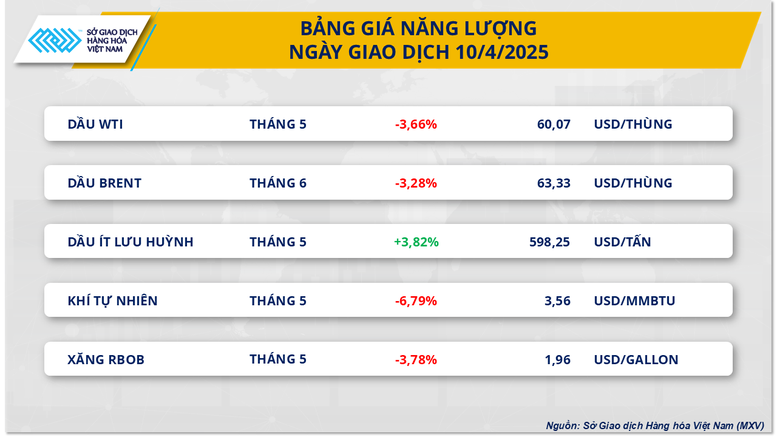

In the energy market, according to MXV, the energy market was in red in yesterday's trading session. In particular, the prices of two crude oil products returned to a sharp downward trend due to concerns about trade tensions between the US and China.

At the end of the trading session, both Brent and WTI crude oil prices fell by more than 3%. Brent crude oil prices recorded a decrease of 3.28%, down to 63.33 USD/barrel; while WTI crude oil prices have returned to nearly 60 USD/barrel, specifically stopping at 60.07 USD/barrel, down 3.66%.

In the latest announcement from the White House on April 10, US President Donald Trump raised tariffs on imported goods from China to 145%, including the previous base tariff of 20% and additional tariffs. This move was made after Beijing applied retaliatory tariffs of 84% on US goods, escalating trade tensions between the world's two largest economies.

Also yesterday, President Trump continued to warn of new sanctions, this time against Mexico. In a new post on the social network Truth Social, President Trump asked Mexico to implement the 1944 water agreement between the two countries and transfer 1.3 million acre feet of water to the US state of Texas, equivalent to about 1.6 billion cubic meters.

Source: MXV

Many goods imported into the US from Mexico and Canada are currently subject to a 25% tariff due to the fentanyl controversy. Canada is also imposing a 25% tariff on some US vehicle imports as a retaliatory measure. The global economic outlook remains uncertain and concerns about oil demand have not subsided.

Meanwhile, the US Energy Information Administration (EIA)'s short-term energy outlook report released yesterday showed that the global oil demand forecast has been lowered compared to the previous one. The EIA also reduced its forecast for future oil prices due to the OPEC+ group's plan to increase production and concerns about the global economic recession. These factors continue to put great pressure on the energy market in the coming time.

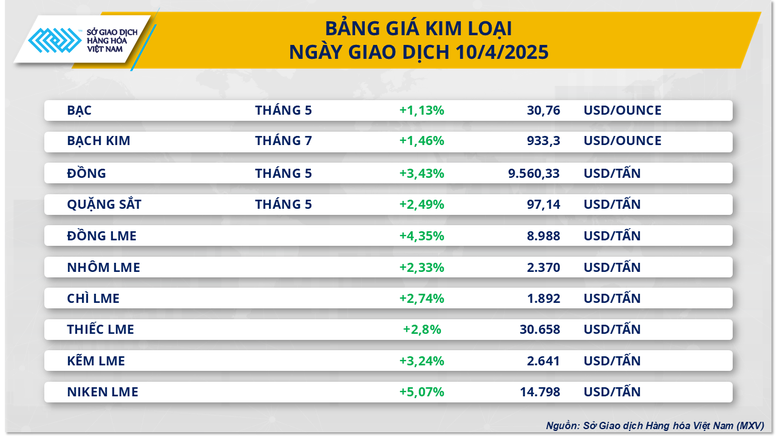

For the metal market, at the end of yesterday's trading session, the metal market witnessed a strong recovery in all 10 commodities. According to MXV, the main reasons supporting this increase were concerns about trade tensions, supply shortages and the US reducing monetary tightening.

Source: MXV

At the end of the session, silver prices increased by 1.13% to 30.76 USD/ounce. Meanwhile, platinum also increased by 1.46% to 933.3 USD/ounce.

Precious metals continued to be supported as global trade tensions escalated following news that China raised retaliatory tariffs on US imports.

In addition, according to the minutes of the US Federal Reserve’s March meeting released yesterday (April 9), policymakers agreed to slow down the pace of quantitative tightening (QT). This means that the Fed will loosen monetary policy, thereby helping to maintain abundant liquidity in the banking system, helping to promote cash flow into safe-haven assets such as precious metals.

In another development, the European Union (EU) and China are negotiating to set a floor price for electric vehicles (EVs), replacing the tax of up to 45.3% that the EU has applied since October 2024. This move is seen as an effort to reduce trade tensions between the two sides, in the context of the US increasing pressure on both the EU and China.

The push for electric vehicles in Europe could reduce demand for platinum, a metal used primarily in the catalytic converters of gasoline and diesel vehicles. This has helped to curb the rise in platinum prices on the international market. Meanwhile, the negotiations between the EU and China are aimed not only at reducing tariffs but also at stabilizing the global supply chain, creating more favorable conditions for the development of the electric vehicle industry.

For the base metals group, COMEX copper prices climbed 3.43% to $9,560/ton. Meanwhile, iron ore jumped 2.49% to $97.14/ton.

Copper prices were supported yesterday by concerns about shrinking supplies. Chilean state-owned mining company Codelco’s copper output fell 6% year-on-year in February to 98,100 tonnes, according to data released by the National Copper Commission of Chile (Cochilco) on Thursday. Codelco is the world’s largest copper producer, but has struggled to improve declining output in recent years.

Source: https://baodaknong.vn/thi-truong-hang-hoa-11-4-luc-mua-chiem-uu-the-tren-thi-truong-249039.html

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)