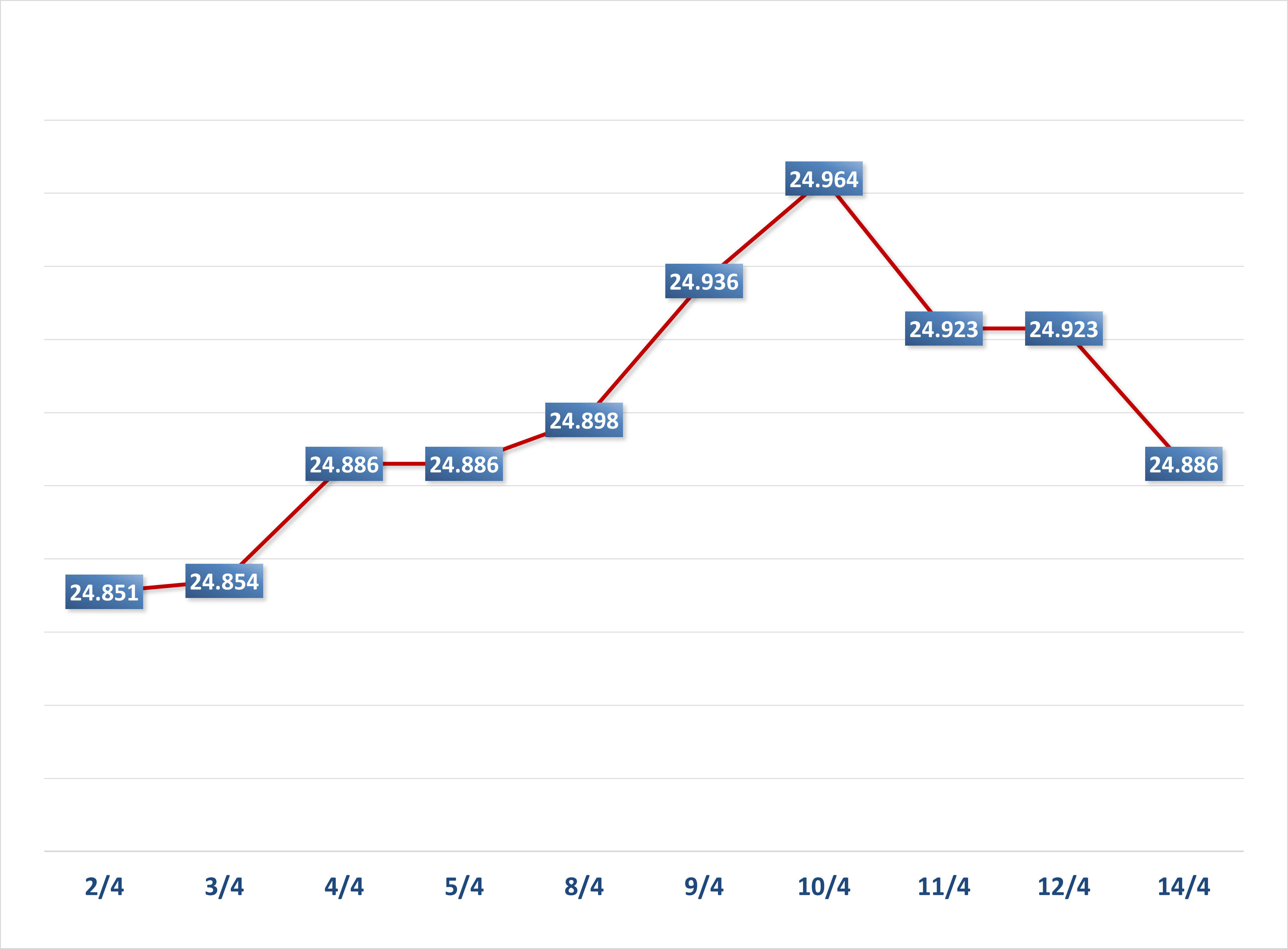

After plunging, investors rushed to buy, causing gold prices to recover at the end of last week, signaling a positive new week. Domestically, gold continued to heat up as plain rings nearly caught up with SJC gold bars.

The world gold price ended last week at $2,748/ounce, lower than the peak of $2,785/ounce set in the middle of the week. However, this price was 0.6% higher than the closing price of the last session of the previous week.

Basically, gold is still in an uptrend. Experts say that despite the strong sell-offs that caused gold prices to plummet, investors immediately rushed to buy again, helping gold prices quickly recover.

Most experts say that the positive point for gold is that investors have returned immediately after the sell-off, which occurred when the US announced a decrease in unemployment benefits. This proves that investors are in a bottom-fishing trend and have high expectations for the price increase of the precious metal.

According to Ole Hansen, Head of Commodity Strategy at Saxo Bank, the US presidential election, which is taking place in less than two weeks, is the top concern for investors right now. This is an important factor that encourages investors to increase their purchases. This will push gold prices to continue to rise strongly in the coming time.

Ole Hansen noted that no matter which candidate wins, the US public debt will not improve. According to him, the debt will increase sharply compared to the current level of 35,000 billion USD.

Furthermore, James Stanley, senior strategist at Forex.com, said gold continued to be supported by the possibility of the US Federal Reserve easing monetary policy at its meeting on November 2. He said that a 25 basis point interest rate cut is certain, and there may even be another 25 basis point cut in December.

“Despite high inflation in the US, the Fed has remained adamant about its monetary easing policy. The Fed has repeatedly signaled this even when economic data has been positive,” James Stanley explained.

However, according to analysts, the core personal consumption expenditure (PCE) index, a very important inflation measure released this week, will make it difficult for the Fed to give guidance on the number of interest rate cuts between now and the end of 2024.

On the other hand, Alex Kuptsikevich, senior market analyst at FxPro, commented that although the precious metal recovered at the end of the week due to investors' bottom-fishing demand, cautious sentiment reduced buying volume.

“Precious metals prices could have gone even higher, but the cautious market sentiment has kept the rally in check,” said Alex Kuptsikevich.

Therefore, Alex Kuptsikevich predicts that gold prices will have a short-term downward correction before the US presidential election. He predicts that the price of the precious metal will fall to the range of 2,670-2,700 USD/ounce this week. However, this correction will not affect the long-term upward trend of gold.

Alex Kuptsikevich noted an important thing, if gold has a downward correction, it will be a great opportunity for investors to increase bottom fishing - a positive signal for the market. This confirms that the number of investors participating in the gold market is very large.

In the domestic market, last week, the price of SJC gold bars increased to 89 million VND/tael, while plain gold rings also nearly caught up with the price of SJC gold bars, anchored at 88.9 million VND/tael.

Source: https://vietnamnet.vn/song-noi-cuoi-tuan-gia-vang-cho-tuan-moi-but-pha-2336034.html

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)