Amidst the "tug of war" around the 1,300-point area of the VN-Index, foreign investors continuously bought with a volume of more than 2,000 billion VND after only 3 sessions.

VN-Index faces profit-taking pressure, foreign investors net buy more than 2,000 billion VND

The Vietnamese stock market (TTCK) returned to a gloomy state after a series of increases to the 1,290 point mark last week.

Profit-taking pressure suddenly increased, as of yesterday's session (October 3), the VN-Index dropped sharply by nearly 10 points to 1,278.1 points. The negative trend continued in this morning's session, October 4. At one point, the VN-Index dropped to 1,274 points.

The "tug of war" trend has appeared since the trading session last weekend until now, the index is facing psychological pressure around the 1,300 point area.

VN-Index continuously "struggles" before the 1,300 point zone

The return of foreign net buying is considered a bright spot in the stock market this week with negative developments.

In the session of October 3 alone, the net buying value reached 488 billion VND on all 3 floors, thereby contributing to improving liquidity. On the HOSE floor alone, the trading value in the session of October 3 reached more than 23,270 billion VND.

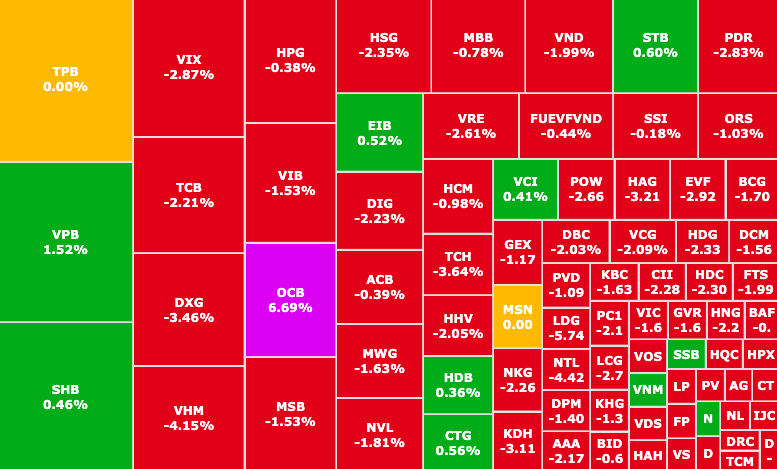

The strongest buying move of foreign investors focused on FUEFVND fund certificates with a sudden value of up to 472 billion VND.

Next are STB (Sacombank, HOSE) and VHM (Vinhomes, HOSE) with the gathering force of over 100 billion VND, respectively 141 and 118 billion VND. In addition, TCB (Techcombank, HOSE) and VNM (Vinamilk, HOSE) were also bought respectively 87 and 65 billion VND.

On the contrary, OCB (OCB, HOSE) was under the strongest selling pressure from foreign investors with nearly 59 billion VND. Following that, FPT (FPT, HOSE), MSB (MSB, HOSE), VRE (Vincom Retail, HOSE) were under selling pressure from 30 to 56 billion VND.

Thus, since the beginning of October 2024, foreign investors have net bought with a total value of more than VND 2,000 billion, focusing mainly on stocks with potential in terms of long-term valuation such as VNM (Vinamilk, HOSE) reaching VND 881 billion, MSN (Masan, HOSE) reaching VND 694 billion,... and many other leading stocks in the VN30 group.

What signal from foreign block?

Ms. Le Thi Nhi, Head of Investment Consulting Department, Mirae Asset Securities , said that this move shows that foreign investors are focusing on and taking advantage of the attractively priced market opportunities to increase their portfolios.

It is worth noting that this development occurred right in the context of the Vietnamese stock market receiving a lot of positive and important information.

Typically, the monetary policy of major central banks such as the US Federal Reserve (FED) is gradually loosening, making it easier for money to be distributed to many other markets around the world.

Most recently, right after the US, the central bank of the world's second largest economy - China, has also lowered interest rates and reserve requirements to support the economy, helping Chinese stocks in recent days to continuously increase strongly and dramatically in trading liquidity.

In addition, the removal of regulations to remove bottlenecks for foreign investors to buy stocks without deposit (Pre-funding) from the Ministry of Finance plays the most important role, helping to clear psychology and large capital flows into the market.

Foreign investors returned to net buying, helping to increase positive sentiment and improve confidence in the market.

This shows that foreign investors have a more comprehensive vision and assessment of the economy as well as the growth potential of the Vietnamese stock market.

This belief partly promotes foreign net buying activities with increased transactions. This helps increase market liquidity, improve demand for stocks, and at the same time, create prospects for price increases for leading enterprise stocks.

In addition, the net buying trend of foreign investors also contributes to creating a positive premise for the general sentiment of the market. Because in reality, the investment trend of domestic investors often follows the trend of foreign investors.

Explaining this, Ms. Nhi said that foreign investors (especially funds) often tend to buy stocks with good fundamentals, especially large-cap stocks in key sectors of the Vietnamese market such as Banking, Real Estate, Consumption, etc. Therefore, this will also create positive impacts on the top stocks of the market such as VN30 (SSI, FPT, TCB, VNM, FPT, etc.).

Source: https://phunuvietnam.vn/tin-hieu-gi-cho-thi-truong-chung-khoan-khi-khoi-ngoai-manh-tay-mua-rong-giua-luc-vn-index-giang-co-20241004000303042.htm

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)