Stock Market Perspective Week 24-29/6: Accumulate, prioritize stocks with signals of breaking the base

Short-term investors need to focus their portfolio on stocks that are selected by cash flow or are showing signs of breaking through the accumulation base and preparing to enter a new uptrend.

A week of volatile and highly divergent trading on the Vietnamese stock market. Selling pressure was somewhat dominant last week, however, when touching the support level of 1,270 points, buying pressure tended to increase, showing that the VN-Index is still in a positive zone.

Liquidity on both exchanges this week decreased compared to the previous trading week, a common trend when investors are cautious during the derivatives expiry week and restructuring of ETF portfolios. Foreign investors this week maintained net selling with -4,963 billion VND on HoSE, focusing on FPT code (-1,127 billion VND), along with HPG (-399.3 billion VND), VND (-378.4 billion VND) and VHM (-353.9 billion VND), VRE (-341.6 billion VND)... On the other hand, net buying was at TCH (+166.2 billion VND), CTR (+159.5 billion VND), HAH (+116.6 billion VND)...

|

| Source: Mirae Asset Securities Company synthesis. |

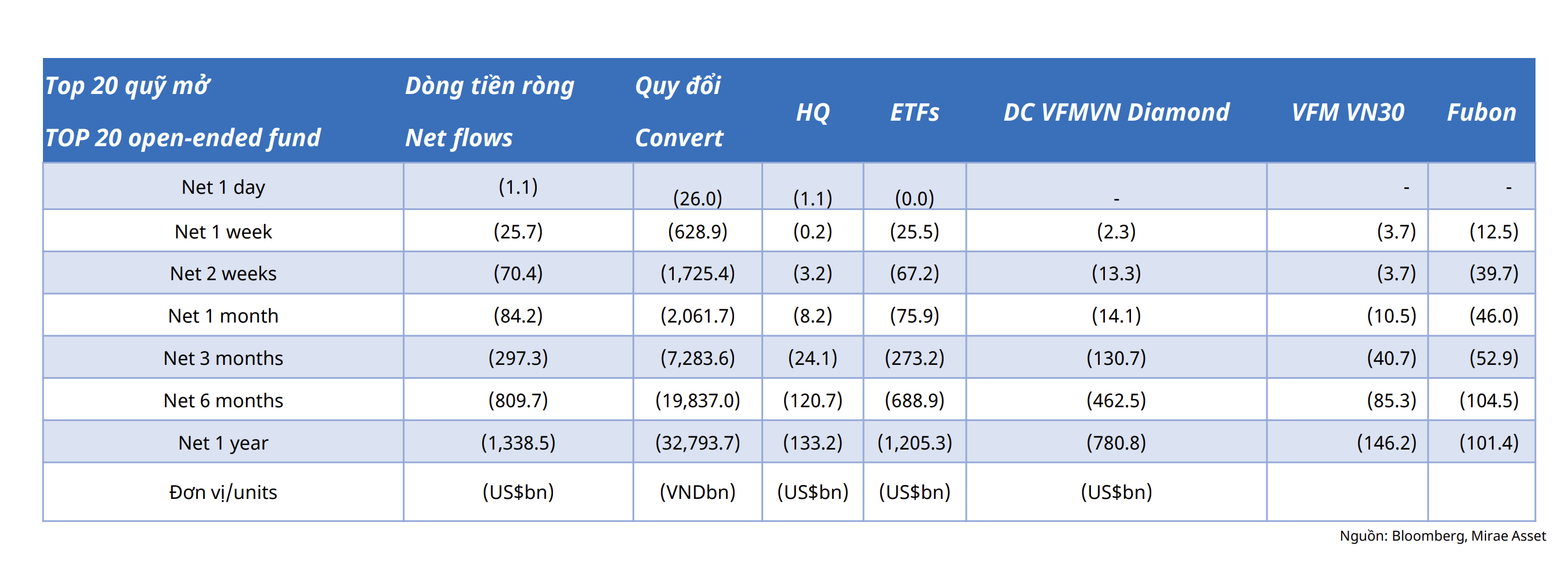

Mirae Asset statistics show that open-end funds sold net in the week (June 17-21) with a value of VND628 billion. Of which, ETFs sold 25.5 million USD and became the strongest selling group. Note that Fubon sold (12.5 million USD), DC VFM Diamond (2.3 million USD).

In the last 5 trading sessions (June 14-20, 2024), individual investors continued to act as the main counterweight to foreign net selling. This group bought VND 4,066 billion, equal to the selling value of VND 4,469 billion by foreign organizations.

In the remaining 3 groups, domestic organizations bought 462 billion VND, corresponding to the selling value of 58 billion VND by foreign individuals and 301 billion VND by the self-employed sector.

The highlight of last week's news was that the State Bank announced credit growth figures as of June 14 of +3.79%, and said it would transfer credit limits to other banks for banks that cannot lend;

The Ministry of Industry and Trade issued a Decision to investigate anti-dumping measures on some galvanized steel products originating from China and South Korea, and at the same time received a complete and valid dossier requesting an investigation to apply anti-dumping measures on hot-rolled steel products (HRC) from India and China.

The prominent trading stocks include telecommunications VGI (+9.7%), FOX (+1.92%), PIA (+15.79%) and especially codes on the UpCOM floor such as TTN (+24.1%), MFS (+77.75%), ABC (+33.78%)... Impressive developments also included oil and gas stocks, typically PLX (+4.44%), OIL (+20.72%), POS (+17.15%)... The automobile and spare parts group also traded actively with SVC (+9.47%), HAX (+2.64%), CTF (+4.05%), DRC (+0.44%)... The information technology group also traded in green with FPT (+3.89%), CMG (+0.86%), ICT (+25.33%), ITD (+10.4%)..., meanwhile, the securities group and the food and beverage group recorded downward adjustments.

Cash flow tends to look for stocks with promising business results in the last 6 months of the year.

Ms. Hoang Phuong Anh, a securities consultant at SSI Securities Company, believes that with the current fluctuating and divergent developments, the market will need to accumulate and have strong enough positive information to officially return to the uptrend. Therefore, maintaining a safe portfolio ratio of 60/40 (stocks/cash) is appropriate for the current period.

Short-term investors need to focus their portfolio on stocks that are selected by cash flow or are showing signs of breaking through the accumulation base and preparing to enter a new uptrend.

Medium and long-term investors should persistently hold a portfolio of medium and long-term stocks that are generating good profits.

From a technical perspective, SHS Securities Company experts believe that the short-term trend of VN-Index will continue to accumulate in the range of 1,250 points - 1,300 points with the equilibrium point being the price range around 1,280 points, equivalent to the average price of 20 sessions. With the current developments, VN-Index is expected to surpass the price range of 1,285 points, the highest price range in May 2024, aiming to return to the resistance range of 1,295 points. In a less positive case, VN-Index will return to trading in the range of 1,250 points - 1,280 points.

The current short-term and medium-term trend needs to wait for further assessments and updates on the business results of the second quarter of 2024, as well as GDP growth in the second quarter. The cumulative development is appropriate in the context of geopolitical tensions in the world, inflationary pressure, exchange rates, and foreign net selling that has not cooled down even though the economy is still maintaining growth and interest rates are stable on a low base.

In the medium term, VN-Index is accumulating in a narrower channel from 1,245 - 1,255 points to 1,300 points, expanding to 1,320 points (according to the figure). In which, the 1,245 - 1,255 point area corresponds to the highest price area in 2023, 1,300 - 1,320 points is the highest price area in June and August 2022. The equilibrium point is 1,280 points and is similar to the short-term trend.

Source: https://baodautu.vn/goc-nhin-ttck-tuan-24-296-tich-luy-uu-tien-co-phieu-co-tin-hieu-pha-nen-d218335.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)