The domestic and foreign business community expects that changes in Vietnam's tax policy will create a favorable business environment, promote economic growth, ensure fair tax practices and adjust Vietnam's tax system to global standards.

The domestic and foreign business community expects that changes in Vietnam's tax policy will create a favorable business environment, promote economic growth, ensure fair tax practices and adjust Vietnam's tax system to global standards.

|

| The petroleum industry plays an important role in Vietnam's economy and is a sector that is subject to increased supervision. |

Great strides

The key objective of Vietnam’s tax reform policy in 2024 is to reform the tax system to improve management efficiency and compliance. This includes improving applications to make reporting and paying taxes easier, simplifying the process for businesses and individuals.

E-commerce and online business continue to grow, so the Government has taken measures to avoid tax losses from this sector. New regulations require e-commerce platforms to collect taxes on behalf of individual sellers, ensuring that transactions pay taxes correctly and fully according to regulations.

The petroleum industry plays an important role in the Vietnamese economy and is an area that the Government is increasing its oversight. In 2024, tax authorities will strengthen controls on retail petroleum invoices to prevent tax fraud.

The real estate market is also one of the reform targets. The government aims to eliminate loopholes in tax administration, control real estate transfer transactions that are not declared and fully paid taxes.

A major step forward in 2024 is the promulgation of a new law on value added tax (VAT), along with the Law on amending and supplementing a number of articles of tax laws to adjust them in line with international standards. These changes aim to simplify VAT compliance and enhance tax fairness across sectors. The VAT Law was officially passed on November 26, 2024 and will take effect from July 1, 2025.

In addition, the Draft Decree amending Decree No. 132/2020/ND-CP was drafted with important changes related to the limit on interest expenses.

Another notable aspect of the 2024 reforms is the new Draft Law on Corporate Income Tax (CIT) with many important changes. The highlight is the application of global minimum tax regulations, in line with international standards ( the National Assembly passed Resolution No. 107/2023/QH15 at the end of November 2023 to promptly provide guidance on the application from the 2024 fiscal year). The Draft Law also considers adjusting the principles of calculating CIT on capital transfer transactions of foreign investors.

The tax reforms are expected to boost economic growth, ensure fair tax practices, adjust Vietnam's tax system to be more consistent and closer to international practices, and create a solid foundation for the country's future development.

Expectations from the business community

With proposals to reform the tax system from 2025, with a vision to 2030, the domestic and foreign business community expects that changes in tax policies will create a favorable business environment, ensuring sustainable development for businesses.

Enterprises expect that the regulatory enforcement agency will be flexible in applying and interpreting regulations in practice. For example, violations of other specialized regulations should not be the basis for tax authorities to assess the tax compliance of enterprises (such as corporate income tax expenses, causing difficulties in processing VAT refunds, etc.).

Along with that, businesses also expect that the authorities will be receptive to make positive changes in the regulatory system. For example, regarding the handling of violations in the field of tax and invoices, recently, the application of penalties on each erroneous invoice is assessed to have a great impact on businesses, especially small and medium enterprises or businesses with a large number of transaction invoices.

In addition, the tax administration method needs to reduce the burden on taxpayers and clearly separate the responsibilities between taxpayers and tax authorities. For example, the management of fraudulent or inactive businesses at the place of business registration, or the allocation of taxes to localities, etc. should be carried out by the tax authorities themselves, instead of the current method, which causes difficulties and burdens for taxpayers.

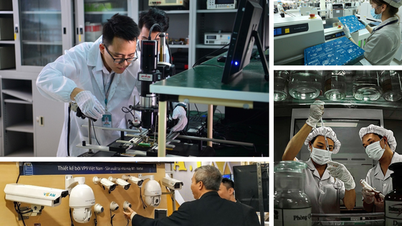

With a vision to 2030, Vietnam focuses on developing emerging industries such as semiconductor chips, artificial intelligence, big data, e-commerce, green energy, green economic development, circular economy, sharing economy... To implement that long-term and sustainable business strategy, the Vietnamese Government upholds the spirit of "harmonized benefits, shared risks; harmonized interests between the State, people, and businesses".

The Government’s support for businesses needs to be demonstrated through the development and good management of attractive, transparent investment incentive policies that are consistent with international practices and standards. Incentive policies need to be reviewed, changed, or redesigned to suit key industries and development priorities.

The business environment in Vietnam is improving positively, marking a transition into a new era. Enterprises believe that institutional reforms in general and tax procedures in particular will bring great achievements to Vietnam.

(*) Forvis Mazars Vietnam Company

Source: https://baodautu.vn/cai-cach-thue-va-ky-vong-tu-cong-dong-doanh-nghiep-d244634.html

![[Photo] Prime Minister Pham Minh Chinh and United Nations Secretary-General Antonio Guterres attend the Press Conference of the Hanoi Convention Signing Ceremony](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761391413866_conguoctt-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761390815792_ctqh-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761390212729_dsc-1484-jpg.webp)

![[Photo] General Secretary To Lam meets with General Secretary and President of Laos Thongloun Sisoulith](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761380913135_a1-bnd-4751-1374-7632-jpg.webp)

Comment (0)