, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 37 VND this week, currently at 24,923 VND.

* The reference exchange rate at the State Bank's transaction office has slightly decreased, currently at: 23,727 VND - 26,119 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,530 VND | 25,920 VND |

Vietinbank | 25,410 VND | 25,990 VND |

BIDV | 25,550 VND | 25,910 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 26,743 VND - 29,558 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 28,228 VND | 29,775 VND |

Vietinbank | 28,419 VND | 29,919 VND |

BIDV | 28,940 VND | 28,964 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office increased slightly, currently at: 165 VND - 183 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 172.44 VND | 183.40 VND |

Vietinbank | 175.81 VND | 185.51 VND |

BIDV | 176.96 VND | 185.22 VND |

MINH ANH

* Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-13-4-dong-usd-trai-qua-phien-tuan-do-lua-249202.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

Comment (0)