How much is 1 USD in VND today?

State Bank USD exchange rate is at 23,956 VND.

Vietcombank USD exchange rate is currently at 24,200 VND - 24,570 VND (buy - sell).

The Euro exchange rate is currently at 25,508 VND - 27,086 VND (buy - sell).

The current Japanese Yen exchange rate is 159.44 VND - 169.87 VND (buy - sell).

The British Pound exchange rate is currently at 29,925 VND - 31,405 VND (buy - sell).

Today's Yuan exchange rate is at 3,310 VND - 3,475 VND (buy - sell).

USD price today

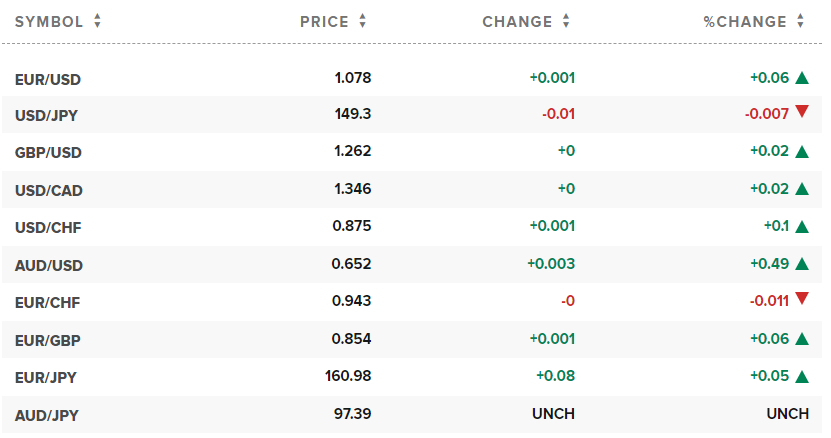

The US Dollar Index (DXY) measures the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recording at 104.04 points.

While core inflation remains subdued, the overall US economic picture does not change the market's outlook on when the Fed will cut interest rates.

Reports released by the US Department of Labor showed that the consumer price index (CPI) increased slightly compared to the previous report in October and November 2023.

“The revision is not going to cause the Fed to cut rates,” said Steven Ricchiuto, chief U.S. economist at Mizuho Securities USA LLC. “The Fed itself is in no rush to do so. From their perspective, the situation is pretty good.”

The dollar index fell 0.07% to 104.04, while the euro rose 0.08%. EUR/USD was at 1.0785.

Marc Chandler, market expert at Bannockburn Global Forex, assessed: the data revisions are too small to affect the market.

“I think the FX market is in a consolidation process, unlike last year when everyone was assessing how much the Fed would cut rates and when the Fed would start cutting,” he said.

Federal Reserve officials this week again signaled there was no urgent need for the Fed to cut interest rates, a message that was supportive of the dollar and sent the yen to a 10-week low.

As for the Bank of Japan, markets are starting to lose hope that the central bank will raise interest rates to exit its current easing policy. BOJ Governor Kazuo Ueda said that the bank is likely to keep its current policy unchanged even after ending its negative interest rate policy, which the market expects to happen early next month.

The JPY/USD pair was at 149.32 after climbing to 149.575 earlier in the session, its highest since Nov. 27. The pair is on track for a gain of about 0.64% this week.

Japan's Finance Minister Shunichi Suzuki said he was "watching exchange rate movements carefully".

The next important US data to be released is the January CPI on February 13.

According to the CME FedWatch tool, the market has all but ruled out a rate cut at the Fed's next policy meeting in March. A month ago, the odds were at 65.9%. For the May meeting, the probability is now around 60%.

The British pound rose 0.15%. GBP/USD was at 1.2635. Both the euro and the pound have been relatively firm this week. Officials from the European Central Bank and the Bank of England have both ruled out any interest rate cuts in the near future.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)