In addition, there are 4 lower revenue items including: Environmental protection tax (96%), registration fee (88%), dividend revenue (66%), land and water surface rent (37%).

There are 9 Tax Departments with higher revenue than the same period: Vinh City Department (reaching 321% compared to the same period), Bac Vinh Department (reaching 241%), Bac Nghe II (238%), Song Lam I (195%), Tay Nghe II (154%), Song Lam II (135%), Phu Quy II (128%), Tay Nghe I (123%), Phu Quy I (111%). There is 1 Tax Department with lower revenue than the same period: Bac Nghe I (47%).

The Provincial People's Committee has also just issued a budget collection directive, accordingly assessing the context of 2024 with many difficulties, challenges, and impacts of the world economic situation, affecting the domestic economy.

The Provincial People's Committee requests the Provincial Tax Department and the Provincial Customs Department to preside over and closely coordinate with departments, branches, sectors and People's Committees of districts, cities and towns to review and grasp the subjects and sources of budget revenue; control to collect correctly, fully and promptly taxes, fees and charges according to regulations.

Proactively and resolutely develop plans and set specific schedules for tax debt collection and settlement. At the same time, coordinate well with the State Treasury and credit institutions in providing and exchanging information to implement tax debt settlement measures in accordance with legal regulations.

Effectively manage new revenue sources arising in the context of digital economic development and cross-border electronic transactions; strengthen tax inspection and examination, combat transfer pricing, tax evasion, tax fraud, and strictly control tax refunds.

The Provincial People's Committee assigned the Provincial Tax Department to coordinate with the Department of Natural Resources and Environment, the Department of Planning and Investment, the Department of Construction, the Management Board of the Southeast Economic Zone and the People's Committees of districts, cities and towns to urge the collection of land use fees and land rents for real estate business projects that have been allocated land, and determine land prices to fully and promptly collect the amount payable to the State budget.

At the same time, localities will strengthen inspection of project implementation progress to propose land recovery for projects that are slow to implement or do not fulfill tax obligations according to the law... Regularly urge tax and land rent payments that have been extended in 2023 according to regulations.

For the field of import and export tax collection: Focus on developing and implementing plans to mobilize and attract businesses to carry out import and export procedures through Cua Lo port, Nam Can International Border Gate, etc. Proactively propagate and provide information on customs laws and policies, and publicly and transparently publicize administrative procedures.

The Provincial People's Committee requested the Provincial Tax Department and the Provincial Customs Department to proactively deploy solutions to prevent revenue loss in areas with potential budget revenue loss.

Source

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

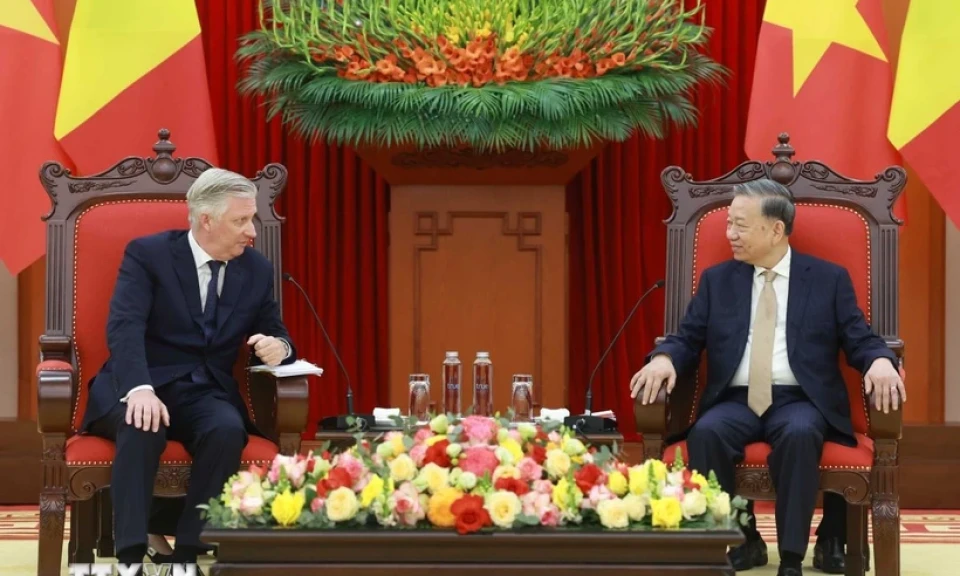

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

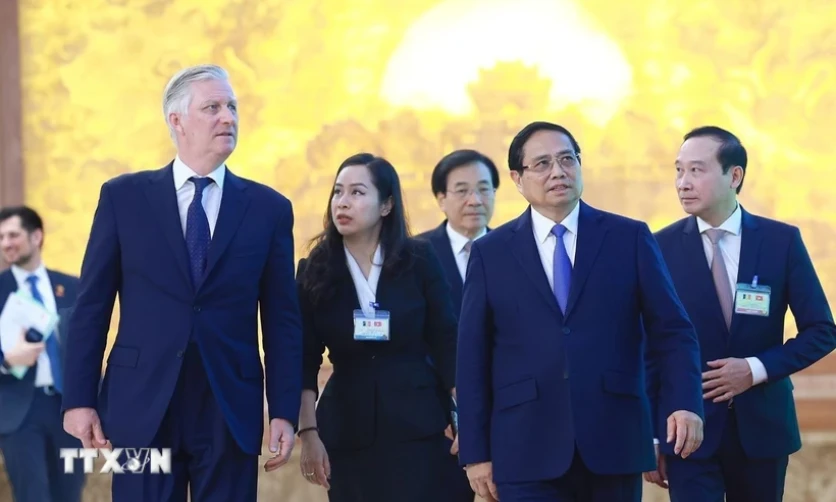

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[6pm News] Of the 40 newly discovered gold mines, 4 are in Thanh Hoa](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/08644991aa1b4030a549159f2f87c0d6)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)