Although the market showed signs of improvement in the first sessions of the week, it went down at the end of the week when unfavorable information about businesses in the "renewable energy" sector triggered a sell-off in a series of stocks on all three exchanges and caused the stock indexes to make strong corrections.

However, market sentiment stabilized in the following session, helping the VN-Index close the week at 1,138.1 points, up 1.6% from the previous week. In contrast, the HNX-Index fell 0.7% from the previous week to 225.8 points and the UPCoM-Index fell 1.6% from the previous week to 84.7 points.

Cautious sentiment caused liquidity to continue to decrease with the average trading value of the three exchanges reaching VND17,943 billion/session, down 5.8% compared to the previous week. Foreign investors sold more strongly with a total value of VND390.2 billion, 10 times higher than the previous week.

Specifically, the net selling value recorded on HoSE, UPCoM and HNX was VND372.6 billion, VND15.3 billion and VND2.2 billion, respectively.

Mr. Nguyen Van Giap, Head of Investment Consulting Department, VPS Securities JSC and Mr. Nguyen Phuong Hieu - Consultant - individual customers both share the same opinion that VN-Index will likely maintain the 1,200 point level and there will be some corrections to consolidate this support zone.

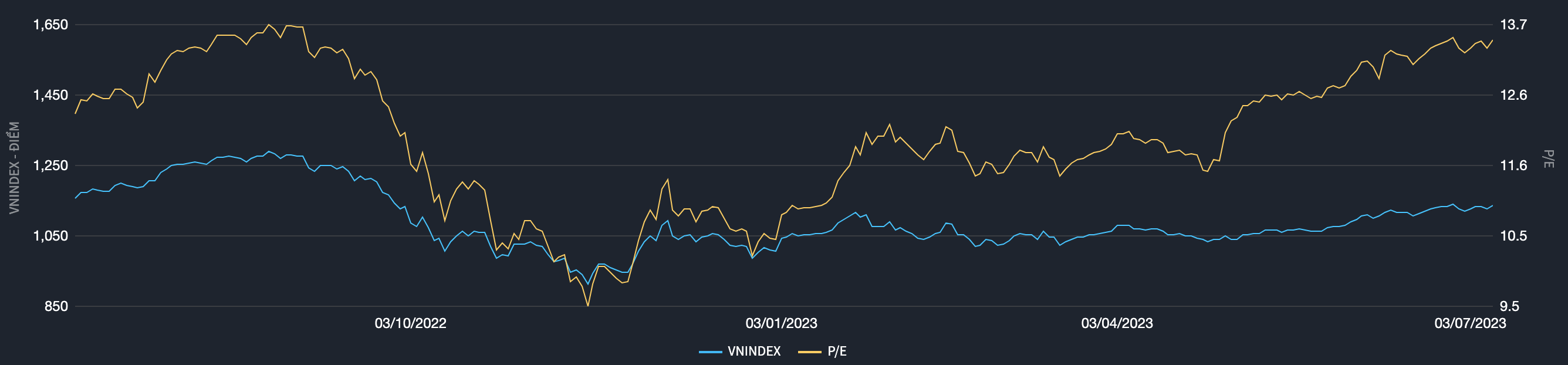

Market valuation over the past year (Source: Fiintrade).

Nguoi Dua Tin: After a week of fluctuating movements, the VN-Index has set a new high since the beginning of 2023. In the first half of the year, the VN-Index has broken through 113 points, equivalent to 11.3% to reach 1,130. The market's growth is accompanied by significantly improved liquidity, the number of investors opening new accounts is also recorded at a high level. Will this situation continue into July, which side will the next trend of the VN-Index lean more towards, in your opinion?

Mr. Nguyen Van Giap: Currently, foreign investors are holding a large amount of Long contracts in July, while institutional investors and self-employed traders are still actively net buying. In addition, in terms of technical analysis, a marubozu candlestick on July 7 completely negated the previous declines.

All of the above factors promise the next increase of VN-Index. In addition, with GDP growth of more than 4% in the second quarter, on the positive side, there will be further moves to lower interest rates in the next quarter to achieve the KPI of 6% this year (the third and fourth quarters will have to increase by 8-9% to achieve this KPI).

However, to achieve such GDP growth, in my opinion, is almost very difficult. Therefore, I think there will be no uptrend this year, but will continue to be a wide range sideways.

Investors should be cautious, because the peak is always noisy, the bottom is always quiet. If there are sessions of market-wide explosion, then you should stop buying and re-evaluate the growth potential of the stocks you are holding. This year, in my opinion, the market can reach 1,200, but there will be alternating corrections, while many stocks are at the level equivalent to the VN-Index of 1,300 points.

Mr. Nguyen Phuong Hieu: In my opinion, the current situation reflects the Government's policy efforts in the past half year. It can be seen that the cash flow is shifting back to the stock market, and investor confidence is gradually returning after the incident from October 2022.

With the current situation, if the State Bank continues to maintain the current low interest rate, and the inter-market developments do not have any "shocking" fluctuations, it is highly likely that the VN-Index can still maintain its upward momentum to conquer higher milestones such as the 1,150 or 1,200 zone. During the increase, there will be inevitable adjustments, so that the market does not fall into a state of overheating and "reckless" increase.

Nguoi Dua Tin: The semi-annual business results announcement is approaching. In your opinion, are the results of the second quarter better than the gloomy first quarter?

Mr. Nguyen Van Giap: In my opinion, the second quarter will see more improvement, when monetary policy will reduce debt pressure of many businesses; as well as the current economic context will help many industry groups have the opportunity to break through.

After the semi-annual business results are revealed, many businesses will be assessed as being at the bottom of the profit zone this year. However, if expectations are too high, investors should consider because as shared above, this year will still be difficult in general.

Mr. Nguyen Van Giap, Head of Investment Consulting Department, VPS Securities JSC.

Mr. Nguyen Phuong Hieu: At present, there has been a lot of information related to the forecasted business results (KQKD) of many enterprises. For example, BFC in the fertilizer industry, the business results in the second quarter of 2023 were profitable, compared to the loss of 40 billion VND in the first quarter of 2023, this industry is reaching the bottom of profits in this second quarter.

In addition, there are also some industries that are showing signs of bottoming out in profits, for example, the steel industry also has a positive forecast for business results when the rate of reduction in raw material prices is faster than the reduction in selling prices, demand recovers, businesses reopen blast furnaces...

Therefore, in my opinion, the 2023 semi-annual financial report is quite positive for the market in general, and especially for industries related to production and export.

Nguoi Dua Tin: In your opinion, in addition to the current prominent industries such as public investment and construction materials, what other industries can investors choose that are likely to continue attracting cash flow in the coming time?

Mr. Nguyen Van Giap: In my opinion, the seafood - chemical - transportation groups will be stable in the coming period. Seafood will benefit greatly when bank interest rates and fees are reduced; in addition, the proposed VND10,000 billion credit package to stimulate demand and support seafood enterprises in purchasing raw materials for aquaculture from farmers; the 2% reduction in VAT will also benefit this group of industries.

The transport & chemicals group will benefit from short-term news. The Panama Canal is restricted to ships due to low water levels, the impact of El Nino has led to an increase in global freight rates. Global urea prices have also increased again due to fires and explosions at many large chemical plants around the world.

This is a period of strong differentiation in the market, many stocks like VND are experiencing a comeback due to the risk of "all-in" on Trung Nam bonds, so you should choose good fundamental stocks at the current stage.

Mr. Nguyen Phuong Hieu: In addition to the fertilizer and steel industries, in the short term, I personally think that export-related industries such as textiles, seafood or wood are also investment options worth considering for investors, when the State Bank of Vietnam is continuously lowering interest rates, causing the USD/VND exchange rate to increase, and export industries will have certain favorable conditions .

Source

Comment (0)