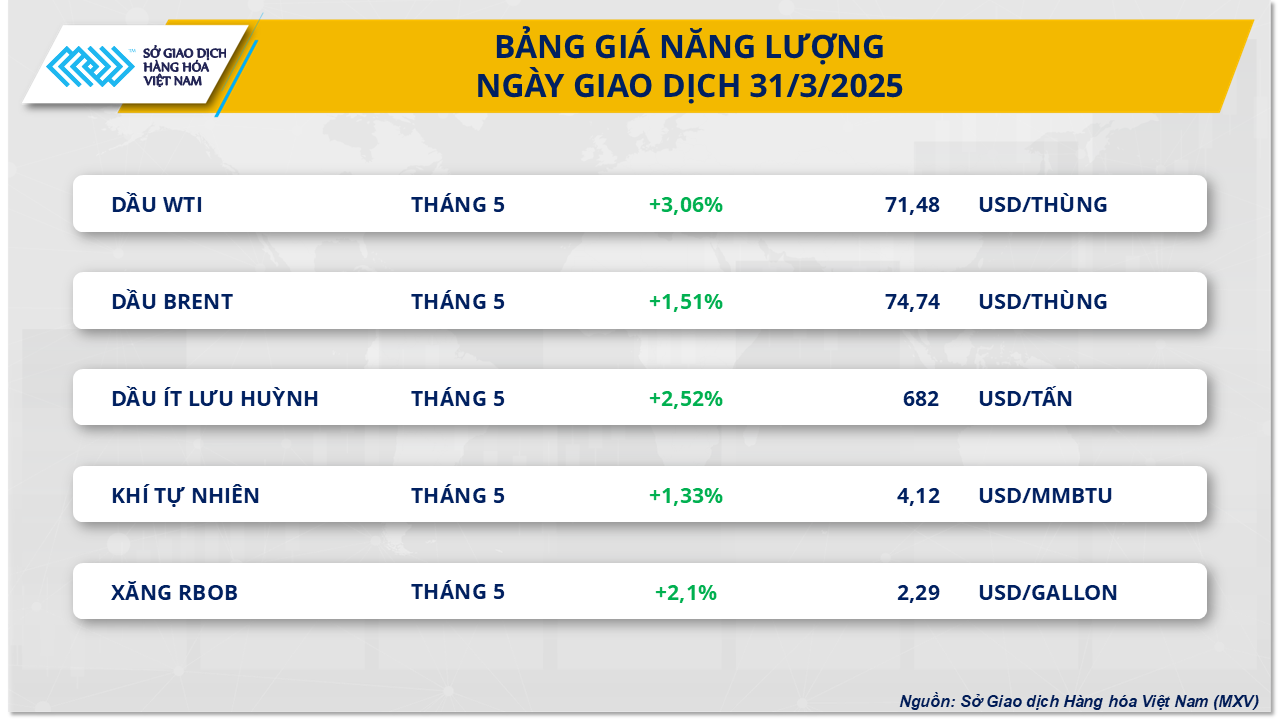

In the energy market, at the end of the last trading session of March, green covered all 5 energy products. In particular, the price of two crude oil products increased sharply after recent statements by President Donald Trump targeting Russia and Iran.

Closing, both oil products were at their highest levels since early March. Of which, Brent oil price increased by 1.51% to 74.74 USD/barrel; WTI oil price increased by 3.06% to 71.48 USD/barrel. This is the strongest increase of WTI oil price since the beginning of this year.

Over the weekend, US President Donald Trump made two major announcements targeting Russia and Iran, two of the world's largest oil suppliers.

In an interview with NBC News, Mr. Trump expressed his displeasure with Mr. Putin's criticism of Ukrainian President Volodymyr Zelenskiy and warned that he could impose secondary tariffs of 25% to 50% on countries importing oil from this country. This move is intended to put pressure on Moscow if it is seen as hindering Washington's efforts to end the conflict in Ukraine. However, he still affirmed the "good" relationship between the two leaders and was optimistic about the peace process in Ukraine, something the Kremlin also agreed with.

Source: MXV

On Iran's side, Mr. Trump continued to emphasize his tough stance, warning of stronger measures if the two countries failed to reach an agreement on Tehran's nuclear program. He even did not rule out the possibility that the US would use force - which could increase tensions in the already unstable Middle East region with hotspots such as the Gaza Strip and Yemen.

Earlier, the White House also announced the latest round of sanctions against Iran, including several entities from China, the largest customer of Iranian crude oil. This has raised concerns about a significant narrowing of the supply-demand gap as Chinese oil importers will have to look for other sources of supply.

China is also the largest customer of Venezuelan crude oil and it and many others continue to look for alternative supplies following US sanctions targeting the commodity.

On March 29, the US government sent notices to foreign joint venture partners of Venezuelan state oil company PDVSA that they were revoking their licenses to export crude oil and related products from Venezuela. Among the companies that received the notices were Repsol from Spain, Eni from Italy, Maurel & Prom from France, Reliance Industries from India, and Global Oil Terminals from the US.

In addition, two other factors that have pushed oil prices to record highs recently are the increase in demand in China and the decrease in crude oil production in the US. According to a report on March 30 by the US Energy Information Administration (EIA), crude oil production in the country has dropped to its lowest level in more than a year. Meanwhile, China's manufacturing PMI index exceeded expectations, showing that energy demand in this country is recovering strongly.

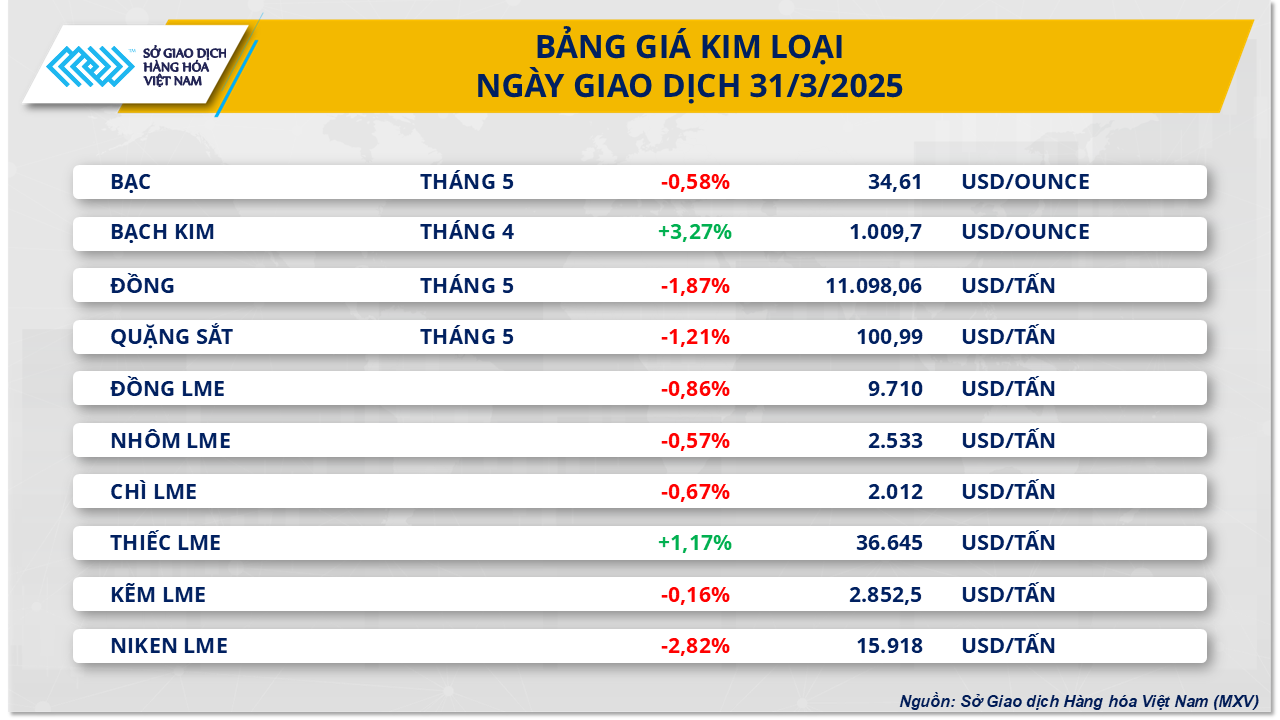

For the metal group, according to MXV, selling pressure dominated the metal market in yesterday's trading session. Except for platinum, which increased, most of the remaining base metal commodities weakened due to the poor demand outlook.

Source: MXV

At the close of trading on March 31, silver prices fell slightly by 0.58% to $34.61/ounce, but were still 17% higher than at the beginning of the year. Meanwhile, platinum prices jumped 3.27% to $1,009/ounce, up 11% from early January.

Platinum is one of the essential metals in the auto industry. Therefore, the market is in a state of confusion ahead of the US’s expected announcement of a reciprocal tax policy on April 2 and the official imposition of a 25% tax on imported cars and components from April 3. This imposition of tariffs is likely to disrupt the supply chain and significantly increase the price of cars and components in the context of inflation that has already made cars more expensive.

In addition to the upcoming auto tariffs, Trump has previously imposed an additional 25% tariff on imported aluminum and steel and threatened to impose more on copper. These are three important materials for car production, so increasing tariffs on these metals will also increase the cost of car production in the US.

In the base metals market, at the close of yesterday's trading session, copper prices lost 1.87% to $11,098/ton. Meanwhile, iron ore also reversed and decreased 1.21% to $100.99/ton.

Copper prices came under pressure after BNP Paribas warned that prices could fall to $8,500 a tonne by the end of the second quarter due to a drop in demand as the speculative wave in the US ends. The bank also cut its forecast for global copper consumption growth in 2025 from 3.1% to 2.3%, while raising its forecast for a supply surplus to 460,000 tonnes.

Source: https://baodaknong.vn/thi-truong-hang-hoa-4-1-dien-bien-trai-chieu-247898.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)